-

Mortgage rates inched higher for the second straight week and further increases are likely in the near term, according to Freddie Mac.

September 6 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

New Jersey Governor Phil Murphy signed a bill to revise the state's Residential Mortgage Lending Act to facilitate transitional licensing for loan officers and to streamline the law's provisions for borrower fees.

August 31 -

Future reductions in loan application defect risk are likely because of mortgage lenders' fintech investments, even as the purchase origination share grows, said First American Financial.

August 31 -

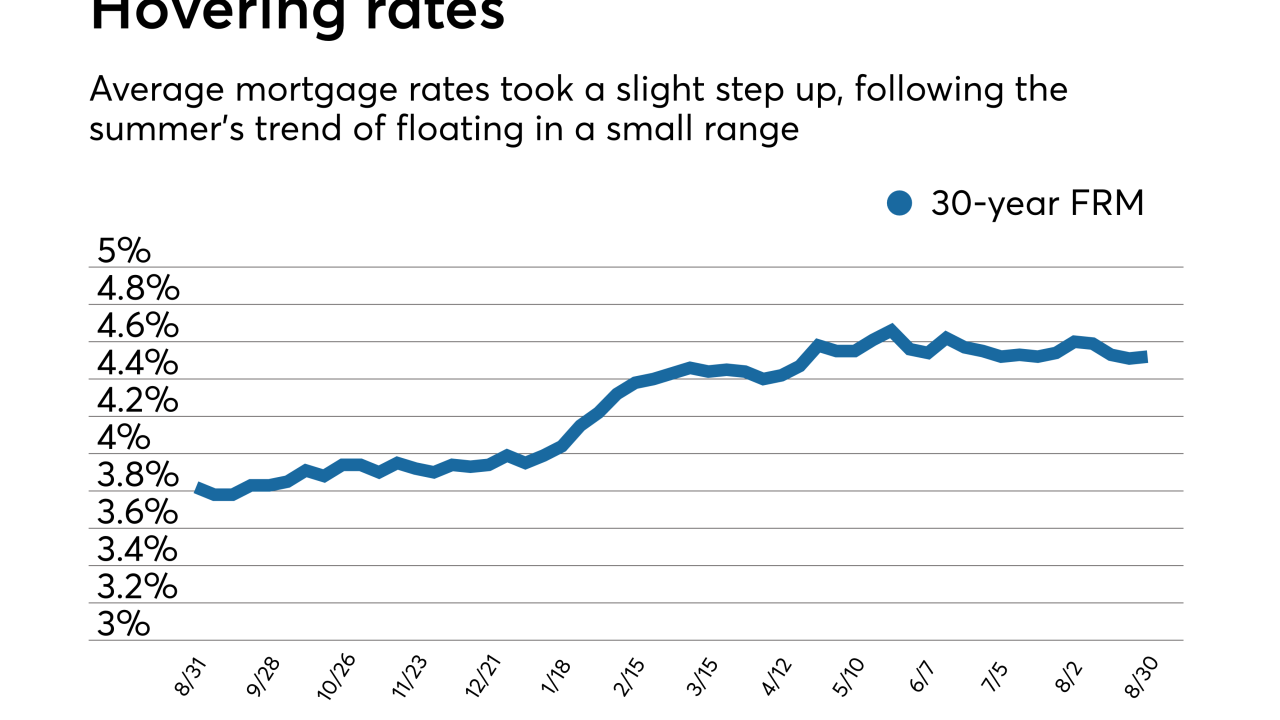

Mortgage rates took small steps up after hitting a four-month low, but continued hovering around the same range they have all summer, according to Freddie Mac.

August 30 -

Mortgage rates decreased for the third straight week and reached their lowest level since mid-April, according to Freddie Mac.

August 23 -

July's year-over-year increase in foreclosure starts for 44% of the nation's metro areas is a result of looser underwriting standards and a sign of future growth in defaults, said Attom Data Solutions.

August 21 -

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

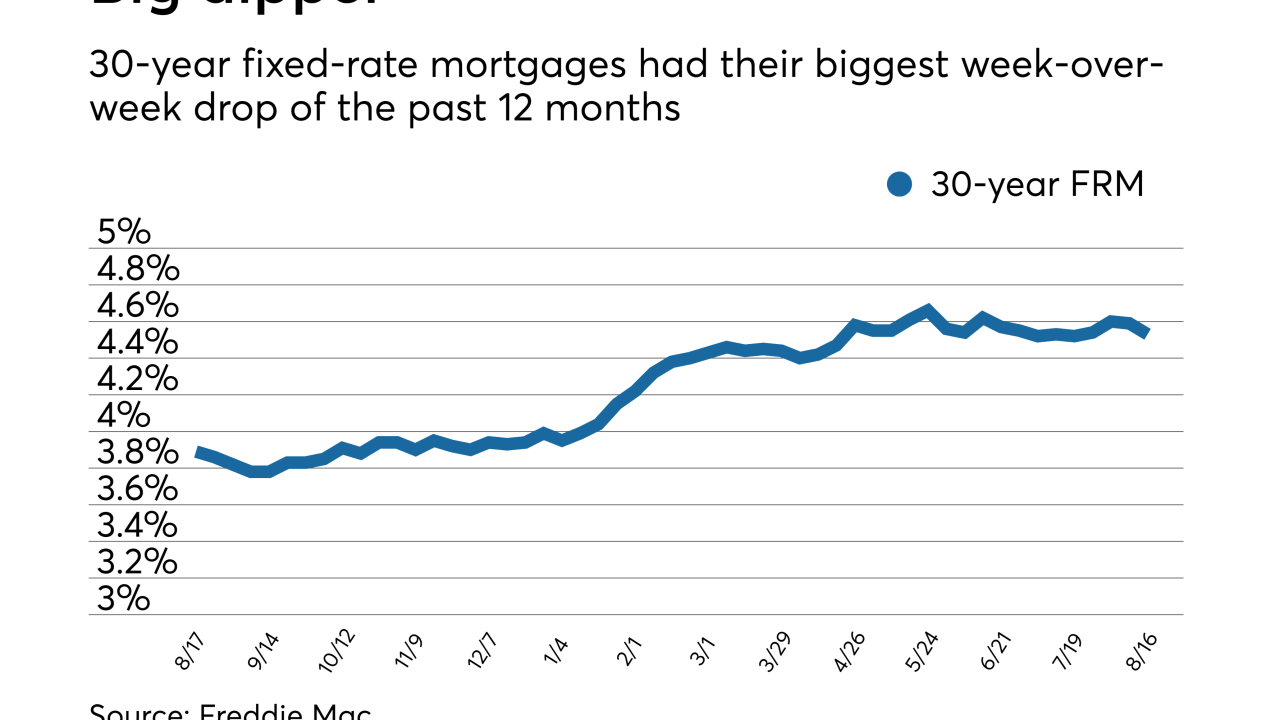

Average mortgage rates fell, including the largest week-over-week drop of the past 12 months, but homebuyer demand stays mum, according to Freddie Mac.

August 16 -

The percentage of low down payment loans using private mortgage insurance continues to grow, and should continue as more first-time homebuyers get conforming loans, according to Keefe Bruyette & Woods.

August 14 -

A mortgage fraud scheme involving fake employment records, initially thought to be contained to Southern California, is occurring statewide, Fannie Mae said in a new fraud alert.

August 9 -

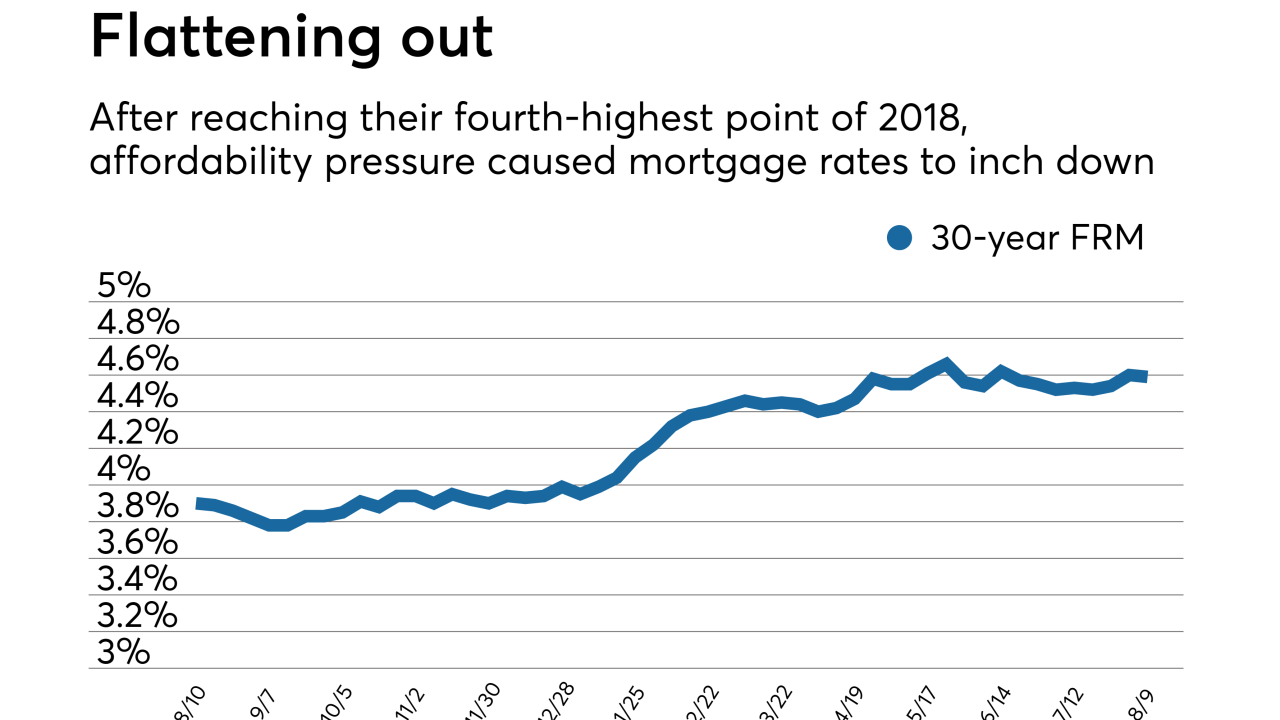

Mortgage rates took a small step back due to affordability pressure after climbing for the past two weeks, according to Freddie Mac.

August 9 -

Mortgage credit accessibility kept climbing in July, mostly thanks to an expansion of jumbo loan products offered, pushing that index to its historical high point, according to the Mortgage Bankers Association.

August 7 -

Wells Fargo estimates that in 400 instances, borrowers later went through foreclosure who were improperly denied or not offered a mortgage modification.

August 6 -

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

Social media is a main avenue for mortgage lenders to reach the next generation of homebuyers. New American is trying to make their own lenders experts in the space.

August 3 -

Mortgage rates rose to their highest level in seven weeks and fourth-highest of 2018, thanks to strong economic trends, according to Freddie Mac.

August 2 -

Freddie Mac produced modest second-quarter results, reflecting a stabilizing business that CEO Donald Layton compared to a utility company.

July 31 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

Ellie Mae saw a 20% year-over-year increase in second-quarter revenue with more loans closed using Encompass, but net income fell nearly 50% on an accounting change and acquisition costs.

July 26