-

Approximately two-thirds of millennial and Gen-Z renters expect to purchase a home in the next five years, although their aspirations for homeownership slipped from a year ago, a Pulsenomics survey found.

June 12 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

Manhattan condo owners who've enjoyed property-tax reductions are heading for the exits of their posh buildings as their breaks are set to expire.

June 4 -

President Trump's tax reform package had an impact on nearly half of potential buyers searching for a new home, nine percentage points less than one year ago, according to a new Redfin survey.

May 17 -

Angelo Mozilo had a front-row seat during the collapse in housing prices a decade ago. Now the former chief executive officer of Countrywide Financial Corp. is predicting another drop, and for some homeowners it may be even worse.

May 9 -

Consumers always want more bang for their buck and are moving to places where their dollar goes further. With that as a driver, here's a look at the 10 hottest housing markets homebuyers are flocking to, according to Redfin.

May 6 -

Tax reform leaves mortgage-related deductions far too low to help the average homeowner this tax season, in contrast to last year, when they slightly exceeded the standard deduction.

April 15 -

From Syracuse, N.Y., to Lake Havasu City, Ariz., here's a look at the top 12 cities where property taxes are skyrocketing, signaling a potential strain on some homeowners' ability to make mortgage payments.

April 10 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

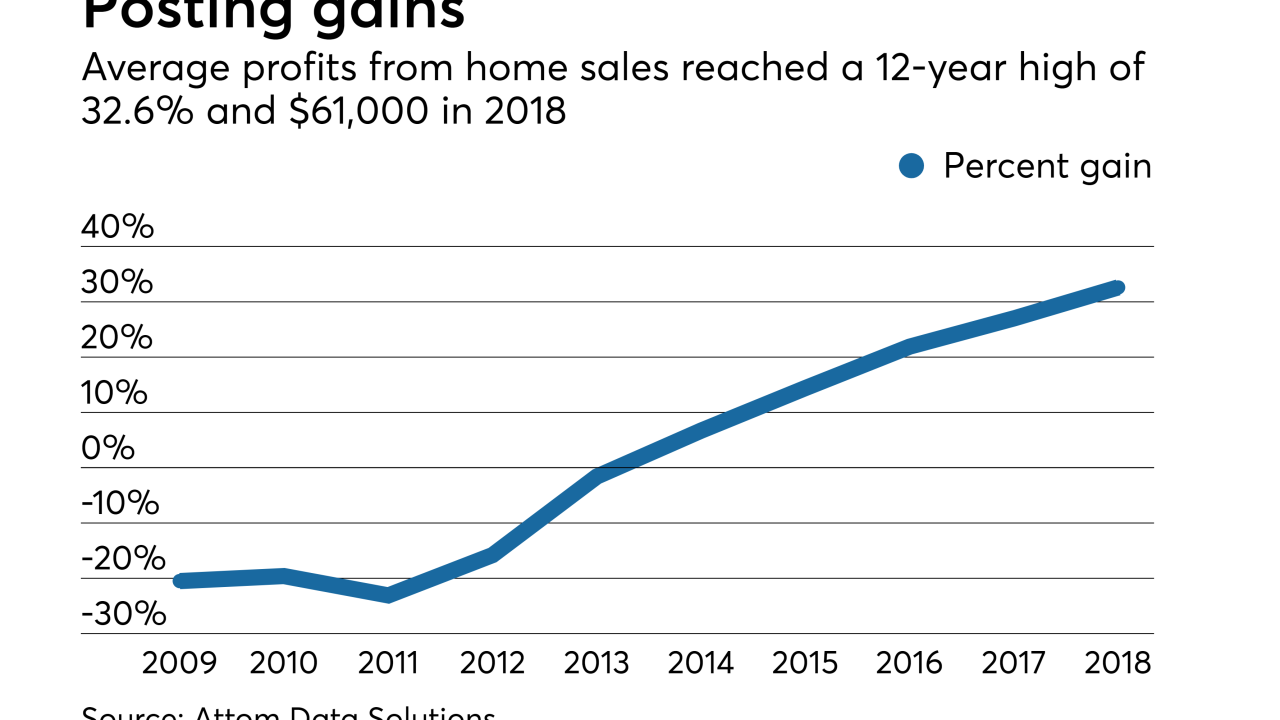

While home sellers gained the most money on their houses since 2006, the fading impact of tax cuts and slow rise of mortgage rates could shorten upcoming margins, according to Attom Data Solutions.

January 31 -

Being a homeowner may not be the most cost efficient move in some areas.

January 15 -

Manhattan home prices fell in the fourth quarter, with the median slipping to less than $1 million for the first time in three years, as ample inventory continued to allow buyers to demand sweeter deals.

January 3 -

New York Gov. Andrew Cuomo has signed into law a bill that provides a property tax break for Syracuse property owners who buy flood insurance.

January 3 -

Builder M/I Homes set third-quarter records in four areas and recorded consistent levels of mortgages held for sale in its most recent earnings results.

October 24 -

Lower corporate tax rates weakened the incentive for developers to use the Low-Income Housing Tax Credit program, which could prompt affordable housing construction to fall by as much as 40% by 2022, according to data aggregator Reis.

September 25 -

Thirty states told the Council of Development Finance Agencies they issued mortgage revenue bonds in 2017 compared to only 18 that issued mortgage credit certificates.

September 21 -

A man from Hialeah, Fla., will face sentencing in November after pleading guilty to conspiracy in an $8 million mortgage and tax-refund scheme.

September 12 -

Multiple agencies are looking into its purchase of certain credits tied to low-income housing developments, the bank said in a securities filing Friday.

August 3 -

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

From medical expenses to home improvements, here's a look at some of the most frequently cited reasons homeowners are borrowing against their home equity.

June 26