For the first time since early September 2022, the Freddie Mac Primary Mortgage Market Survey has the 30-year below 6%, but the 15-year gained this week.

Even with the increase in business, Fidelity National Financial reported a net loss for the period, a result of the stock distribution for its life unit.

The sector has specialized data that experts can help with and may mitigate cyclical risk, but costs and customers are considerations, an industry veteran says.

-

Aulene Wessel also previously worked in the fintech sector, and will be heading up accounting in her new post at the nonbank mortgage lender and servicer.

-

The bank announced Tuesday its Blueprint for Housing Opportunity plan, a five-year commitment dedicated to increasing the supply of housing.

-

Competitive credit could offer nine-figure cost benefits, according to a study VantageScore cited. FICO, which just added a new borrower tool, disagrees.

-

President Donald Trump talked about institutional single-family home ownership and housing affordability, as well as inflation, but left credit card rate caps, debanking and even crypto alone at the State of the Union address.

-

Judges on the U.S. Court of Appeals for the District of Columbia struggled to find a resolution to an injunction issued last year that halted reductions-in-force by the Consumer Financial Protection Bureau.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

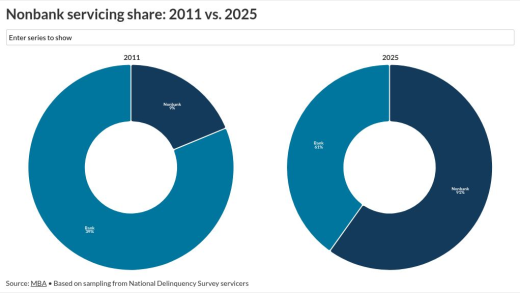

Bowman's Basel III relief may ease MSR capital but won't bring banks back; risk weights and economics still favor nonbanks, according to the Chairman of Whalen Global Advisors

-

Treasuries rallied and broke key levels, but stubborn 5-year resistance still caps momentum and rate-cut expectations remain unchanged, the CEO of IF Securities writes.

-

The 5-year yield swung sharply after conflicting BLS jobs and CPI data, with softer inflation boosting rate-cut hopes, according to the CEO of IF Securities.

Big players, Wall Street and tech firms stand to gain. Community lenders call for policymakers to protect g-fee parity and the cash window. Part 5 in a series.

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

-

The CFPB is in an existential legal brawl against it's own acting director, Russell Vought, and President Donald Trump, whose confirmed goal is to kill the agency.

- UPCOMING LIVESTREAMThursday, March 19, 20261:00 p.m. / 10:00 a.m.

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- Partner Insights from Hyland

- Partner Insights from Plaid

-

-