-

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

As home values surged at record highs, the latest month-to-month movements indicate price growth could start returning to a pre-pandemic pace, according to the Federal Housing Finance Agency.

March 30 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

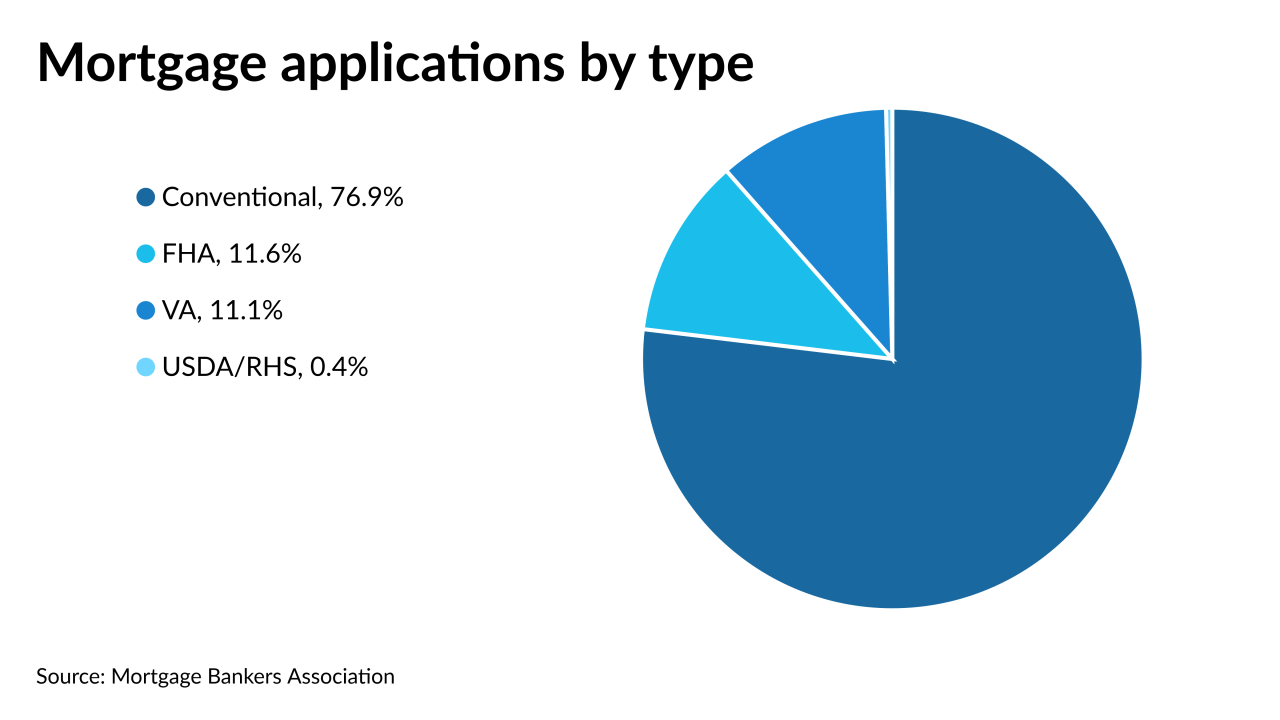

Despite a 3% increase in new mortgages, overall applications dropped 2% on a consecutive-week basis due to a 5% decline in refis, according to the Mortgage Bankers Association.

March 24 -

These trends, in addition to the increase in appraisal contingency waivers, could add risk to mortgage lender businesses.

March 22 -

Also: How 9.3 million renters could enter the purchase market, lessons from Flagstar’s data breach and a possible 15-year plan for Fannie and Freddie.

March 19 -

Household formations, looser credit and an improved economy will overcome higher rates — and even the inventory shortage.

March 19 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

Apart from saving more money, millennials prefer to spend their savings on a home down payment, Zonda economist Ali Wolf said.

March 17 -

“Builders continue to be confronted with rising input costs and a lack of available lots, causing them to slow production,” MBA’s Joel Kan said.

March 16 -

As more borrowers between 21 and 40 leveraged the historically low mortgage rates in January, the average age rose to a report high, according to ICE Mortgage Technology.

March 10 -

Mortgage rates surged 40 basis points since the start of the year as the economy improved.

March 10 -

The number of product offerings stayed at a level last seen in 2014 as slight gains in government and jumbo loans were offset by fewer conventional mortgages coming on the market.

March 9 -

The gap between those that considered it a good or bad time to buy narrowed 10 percentage points in February, the tightest spread since last April, Fannie Mae found.

March 8 -

After the coronavirus spurred a great migration in search of literal greener pastures, homebuyers are returning to cities with the end of the pandemic in sight, according to Redfin.

March 5 -

With the latest growth, interest rates spiked 37 basis points since the calendar flipped to 2021 alongside rising Treasury bond yields.

March 4 -

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

With the pandemic’s radical disruption of the housing market, values grew at the highest rate in eight years, according to CoreLogic.

March 2 -

The rush to refinance led to more errors in January and the shift to more-risky purchase apps will add to lenders' fraud concerns going forward.

March 2