-

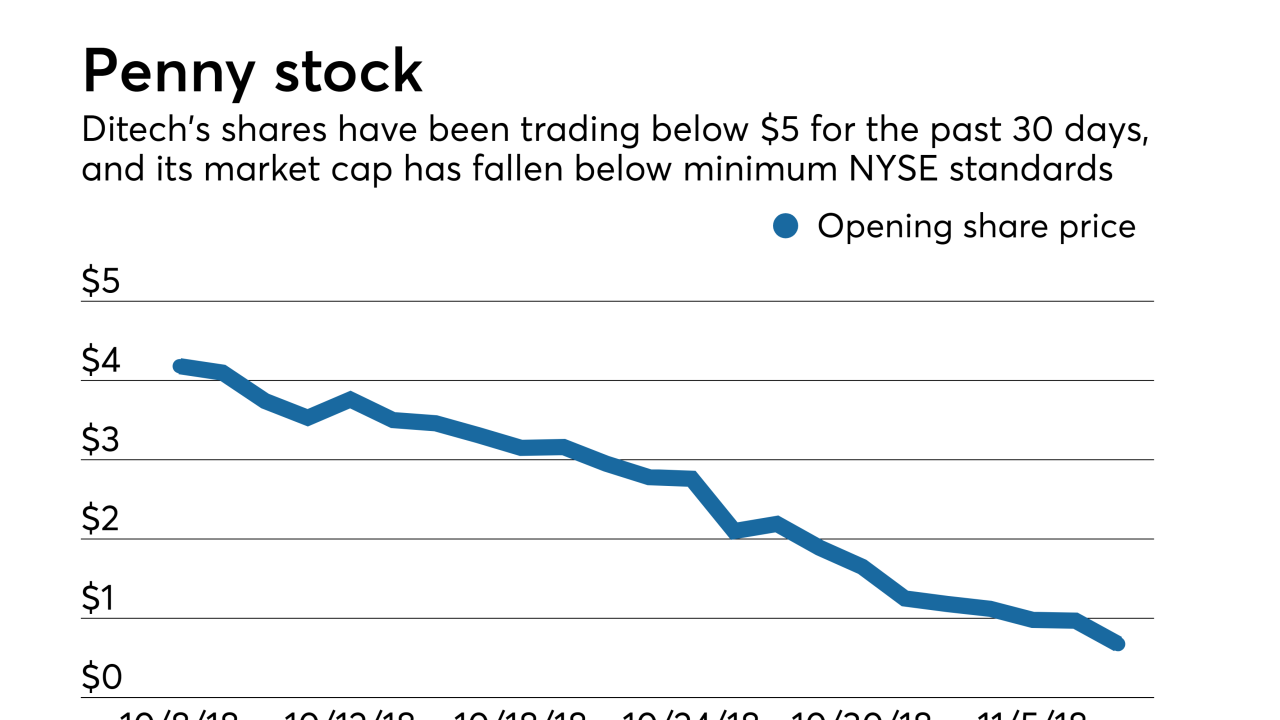

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Hiring by nonbank mortgage lenders and brokers ebbed in September as the housing market prepares to pack it in for the colder months.

November 2 -

New York developer Silverstein Properties Inc. built a $4 billion pipeline of real estate deals just weeks after starting. None of the money was for buildings it will own.

October 19 -

Hiring by nonbank mortgage lenders and brokers reversed course again and got slightly higher in August as originators made a last-ditch effort to reach seasonal homebuyers before fall.

October 5 -

The senator’s bill to reform the 40-year-old law and expand housing investments could gain clout as Democrats look to pick up congressional seats and she eyes a presidential run.

September 25 -

A former Federal Home Loan bank president argues that the system should limit its exposure to risky nonbanks.

September 19 Flushing Bank

Flushing Bank -

LoanDepot's CEO Anthony Hsieh delivered a bracing message to mortgage lenders on Monday — strong new competitors are coming into this market, so they need to expand their offerings.

September 17 -

The number of workers employed by nonbank mortgage lenders and brokers reversed course and inched lower in July as affordability constraints and limited income gains reduced demand.

September 7 -

With spring homebuying in bloom, the second quarter brought profits to independent mortgage bankers after going negative for the second time ever, according to the Mortgage Bankers Association.

August 29 -

Intensifying margin pressure could spur another wave of cost-cutting at nonbank mortgage lenders, unless other strategies, like consolidation or a mortgage servicing book that could increase in value, offset it.

August 23 -

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

Atlantic Bay Mortgage Group and Virginia Community Bank have agreed to back out of a merger that would have been a rare instance of a nondepository lender acquiring a depository institution.

August 14 -

Employment by nondepository mortgage companies in June increased for the third consecutive month as seasonal hiring continued even though home resales inched down another notch.

August 3 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Servicers and MSR investors face increased regulation and oversight as nearly all states now require some form of licensing for firms responsible for mortgage collections.

July 23 -

The high cost of preparing for both CFPB and state exams has a disproportionate impact on small independent mortgage banks that don't have the compliance economies of scale of larger lenders.

July 19 MLB Residential Mortgage

MLB Residential Mortgage -

United Wholesale Mortgage has set out to be an ally to mortgage brokers in unprecedented ways as CEO Mat Ishbia works to evolve the channel's transactional nature into a more relationship-driven dynamic.

July 13 -

When big banks bailed on brokers during the housing crisis, United Wholesale Mortgage doubled down. As third-party originations now make a comeback, the family-owned company is determined to chip away at retail lenders' dominance.

July 13 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11 -

Despite recent industry consolidation, demand from seasonal homebuyers spurred hiring among nonbank mortgage companies for the second consecutive month in May.

July 6