-

From offering operations folks big bonuses to grooming recent grads, lenders are getting creative in their efforts to manage staffing throughout the boom-bust cycle.

March 22 -

After its three acquisitions since last August, the Philadelphia area-based credit data firm predicts more industry consolidation is on the way.

March 17 -

Finance of America Reverse's product combines features of a forward mortgage, like 10 years of payments, with parts of a non-recourse reverse loan.

March 10 -

The number of product offerings stayed at a level last seen in 2014 as slight gains in government and jumbo loans were offset by fewer conventional mortgages coming on the market.

March 9 -

Some applaud the agency's recent delay of the mandatory compliance date for a new Qualified Mortgage standard. Others say it leads to more uncertainty for lenders, opens the door to additional changes and enables some companies to loosen their underwriting.

March 7 -

The abrupt move paves the way for the $6 billion cash deal with Stone Point and Insight Partners to move forward unimpeded.

March 4 -

Since CoStar made its revised offer in February, its stock price dropped nearly $177 per share.

March 4 -

The merger with Capitol Investment V values the title insurer at $3 billion.

March 3 -

The shrinking ranks of appraisers, combined with the record number of loan applications in 2020, created "the perfect storm between supply and demand," which inspired the new payment plan, Incenter's Mark Walser said.

February 17 -

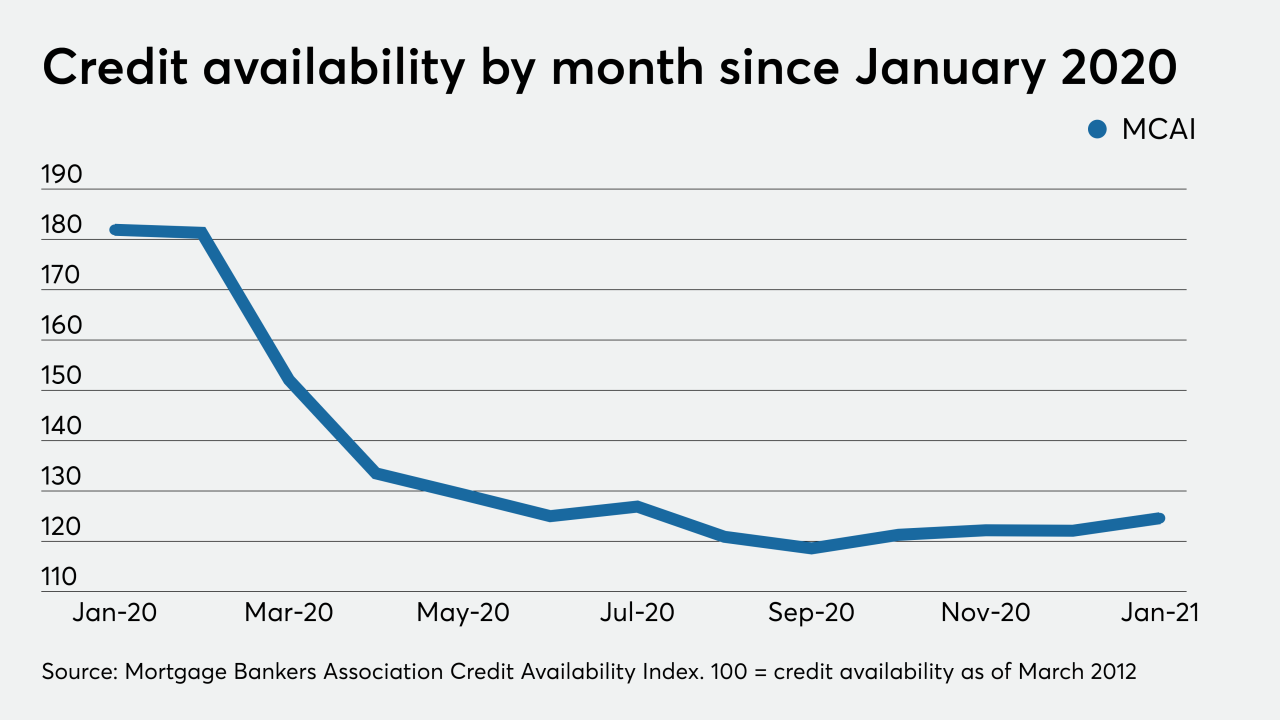

The movement in the MBA’s credit availability index suggests that, amid forecasts of diminished refinancing, lenders want to accommodate consumers buying homes, but they aren’t yet ready to lend as freely as they did before the pandemic.

February 9 -

Pretax operating margins came in much narrower than what is projected for the three stand-alone underwriters.

February 1 -

The acquisition brings the credit report provider into the commercial and residential appraisal technology space.

January 14 -

The Fed’s decision to lower rates amid a pandemic proved serendipitous for home lenders who benefited from a refinance boom last year, but they may need to make adjustments in the coming months.

January 5 -

While it's no silver bullet, automation with careful monitoring and testing can help lenders eliminate racial bias toward potential borrowers, the developers say.

December 23 -

The company also acquired the maker of the ResWare title and escrow software.

December 22 -

Two reports reveal how borrowers prefer to engage with lenders, with younger customers preferring an efficient digital experience and most seeking some form of human interaction.

December 21 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

The affordable housing nonprofit's Equitable Path Forward initiative seeks to eliminate "the deep-rooted legacy of racism in housing."

December 15 -

The industry is now likely to top 2019's nearly $16 billion in premiums written.

December 14 -

The consumer bureau's revamp of criteria for "qualified mortgages," a special regulatory class of loans free from liability, emphasizes pricing instead of a borrower's debt-to-income ratio.

December 10