-

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

Atlantic Bay Mortgage Group and Virginia Community Bank have agreed to back out of a merger that would have been a rare instance of a nondepository lender acquiring a depository institution.

August 14 -

Employment by nondepository mortgage companies in June increased for the third consecutive month as seasonal hiring continued even though home resales inched down another notch.

August 3 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Servicers and MSR investors face increased regulation and oversight as nearly all states now require some form of licensing for firms responsible for mortgage collections.

July 23 -

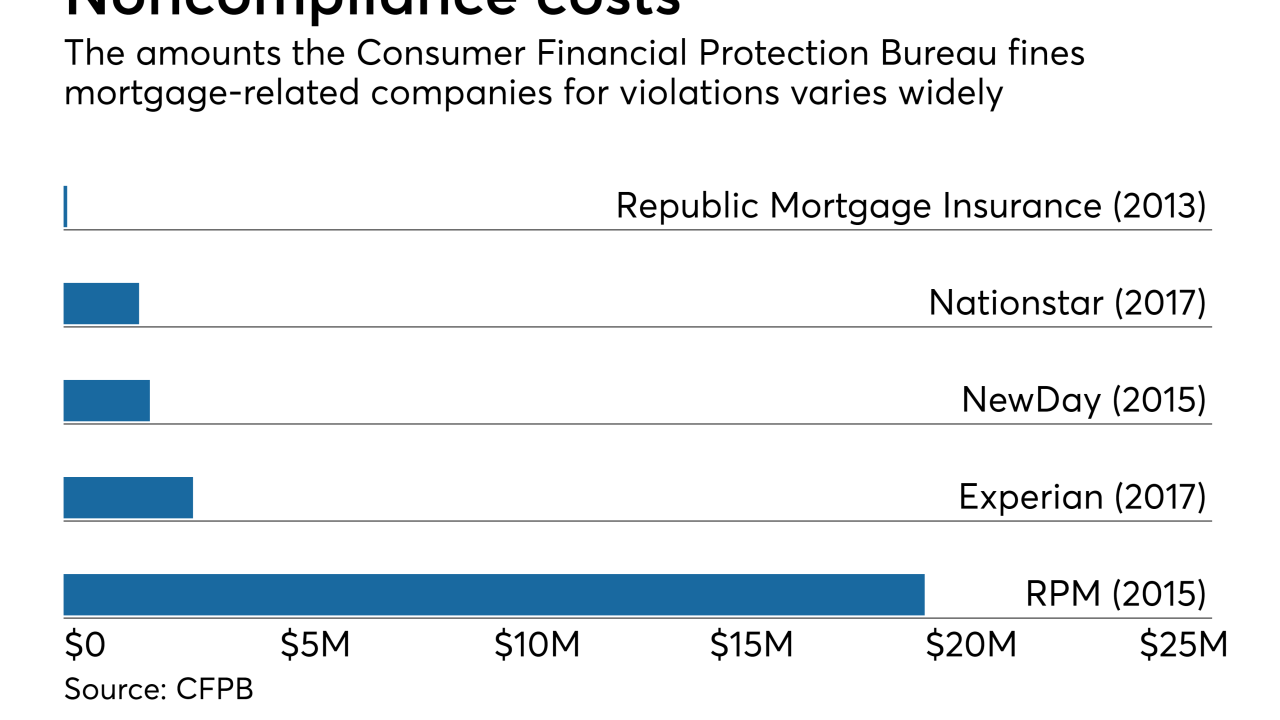

The high cost of preparing for both CFPB and state exams has a disproportionate impact on small independent mortgage banks that don't have the compliance economies of scale of larger lenders.

July 19 MLB Residential Mortgage

MLB Residential Mortgage -

United Wholesale Mortgage has set out to be an ally to mortgage brokers in unprecedented ways as CEO Mat Ishbia works to evolve the channel's transactional nature into a more relationship-driven dynamic.

July 13 -

When big banks bailed on brokers during the housing crisis, United Wholesale Mortgage doubled down. As third-party originations now make a comeback, the family-owned company is determined to chip away at retail lenders' dominance.

July 13 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11 -

Despite recent industry consolidation, demand from seasonal homebuyers spurred hiring among nonbank mortgage companies for the second consecutive month in May.

July 6 -

The number of nonbank lenders and servicers that did not comply with the California Residential Mortgage Lending Act Annual Report requirements grew this year, prompting a reprimand and warning of penalties from the commissioner of the state's Department of Business Oversight.

July 2 -

The shareholders of Nationstar Mortgage Holdings and WMIH Corp. each voted to approve a $1.9 billion acquisition plan that will see the parent company of nonbank lender and servicer Mr. Cooper combine with the successor to S&L and subprime mortgage lender Washington Mutual.

June 29 -

Greg Englesbe resigned as CEO of New Jersey lender E Mortgage Management after a jury awarded $3 million to a woman who accused Englesbe of injuring her when he grabbed and forcibly kissed her at a Philadelphia restaurant.

June 29 -

Declining mortgage origination volume and record-high costs drove production income for independent mortgage bankers into negative territory, according to the Mortgage Bankers Association.

June 6 -

Seasonal hiring gave employment among nonbank mortgage lenders and brokers a boost in April and partially reversed an earlier decline despite growing signs of consolidation in the industry.

June 1 -

Citizens Bank's $511 million acquisition of Franklin American Mortgage will beef up the bank's servicing portfolio and diversify its origination business at a time when higher interest rates have put a damper on refinance volume.

May 31 -

Originations and margins are thinning, and there will be mortgage banking firms that don't make it through this year, but after that, the numbers may look better.

May 22 -

Nationstar Mortgage has agreed to refund or reverse more than $1 million in inspection fees, settling allegations by Maryland officials it illegally charged homeowners.

May 16 -

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7