-

The bank is siding with a growing list of groups, including the U.S. trustee, attorneys general from several states and consumers, who object to Ditech's plan to sell its reverse mortgage business.

July 23 -

Liberty Home Equity, a subsidiary of Ocwen Financial, is offering a new private-market alternative to Federal Housing Administration-insured reverse mortgages.

July 22 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

After hiring half the laid-off staff from Live Well Financial, Open Mortgage plans to engineer a careful transition to operating as a larger-scale business.

June 25 -

Live Well Financial's creditors are seeking a court-supervised bankruptcy, but the mortgage lender is opposing the move, saying it can get more for certain assets if it sells them before filing.

June 19 -

Ditech Holding Corp. has entered into purchase agreements with New Residential Investment Corp. and Mortgage Assets Management, in which each would acquire certain assets in the company's Chapter 11 bankruptcy.

June 18 -

Roughly 50 of the more than 100 staff members Live Well Financial let go after it stopped funding loans will join Open Mortgage, a multichannel lender in expansion mode.

June 5 -

Issuance of mortgage-backed securities increased and came close to matching 2018 levels in the latest month tracked by Ginnie Mae.

May 14 -

The Michigan company said the loan — made to a borrower that plans to shut down its reverse mortgage business — has collateral.

May 13 -

Live Well Financial, a reverse and traditional mortgage lender that abruptly stopped originating on May 3, will lay off 103 employees, according to a Virginia Employment Commission filing.

May 7 -

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Homeowners in Chicago cheated by a mortgage fraud scheme are seeking to form a committee to protect their interests in the bankruptcy of Ditech Holding Corp., the company that owns their loans.

April 23 -

University Bancorp gained a number of offices from Huron Valley Financial. It also hired lenders and staff with experience in reverse mortgages and wholesale lending.

March 23 -

A pair of professors with industry ties say reverse mortgages deserve a second look, partly because of a series of federal reforms in recent years designed to protect taxpayers and consumers.

March 13 -

While millennials comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

March 4 -

Home equity loans the Federal Housing Administration offers to older borrowers are in a better position now that the government shutdown has temporarily ended.

January 28 -

While most single-family Federal Housing Administration lending is somewhat insulated from the government shutdown, the impasse is doing more to hurt funding in niches like nursing home loans and reverse mortgages.

January 18 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Class Valuation, a Troy, Mich.-based appraisal management company, acquired Landmark Network, which specializes in providing valuation services for reverse mortgages.

December 18 -

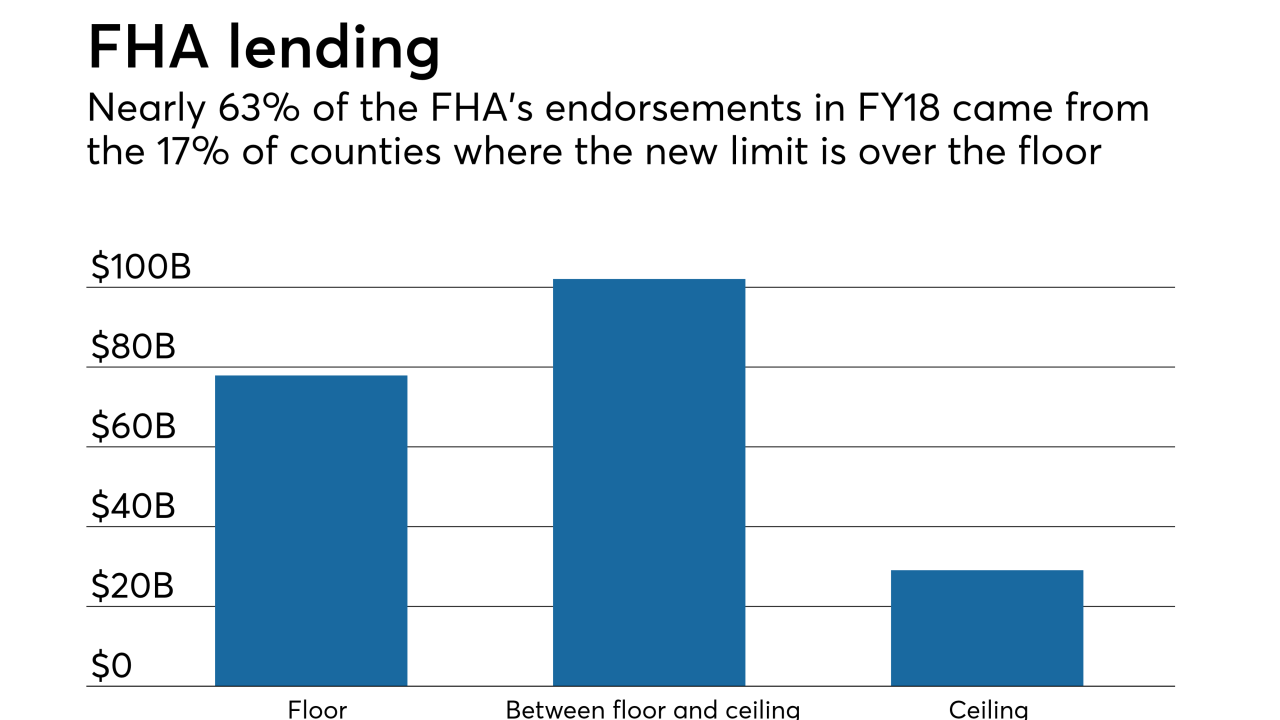

The Federal Housing Administration mortgage loan limit will increase by approximately 7% for next year, mirroring the rise for conforming loans.

December 14