-

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

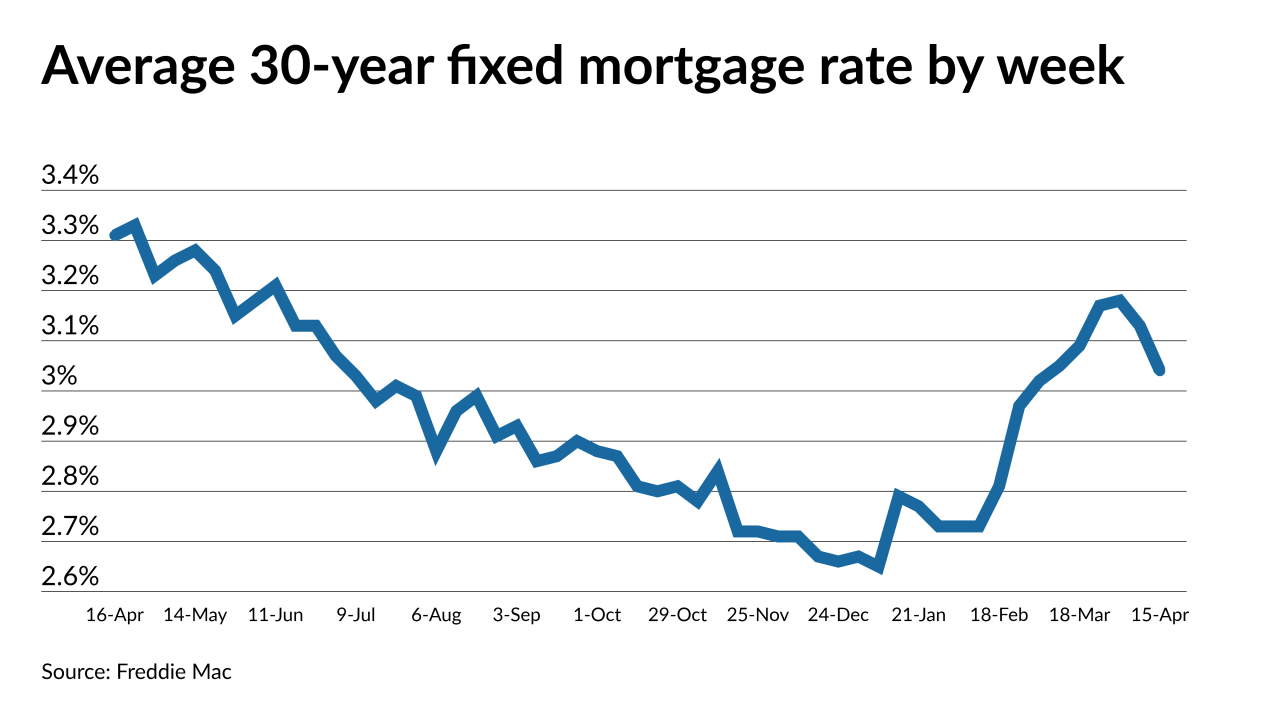

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

More lenders are willing to take on borrowers who are lower on the qualification spectrum as the economy rebounds.

April 8 -

Vaccinations and a third round of stimulus payments are boosting consumers views on the housing market, according to Fannie Mae.

April 7 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

That means depreciation is a risk that could creep back into some regions, potentially requiring lenders and government-related agencies to consider it when setting down payment requirements or managing loan workouts once forbearance ends.

April 6 -

Increasingly extreme weather patterns and natural disasters weigh heavy on the majority of borrowers looking to buy a house, while half will move because of it, according to Redfin.

April 5 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

Ballooned home prices and a dearth of options deterred February 2021 sales, according to the National Association of Realtors

March 31 -

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

As home values surged at record highs, the latest month-to-month movements indicate price growth could start returning to a pre-pandemic pace, according to the Federal Housing Finance Agency.

March 30 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

Despite a 3% increase in new mortgages, overall applications dropped 2% on a consecutive-week basis due to a 5% decline in refis, according to the Mortgage Bankers Association.

March 24 -

These trends, in addition to the increase in appraisal contingency waivers, could add risk to mortgage lender businesses.

March 22 -

Also: How 9.3 million renters could enter the purchase market, lessons from Flagstar’s data breach and a possible 15-year plan for Fannie and Freddie.

March 19 -

Household formations, looser credit and an improved economy will overcome higher rates — and even the inventory shortage.

March 19 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

Apart from saving more money, millennials prefer to spend their savings on a home down payment, Zonda economist Ali Wolf said.

March 17