-

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

One government agency is committed to collecting new data about foreclosure sale outcomes during the current lull in activity. The industry hopes it won’t lead to developments that bog down work later.

March 8 -

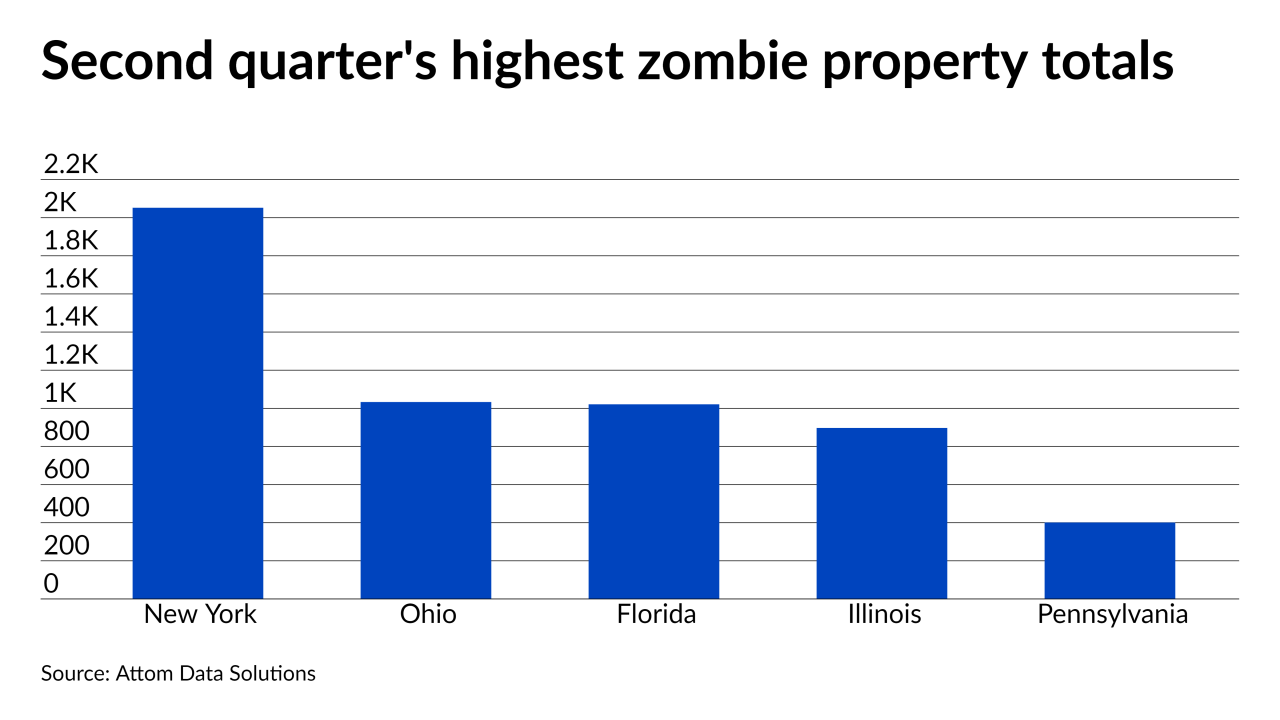

While foreclosure moratoria keep the overall numbers down, zombie foreclosure rates jumped in the majority of states, according to Attom Data Solutions.

February 25 -

With President Biden extending the moratorium, foreclosures hit an all-time low at the start of 2021 as millions of delinquent borrowers avoided entering the process, according to Attom Data Solutions.

February 11 -

The government-sponsored enterprises’ moratoria will now continue well past inauguration day, according to the Federal Housing Finance Agency.

January 19 -

While the annual total marks a 16-year low, the numbers are likely to change dramatically once government moratoria expire, according to Attom Data Solutions.

January 14 -

Recipients can’t charge penalties for, or engage in, evictions solely for nonpayment, must provide a written notice of tenant rights, flexibility in repayment and, where applicable, 30-day vacate notices.

December 24 -

The November foreclosure rate represented an 80% decline from the year before, according to Attom Data Solutions.

December 10 -

While sales increased 24% over August, they were still down 78% from the prior year, Auction.com reported.

November 24 -

While moratoria keep foreclosures low compared to last year's rates, October activity jumped 20% from September, according to Attom Data Solutions.

November 10 -

MCS isn’t the only distressed mortgage services entity gaining interest from investors as poor economic conditions threaten more hardships for homeowners.

October 6 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

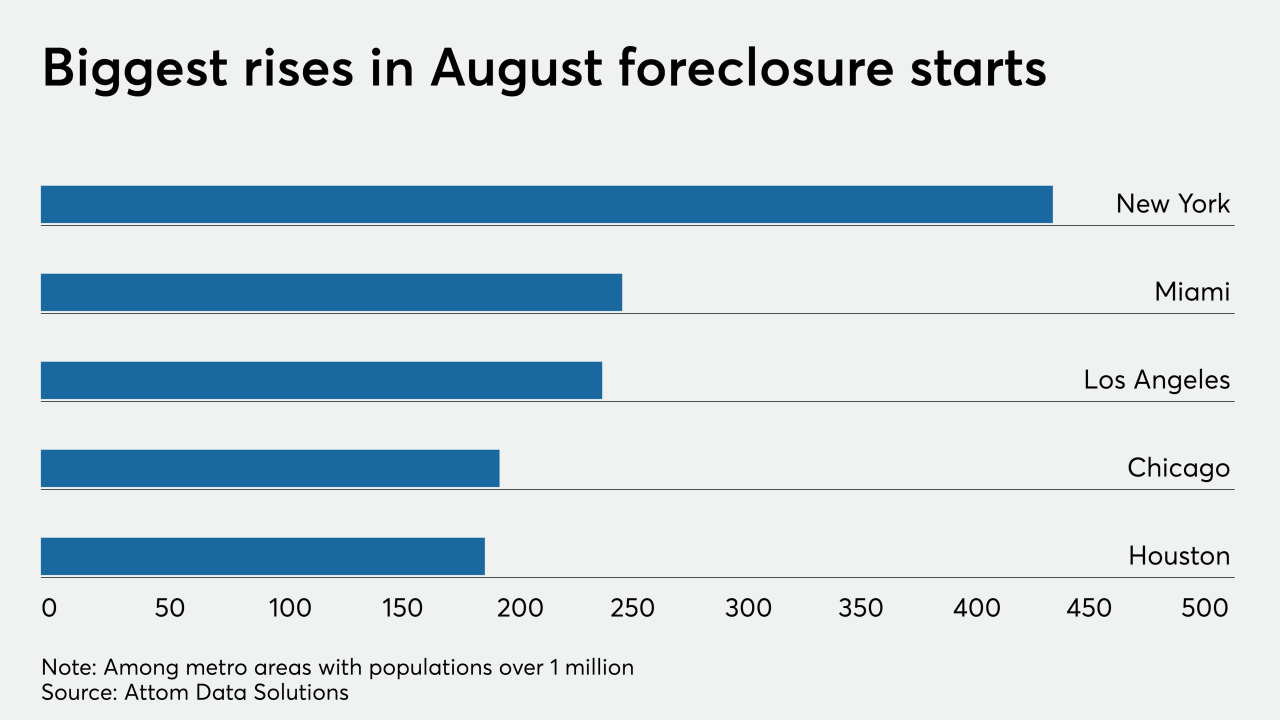

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

With the moratorium still in place, mortgage foreclosure activity fell 83% in July compared to the year before and 4% from June, according to Attom Data Solutions.

August 13 -

A strong housing market prior to the pandemic and the subsequent coronavirus-related moratorium helped to pull foreclosure activity down to historic lows in the first half of 2020, though that could all change soon, according to Attom Data Solutions.

July 17 -

Blackhawk Community Credit Union sold the buildings it acquired in lieu of foreclosure to Rock Renaissance Partnership for $165,000.

June 19 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

Pittsburgh rose from the ash heap of the Great Recession and then became one of the hottest cities in the country for real estate flippers.

March 3