Regulation and compliance

Regulation and compliance

-

At least six Trump administration picks to fill financial posts are still pending, but the bitterly partisan divide over Judge Brett Kavanaugh has taken up most of the energy in Congress.

September 28 -

The Federal Housing Administration is mandating that lenders originating new reverse mortgages offer a second property appraisal in certain cases.

September 28 -

Ocwen Financial Corp. has gotten the go-ahead to acquire PHH Mortgage Corp., subject to revised New York restrictions on acquisitions of mortgage servicing rights, and other conditions imposed by the state.

September 28 -

Another regulator has already gone out on its own with an advance notice of proposed rulemaking. But, Powell said, "It’s a process and we’re very much interested in pushing forward.”

September 26 -

The senator’s bill to reform the 40-year-old law and expand housing investments could gain clout as Democrats look to pick up congressional seats and she eyes a presidential run.

September 25 -

The central bank said the proposal is intended to eliminate duplication of rules for entities covered by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008.

September 21 -

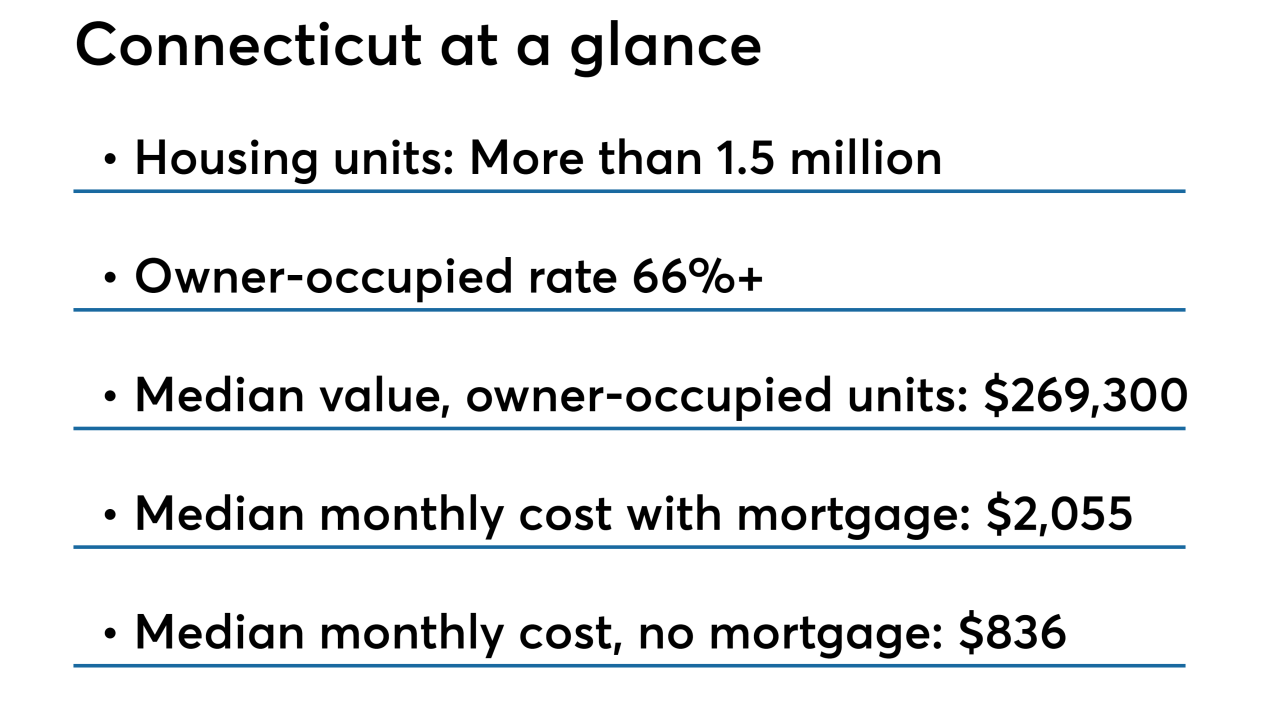

1st Alliance Lending plans to cut up to 35 employees in Connecticut and terminate efforts to expand its East Hartford headquarters in order to prepare for an expected increase in regulatory costs.

September 19 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

Though Acting CFPB Director Mick Mulvaney tried unsuccessfully to strip the agency's fair lending office of its enforcement powers earlier this year, he insisted this week that the bureau "is still in the fair lending business."

September 18 -

In its proposed “disclosure sandbox,” the bureau has eased restrictions on firms seeking a safe harbor from liability.

September 17 -

The federal conservatorship of Fannie Mae and Freddie Mac was never supposed to be permanent. Leaving the situation unresolved keeps the agencies undercapitalized and taxpayers exposed to their risk.

September 14 -

The Federal Housing Finance Agency issued a proposal Wednesday that would require mortgage giants Fannie Mae and Freddie Mac to align their policies on cash flows for current mortgage-backed securities, and eventually for a uniform security when it is implemented next year.

September 12 -

Regulators will continue to issue guidance to articulate general views on appropriate practices, but they will not issue enforcement actions based on violations.

September 11 -

Housing finance reform is still likely years away, but a growing chorus of lawmakers say the government guarantor has the ability to clear the path to a final plan.

September 11 -

The central bank, which received broad authority after the crisis to supervise big banks, is expected to get more attention from lawmakers over its discretion to ease banks’ burden.

September 10 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

From origination to servicing and everything in between, here's a sneak peek at the companies and products presenting demos at the 2018 Digital Mortgage Conference.

September 10 -

The proposal by Reps. Jeb Hensarling and John Delaney is a sign that a bipartisan consensus is building on how to move on from Fannie and Freddie.

September 6 -

The departing House Financial Services chair unveiled a bill with Democrat John Delaney to repeal Fannie and Freddie's charters and establish Ginnie Mae as a backstop.

September 6 -

The Treasury Department and a key housing regulator are preparing to fill a second possible vacancy atop a U.S.-controlled mortgage giant, a move that could strengthen the Trump administration's hand in addressing unfinished business from the 2008 credit crisis.

September 5