-

PMI Rate Pro lets users compare mortgage insurance premium quotes from all six companies in the market.

February 10 -

A city agency that in recent years lost its luster as a place where low-income New Orleanians could go for low-interest mortgages is set to re-emerge as a key player in plans to develop more affordable housing in the city.

February 10 -

Galvanized by the Moms 4 Housing standoff that drew national attention to the region's affordability crisis, Oakland officials may soon overhaul the way homes are bought and sold and other Bay Area cities are considering similar measures.

February 10 -

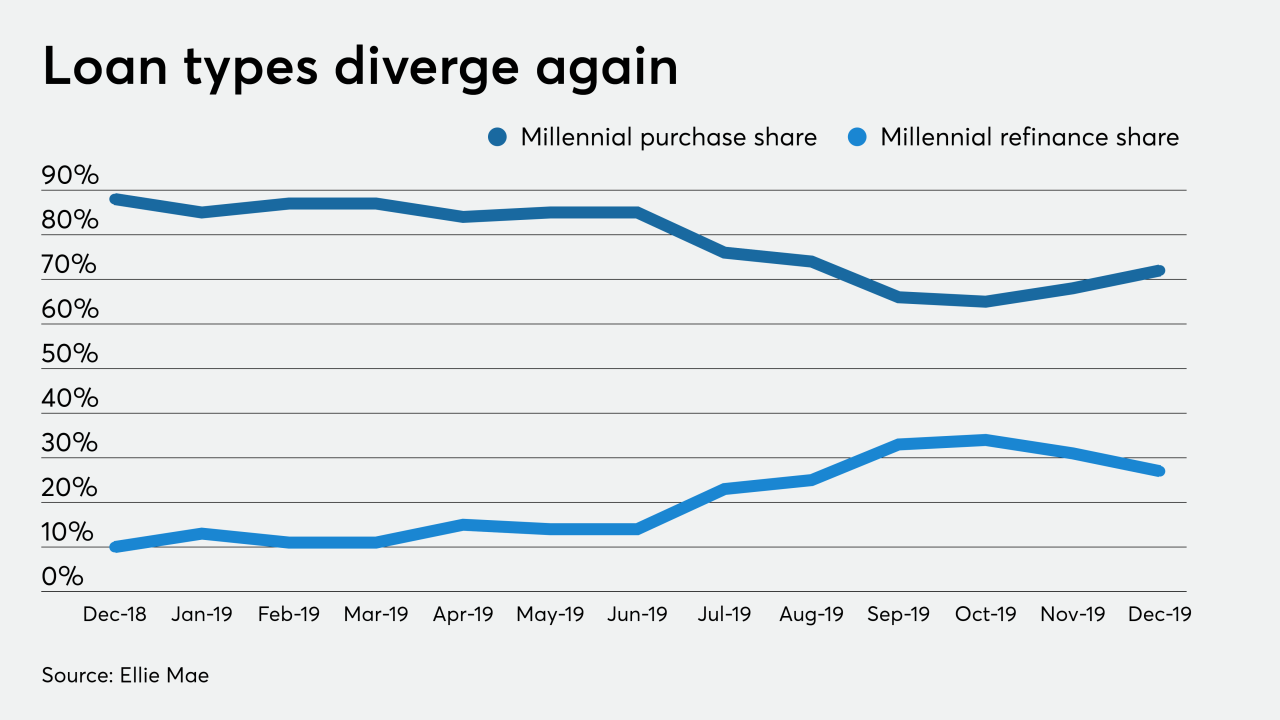

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

Falling interest rates, strong job growth and declining inventories could be setting the conditions for a spring reprise of the painfully hot housing market of 2017, Seattle area real estate agents say.

February 7 -

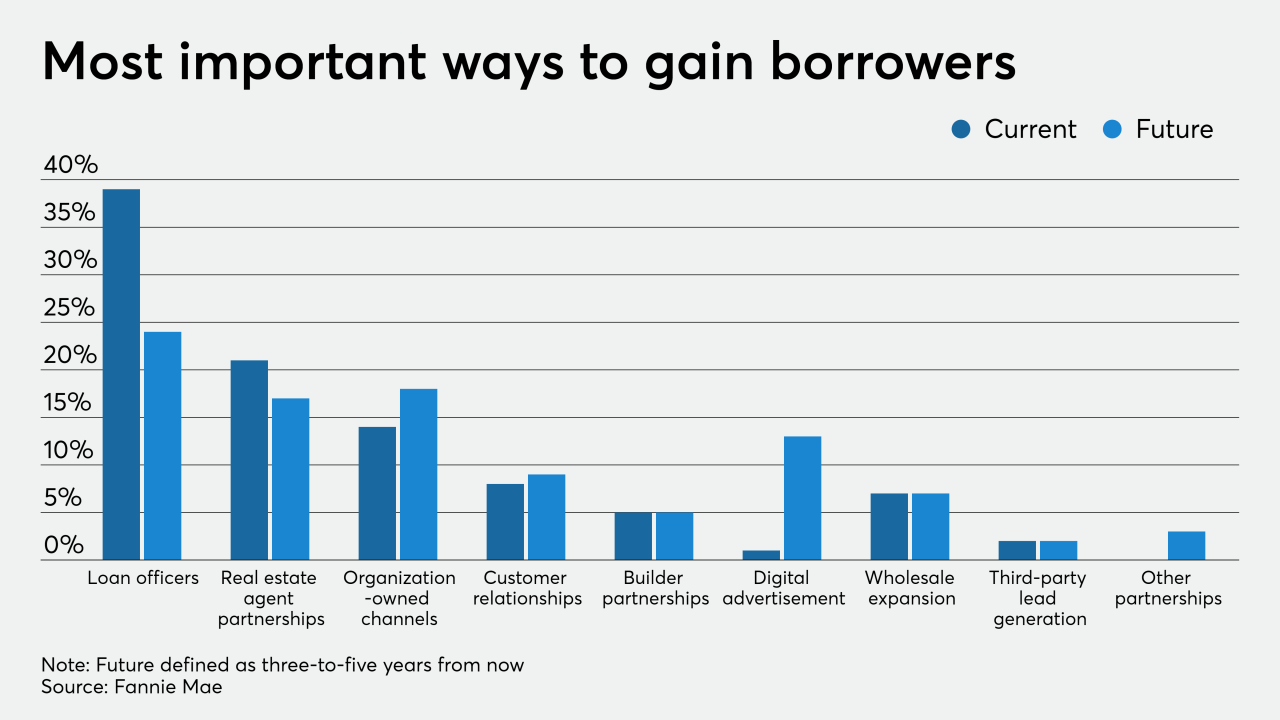

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

A shrinking supply of available homes for sale in Canada's largest city continued to drive prices higher last month, bringing annual increases to the strongest in more than two years.

February 6 -

Mortgage rates continued their slide this week, which along with positive economic news should continue to pump up purchase demand, according to Freddie Mac.

February 6 -

Mortgage application volume increased 5%, led by refinancings, as interest rates continued to fall on fears that the coronavirus was spreading in China and elsewhere, according to the Mortgage Bankers Association.

February 5 -

Home sellers came off the sidelines in January and showed buyers they were ready to play ball.

February 5 -

While down from the year before, December's housing value appreciation kept churning and should climb in 2020 to a new all-time high, according to CoreLogic.

February 4 -

The Spokane, Wash., real estate market remains extremely tight and active, with relatively few houses available, high demand and rising home prices mirroring national trends.

February 4 -

Home sales were up in all three of the Greensboro-High Point, N.C., metropolitan area's counties of Guilford, Randolph and Rockingham.

February 3 -

A year-end surge in Dallas-area home sales is carrying over into the New Year, and local real estate agents are hoping that the increase in business will stretch into the summer.

January 31 -

After a months-long slump in Bay Area home prices, the market appears poised to drive higher as buyers act on low interest rates and fight for scarce inventory.

January 31 -

Loan application defect risk fell in December after stabilizing the prior month, but it's not dropping as it quickly as it once was, according to First American Financial.

January 30 -

The U.S. homeownership rate rose to a six-year high in the fourth quarter, led by gains among young people and low-income Americans.

January 30 -

Mortgage rates continued sliding this week as investors put money into safer assets like bonds, contributing to the 30-year fixed-rate mortgage dropping 9 basis points, according to Freddie Mac.

January 30 -

Dwindling inventories of existing homes in Toronto is driving sales of pricier newly built housing, another sign of tightening in Canada's largest real estate market.

January 30 -

Rising home prices allowed central Ohio homeowners to make more on the sale of their homes last year than ever.

January 30