-

The combination of rising rates and real estate prices has made home buying less affordable, reviving interest in a product that lets consumers borrow against the future equity of their homes.

April 3 -

Risk management concerns were responsible for a five-percentage-point reduction in bank non-qualified mortgage lending last year.

March 31 -

Loan defects are inching upward in a market where higher rates could lead to more fraud risk.

March 31 -

PHH Corp. President and CEO Glen Messina will step down in June at the company's annual meeting.

March 30 -

Home affordability is near lows last seen post-crisis but there is hope wage growth that is outpacing home prices in many counties could reverse or slow the trend.

March 30 -

The industry expects to lean on technological efficiencies this year as higher rates and dwindling refinances test their businesses.

March 28 -

Fintech could cut the closing times on the simplest home loans by more than 50%, but the mortgage business' complexity means there are limits to how much time and money can be saved.

March 28 -

Fannie Mae has obtained reinsurance for $510 million of credit losses on $20.4 billion of single-family residential mortgages through a pair of credit insurance risk transfer transactions.

March 24 -

With refinance volume shrinking, some lenders are making up the difference by turning to alternative loan products for borrowers with lower credit scores.

March 23 -

Higher interest rates have reduced prepayments to levels not seen since 2014.

March 23 -

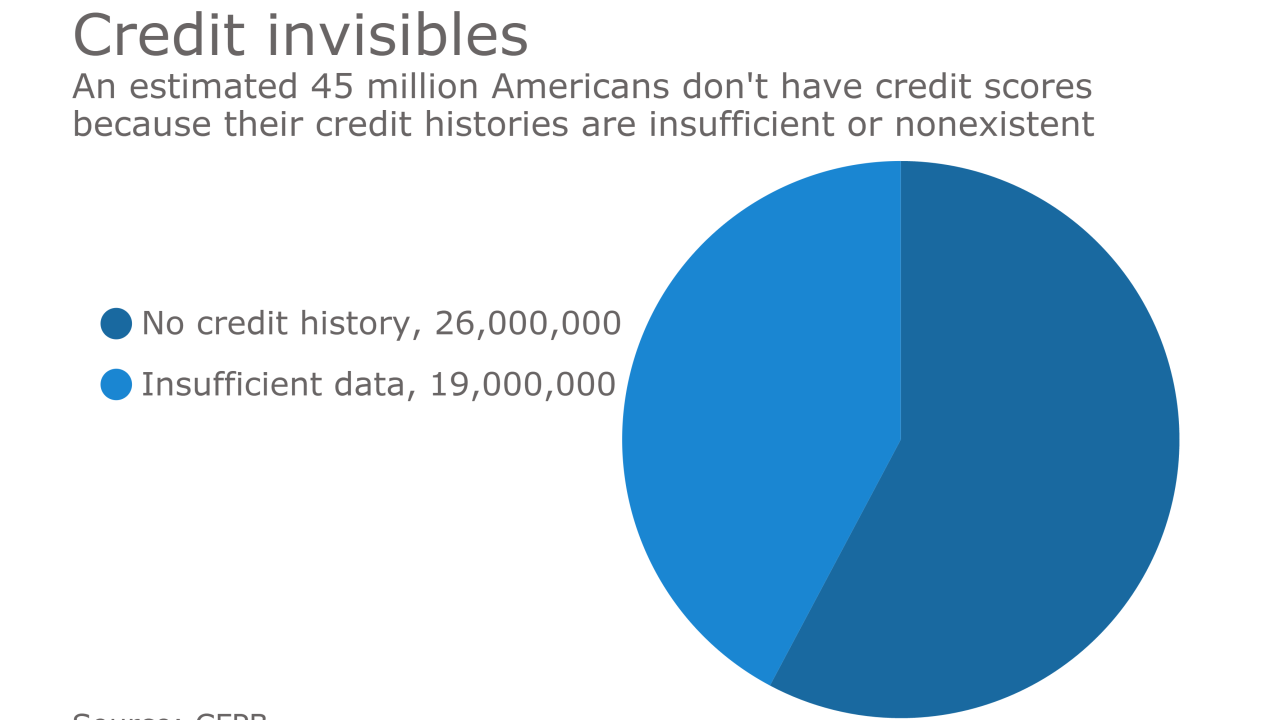

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

Servicers are able to borrow more against their Ginnie Mae mortgage servicing rights as financing providers become more comfortable with the collateral.

March 23 -

Shellpoint is marketing another offering of private-label mortgage bonds backed primarily by loans it acquired rather than loans originated by its own New Penn subsidiary.

March 20 -

A startup lender is catering to tech-savvy, do-it-yourself borrowers by using online and mobile tools to replace the upfront sales and marketing work of salespeople.

March 17 -

Soaring home values have property taxes on the rise. Servicers must be vigilant about borrower payment shock that can add complexity to escrow services and portfolio management. Here's a look at the states with the largest tax hikes.

March 16 -

A $165 million cash settlement has been reached in a class-action lawsuit that alleged investors were misled about the safety of mortgage-backed securities comprised of loans originated by now-defunct subprime lender NovaStar Mortgage Inc.

March 15 -

Walter Investment Management Corp. narrowed its fourth-quarter losses, as disappointed CEO Anthony Renzi called the nonbank lender and servicer's third consecutive annual loss "not acceptable."

March 14 -

Freddie Mac is preparing a transaction that transfers credit risk on $640 million of super-conforming residential mortgages.

March 9 -

Mill City Holdings is returning to market with its fourth securitization of reperforming residential mortgages, this time with a sliver of home equity lines of credit added to the mix of collateral.

March 9 -

Altisource Portfolio Solutions has launched a new mortgage trading platform for mortgage bankers and loan investors.

March 6