-

Agency mortgage-backed security prepayment speeds increased in February with much of the refinance activity coming from newer loans and those with high coupons, a report from Keefe, Bruyette & Woods said.

March 11 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

Och-Ziff Capital is suing BNY Mellon, as trustee, to compel it to calculate interest in a way that is more favorable to the class of securities it holds.

February 6 -

Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

February 1 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

A security lapse left millions of mortgage records exposed online without proper data protections, according to security researchers.

January 23 -

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

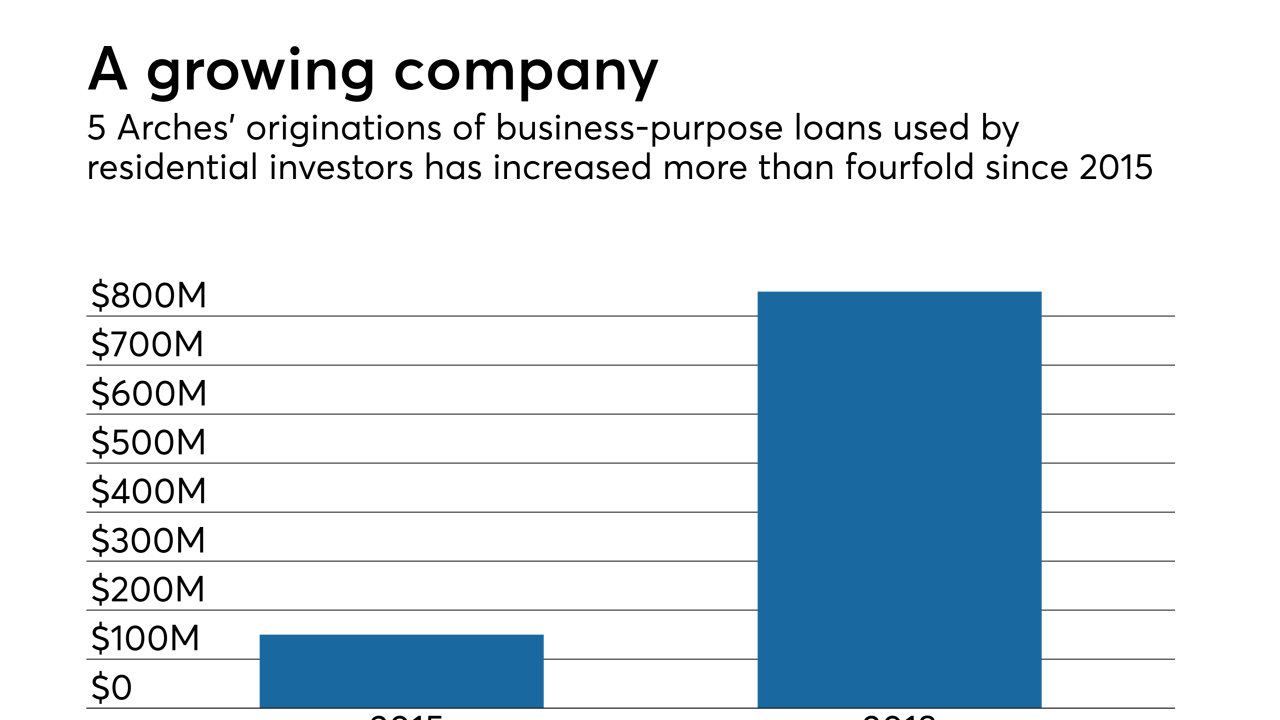

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23