-

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Homeowners in Chicago cheated by a mortgage fraud scheme are seeking to form a committee to protect their interests in the bankruptcy of Ditech Holding Corp., the company that owns their loans.

April 23 -

University Bancorp gained a number of offices from Huron Valley Financial. It also hired lenders and staff with experience in reverse mortgages and wholesale lending.

March 23 -

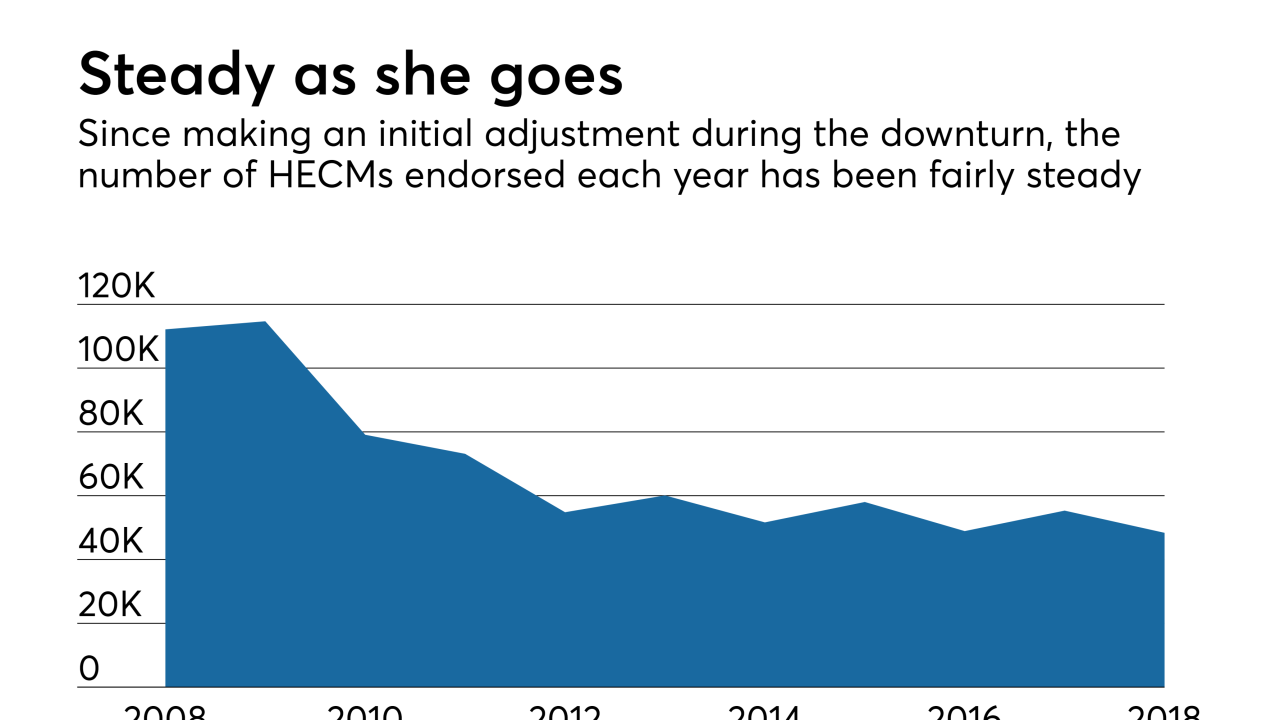

A pair of professors with industry ties say reverse mortgages deserve a second look, partly because of a series of federal reforms in recent years designed to protect taxpayers and consumers.

March 13 -

While millennials comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

March 4 -

Home equity loans the Federal Housing Administration offers to older borrowers are in a better position now that the government shutdown has temporarily ended.

January 28 -

While most single-family Federal Housing Administration lending is somewhat insulated from the government shutdown, the impasse is doing more to hurt funding in niches like nursing home loans and reverse mortgages.

January 18 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Class Valuation, a Troy, Mich.-based appraisal management company, acquired Landmark Network, which specializes in providing valuation services for reverse mortgages.

December 18 -

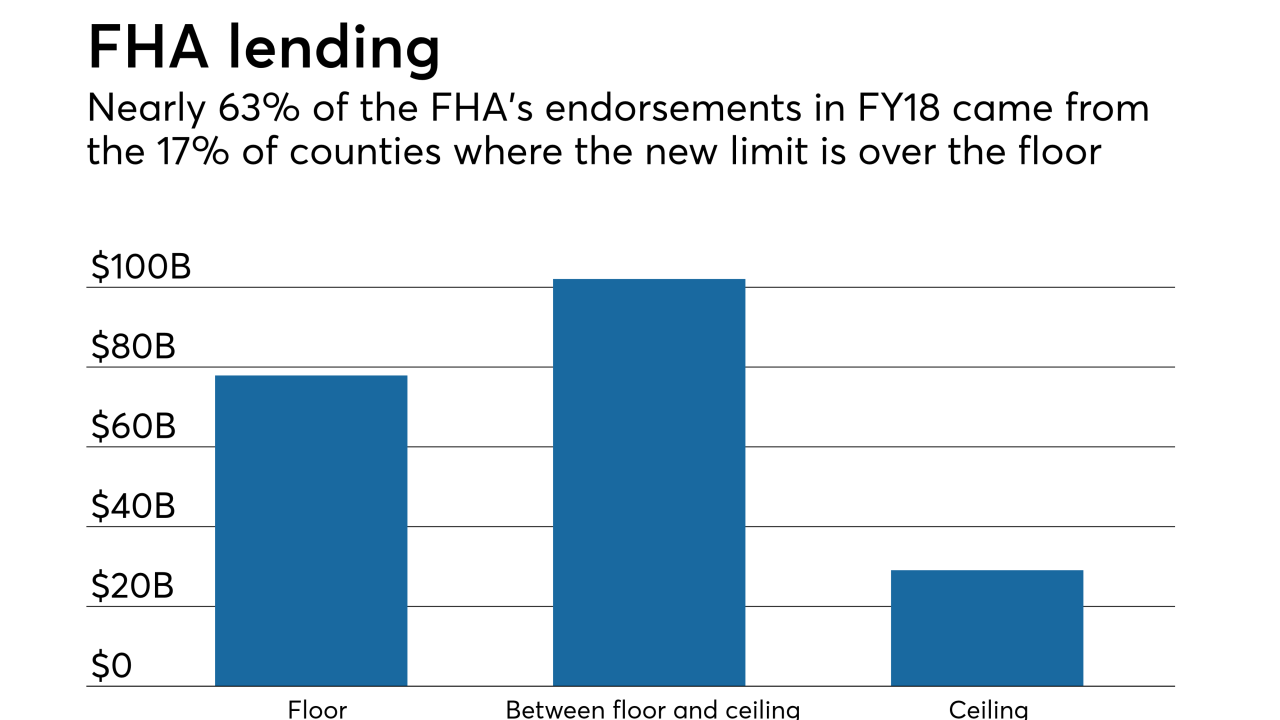

The Federal Housing Administration mortgage loan limit will increase by approximately 7% for next year, mirroring the rise for conforming loans.

December 14 -

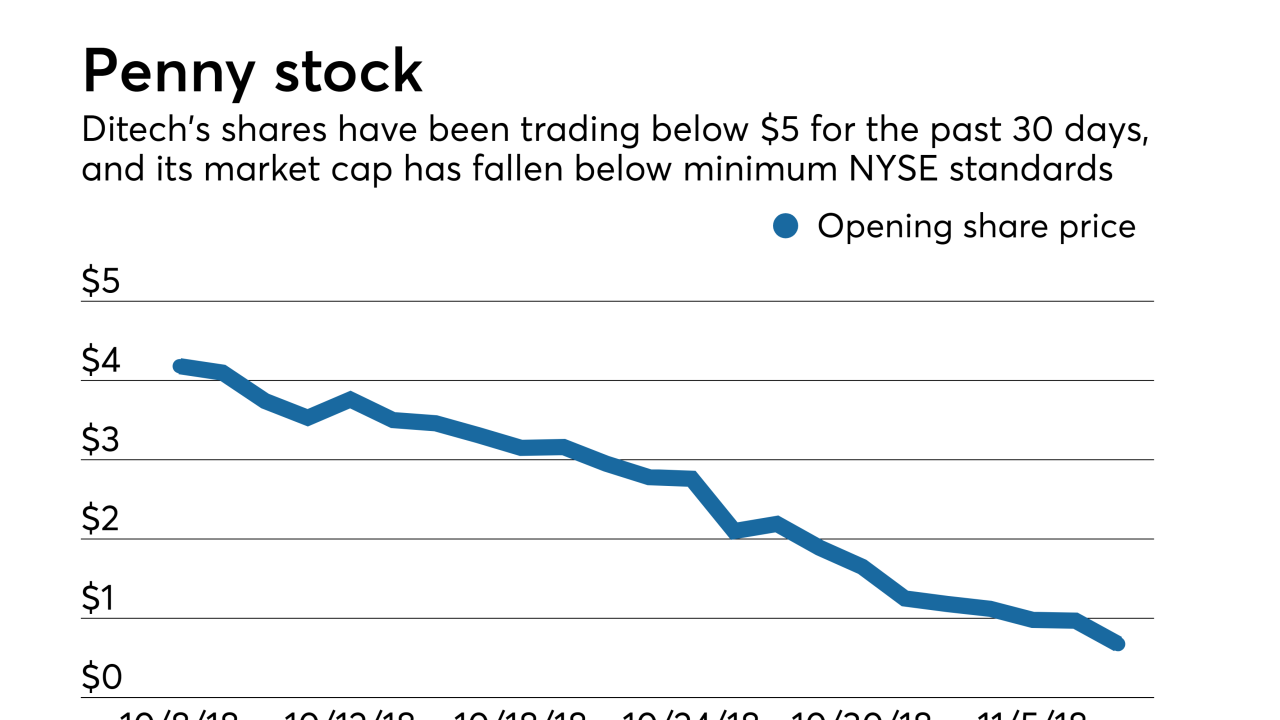

A reduction in Ditech Holdings' quarterly net loss fell short of what the company needed to avoid the possibility of another Chapter 11 filing.

November 15 -

The mortgage insurer’s annual actuarial report showed strength in the agency’s capital reserves even though losses in the “home equity conversion mortgage” program are still a problem.

November 15 -

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Ocwen Financial Corp. recorded a deeper quarterly loss of $40 million after acquiring PHH Corp., but still expects the deal's economies of scale to eventually lower costs and restore profitability.

November 6 -

As the Federal Housing Administration prepares to release its annual actuarial report this month, the industry is questioning how the reverse mortgage program fits into the agency's future.

November 2 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

The $571 million transaction is backed by 915 loans originated from 2002 and 2008 that Waterfall Asset Management acquired over eight years.

November 1 -

The Federal Housing Administration is making it easier for reverse mortgage servicers to submit insurance claims by expanding the types of supporting documentation it will accept on defaulted loans.

October 22 -

ReverseVision and Stratmor Group are building a benchmark for Home Equity Conversion Mortgages that could help determine how well these Federal Housing Administration loans serve seniors.

October 17 -

Ex-Ginnie Mae President Joseph Murin is among several industry veterans joining Ainsworth Advisors, a consultancy run by former mortgage banker David Lykken and former Texas Capital Bank executive Gary Ort.

October 15