-

A strong real estate market is helping drive up residential property values across Scott County, Iowa, as many homeowners are seeing in assessment notices from the assessor's office.

April 12 -

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11 -

Homebuilders in the Twin Cities metro had their sleepiest March in four years with single-family and multifamily construction falling sharply.

April 3 -

An emerging gap between the government-sponsored enterprises on a Federal Housing Finance Agency scorecard item is prompting Fannie Mae to diversify its multifamily credit risk transfer efforts.

March 29 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27 -

A $54-million project to build upscale condominiums at the edge of downtown Detroit has been canceled, unable to get financing, and the Plan B is to put a hotel there.

March 25 -

With a second defendant pleading guilty to conspiracy, it was learned that a Watertown, N.Y., apartment complex is among dozens of rental properties in that state and several others that allegedly received $500 million in fraudulent bank loans.

March 25 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

Lennar, the region's largest home builder has acquired a huge piece of land alongside Interstate 15 in the San Diego community of Rancho Peñasquitos and is preparing to build 324 single- and multi-family homes for middle-class families.

March 22 -

Rhode Island's housing market cooled a bit in February, as the median sales price remain unchanged from the same month a year ago, but the number of sales fell, and houses lingered on the market a week longer before selling.

March 22 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14 -

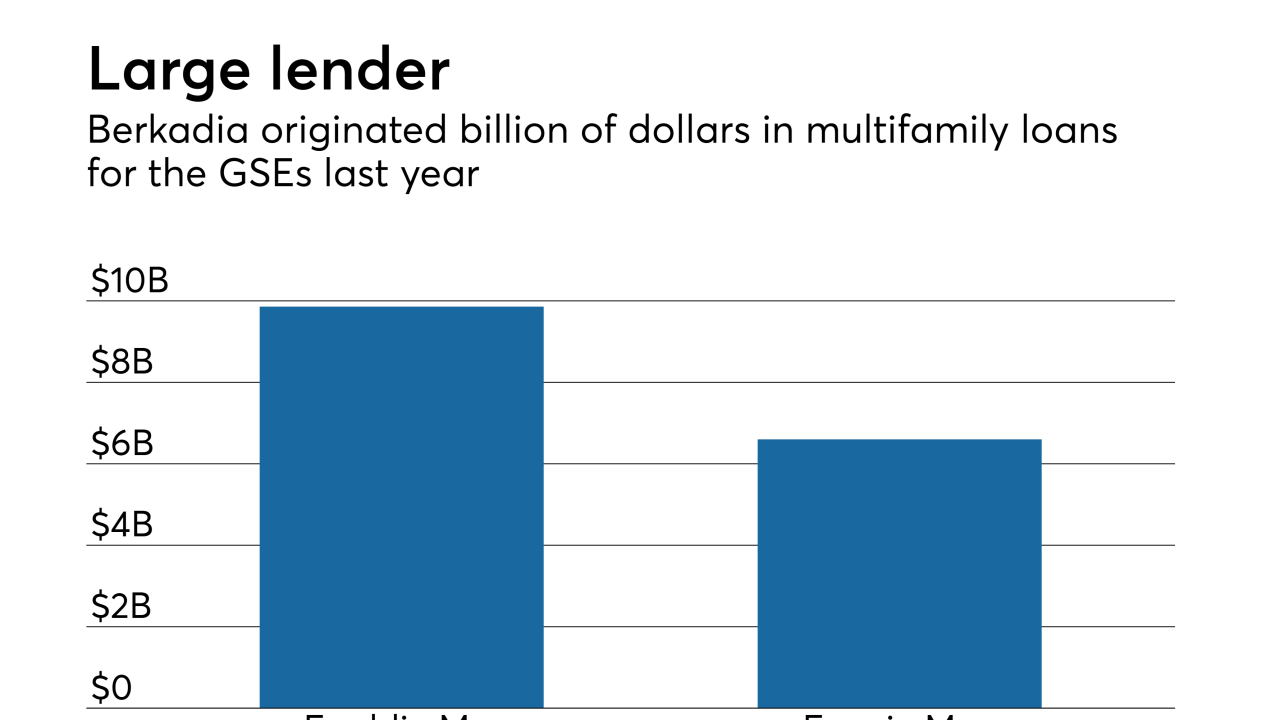

Berkadia, a joint venture run by Berkshire Hathaway and Jefferies Financial Group, is acquiring real estate capital advisory firm Central Park Capital Partners to diversify its capital sources.

March 6 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

The agency's pilot program, designed to streamline mortgage insurance applications associated with the Low-Income Housing Tax Credit program, will now include applications for new construction and substantial rehabilitation.

February 21 -

Stable equity and debt availability should keep multifamily and commercial real estate originations in line with 2017's peak, according to the Mortgage Bankers Association.

February 11 -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

High home prices and expected interest rate hikes should lead to continued growth in multifamily mortgage origination volume in 2019, according to Freddie Mac.

January 14 -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

The government shutdown is not just affecting federal agency employees' ability to make their mortgage or rent payments, it could take them out of the home buying market, Zillow said.

January 8 -

Freddie Mac completed its first multifamily credit risk transfer transaction that used an insurance/reinsurance structure.

January 4