Regulation and compliance

Regulation and compliance

-

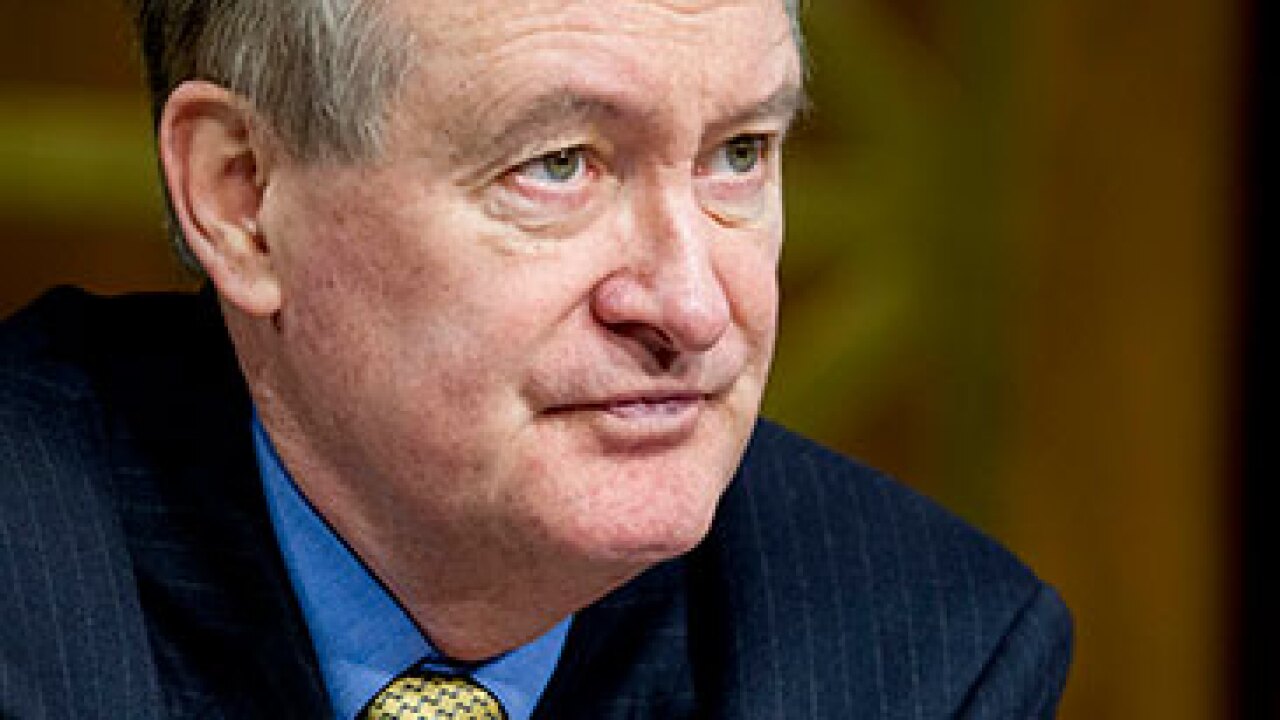

There was another surprise Tuesday as Republicans managed to keep a Senate majority following the elections, likely giving the gavel of the Banking Committee to Sen. Mike Crapo, a right-of-center Idaho lawmaker who has proven willing to reach across the political aisle in the past.

November 9 -

The New York real estate mogul Donald Trump defied all conventional wisdom by winning the presidency, a huge upset that is sending shock waves through the political and policy establishment.

November 9 -

Republican presidential nominee Donald Trump's shocking victory left world markets rattled, and financial services companies facing an uncertain future.

November 9 -

Despite more than a year of campaigning, Donald Trump remains a huge question mark when it comes to banking policies making it unclear exactly what his priorities will be now that he has upset election forecasts and succeeded in winning the White House.

November 9 -

Donald Trumps stunning upset in the presidential race is likely to embolden his followers to push for changes to Internet law that could significantly alter how financial technology is conceived, built and delivered to market.

November 9 -

Donald Trump has already done the impossible by winning the presidency, but once he takes office he may have to do so again by finding a way to pay for the across-the-board tax cuts he promised during his campaign.

November 9 -

PHH Corp. is getting out of the private-label mortgage origination business in the wake of Merrill Lynch ending its relationship, plus it is selling its Ginnie Mae servicing rights to Lakeview Loan Servicing.

November 9 -

Many issues facing President-elect Trump and the 115th Congress will have far-reaching implications for the mortgage industry. Here's a look at five of those most pressing questions awaiting elected officials when they take office in January.

November 9 -

An index to SourceMedia's comprehensive election analysis for professionals in financial services, healthcare and technology, with coverage of more than 50 contests and ballot initiatives

November 9 -

Housing was the talk of the campaign two presidential elections ago, but it stayed under the radar in the 2016 race, leaving plenty of room to speculate about President-elect Donald Trump's likely mortgage policy for the next four years.

November 9 -

U.S. Supreme Court justices signaled they may divide over the ability of cities to use the Fair Housing Act to sue banks for discriminatory lending practices that contribute to urban blight.

November 8 -

The California Department of Business Oversight imposed a fine on the Texas lender for violating restrictions on per-diem interest.

November 8 -

The Justice Department has widened its investigation of Fulton Financials mortgage lending practices to include four new units.

November 7 -

A post-crisis spike in foreclosures, the Deepwater Horizon oil spill and recent flooding in Louisiana all shaped the terms and timing of a bank deal struck in Florida.

November 7 -

Since the government-sponsored enterprises began experimenting with both frontend and backend deals in which part of the credit risk is shared with third parties, investors have been watching carefully.

November 4 -

Fannie Mae's new representation and warranty relief offers lenders a long-awaited incentive to use its automated loan validation technology. But is it enough for lenders to make the necessary technology updates and process changes to implement the tools?

November 3 -

Regulators have pressed banks to watch out for rising concentrations of commercial real estate loans. Some banks have paid heed, but others are skyrocketing past recommended thresholds.

November 3 -

The agency released a plan last week that would stipulate that newly constructed homes financed by the Federal Housing Administration would have to be elevated two feet above the 100-year-based flood level.

November 3 -

The regulator's settlement with Nomura is tied to the failures of two corporate credit unions, though Nomura did not admit fault as part of its settlement.

November 3 -

If Democrats succeed in winning control of the Senate after next week's election, the gavel of the Senate Banking Committee is likely to fall to Sen. Sherrod Brown, a progressive from Ohio who has called on the biggest banks to hold significantly more capital.

November 2