-

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

Liberty Home Equity, a subsidiary of Ocwen Financial, is offering a new private-market alternative to Federal Housing Administration-insured reverse mortgages.

July 22 -

A new wave of mortgage production technologies empower lenders to create a more personalized approach to serving borrowers compared with the ubiquitous loan origination systems created over 10 years ago.

July 12 Blue Sage Solutions

Blue Sage Solutions -

Almost two-thirds of consumers think they must be debt-free to get home financing when in fact they can have debt-to-income levels as high as 43% or greater, according to Wells Fargo.

July 10 -

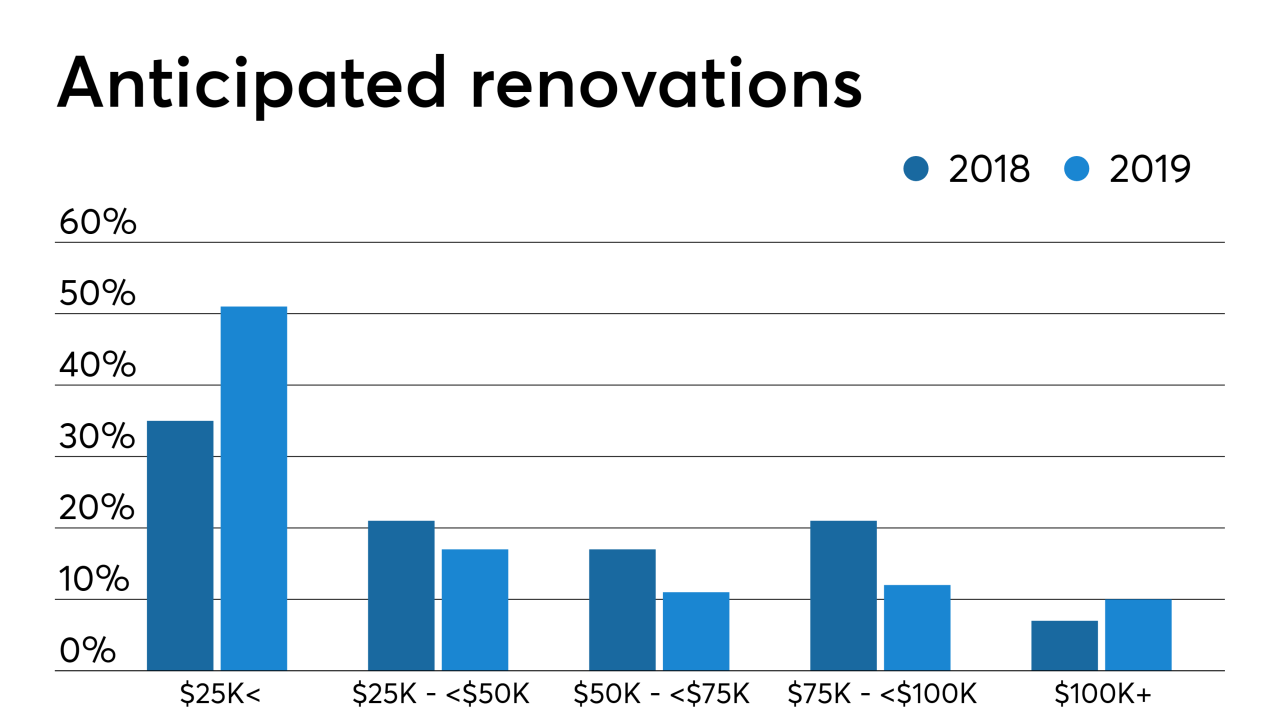

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

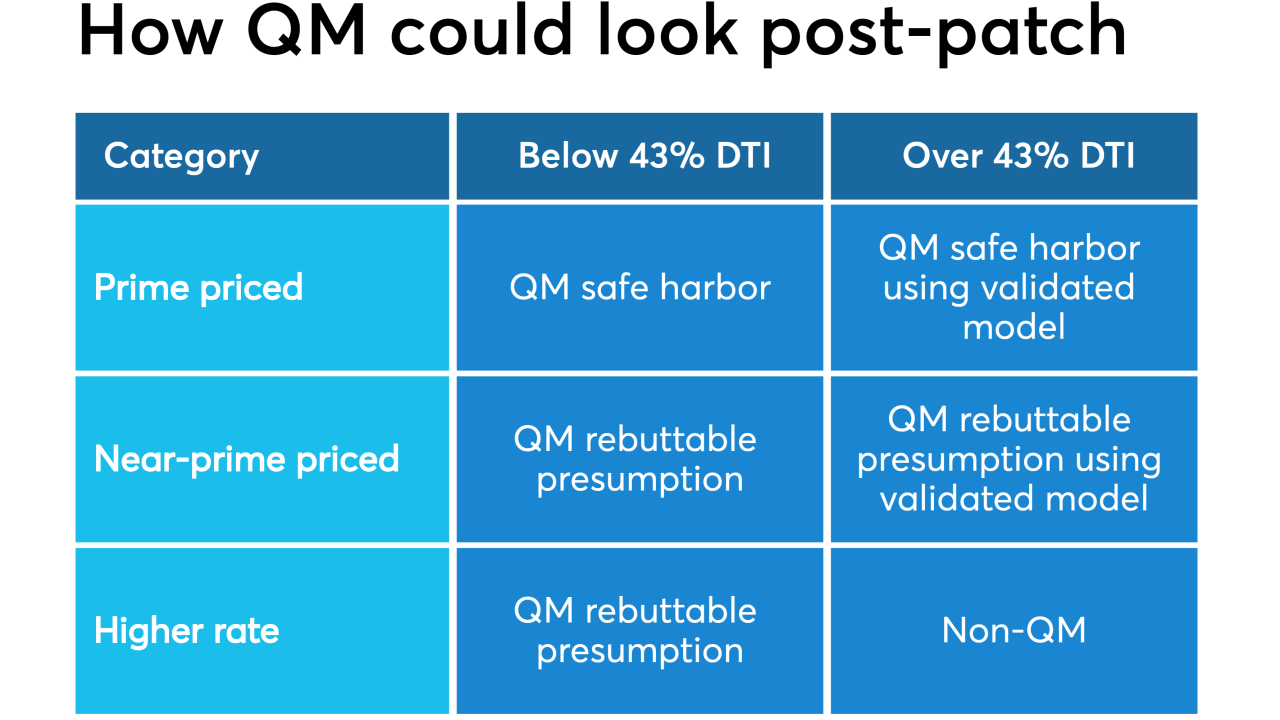

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

With affordability still an issue despite falling interest rates and harnessed home value growth, lenders further loosened credit standards in June, according to the Mortgage Bankers Association.

July 9 -

Mandate for loan officers is to be able to inform on customers' specific financial needs in areas that extend well beyond the home loan.

July 9 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Mortgage and real estate professionals need to do a better job of educating consumers and themselves about the growing vulnerability to wire fraud schemes during the home buying process.

July 3 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

Mortgage application fraud risk declined for the second consecutive month in May as housing market dynamics shifted towards the buyers, First American said.

June 28 -

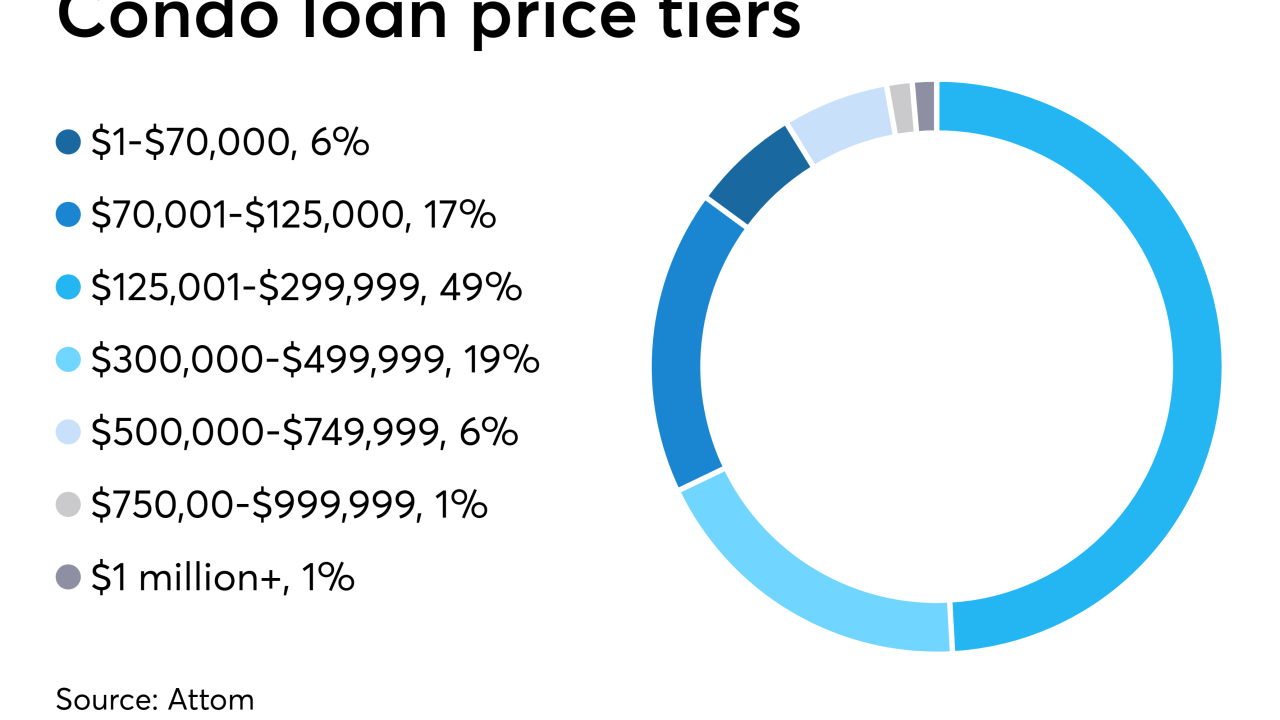

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

Real value comes from the wholesaler using a hands-on approach to ensure that a mortgage broker's customers are treated to the best experience for the life of the loan.

June 21 Home Point Financial

Home Point Financial -

Freddie Mac fulfilled its promise to offer a single mortgage that finances the home purchase price and improvements completed after closing.

June 20 -

Quicken Loans claimed victory in its dispute with the Department of Housing and Urban Development over the False Claims Act, only paying the agency for losses incurred and interest.

June 14 -

Guild Mortgage is targeting Airbnb hosts with its new refinance program, allowing them to use short-term rental income to qualify for a new loan on their owner-occupied primary residence.

June 14 -

Ally wants to increase productivity and improve the use of analytics to build on customer relationships.

June 13