-

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

February 1 -

Some hopeful souls in Washington believe the commercial banking industry will return to originating and servicing higher-risk mortgages, but most banks are more likely to continue withdrawing from the sector.

January 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Independent mortgage banks have been instrumental in filling the void left by banks that have retreated from the home lending market since the Great Recession.

January 25 Mortgage Bankers Association

Mortgage Bankers Association -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

Policymakers should not let mortgage REITs, hedge funds and other firms gain membership through captive insurance companies.

January 18 Pennsylvania Bankers Association

Pennsylvania Bankers Association -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

Employment at nondepository mortgage companies dropped considerably in November, as the combined effects of lower volumes and seasonal slowing reduced hiring needs.

January 4 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

New American Funding expects to add $1 billion to its annual production next year by purchasing Marketplace Home Mortgage.

December 19 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The number of workers employed by non-depository mortgage companies experienced a typical seasonal drop month-to-month, but employment remained higher than a year ago due to the persistence of competitive hiring practices.

December 7 -

The CFPB ordered Village Capital & Investment in Henderson, Nev., to issue refunds and pay a penalty for allegedly misrepresenting the cost savings in a refi product.

December 6 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

Hometown Lenders Inc. will acquire TotalChoice Mortgage in a move to expand its geographic footprint and meet its goal of growing annual originations from $1 billion to $5 billion.

November 30 -

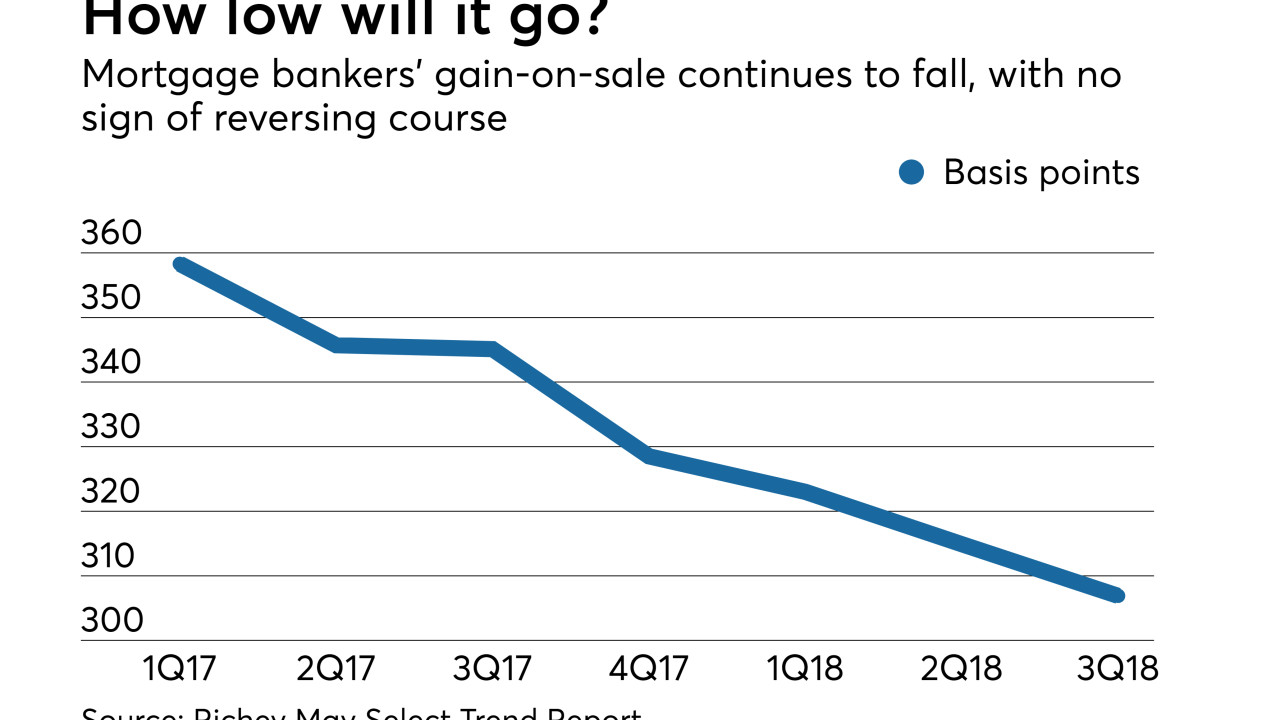

Third-quarter profitability fell to 2008 levels in the Mortgage Bankers Association's latest report, suggesting the seasonally slower fourth quarter could be particularly challenging this year.

November 29 -

Altisource Portfolio Solutions plans to discontinue its buy-renovate-lease-sell business for single-family homes and sell its short-term inventory in order to cut costs and repay debt.

November 26 -

Ginnie Mae is adding steps to its process for evaluating new issuers, including new notification requirements related to subservicer advances, servicing income, and borrowing facilities secured by mortgage servicing rights.

November 16 -

FDIC Chairman Jelena McWilliams questioned whether regulators and banks are fully capturing the emerging risks of a new shadow banking system.

November 15 -

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9