A federal judge in Pennsylvania ruled the debtor could not prove she was injured by any alleged conduct by Nationstar or other defendants WSFS and A&D.

The mortgage numbers are a welcome boost to a market that has struggled to overcome high costs and prolonged economic uncertainty.

As forbearance starts to rise due to the fires, servicers that have just gotten a respite from hurricanes recoveries will have to gear up again.

A California judge dismissed 13 claims against United Wholesale Mortgage that alleged the lender disclosed personal information to third parties.

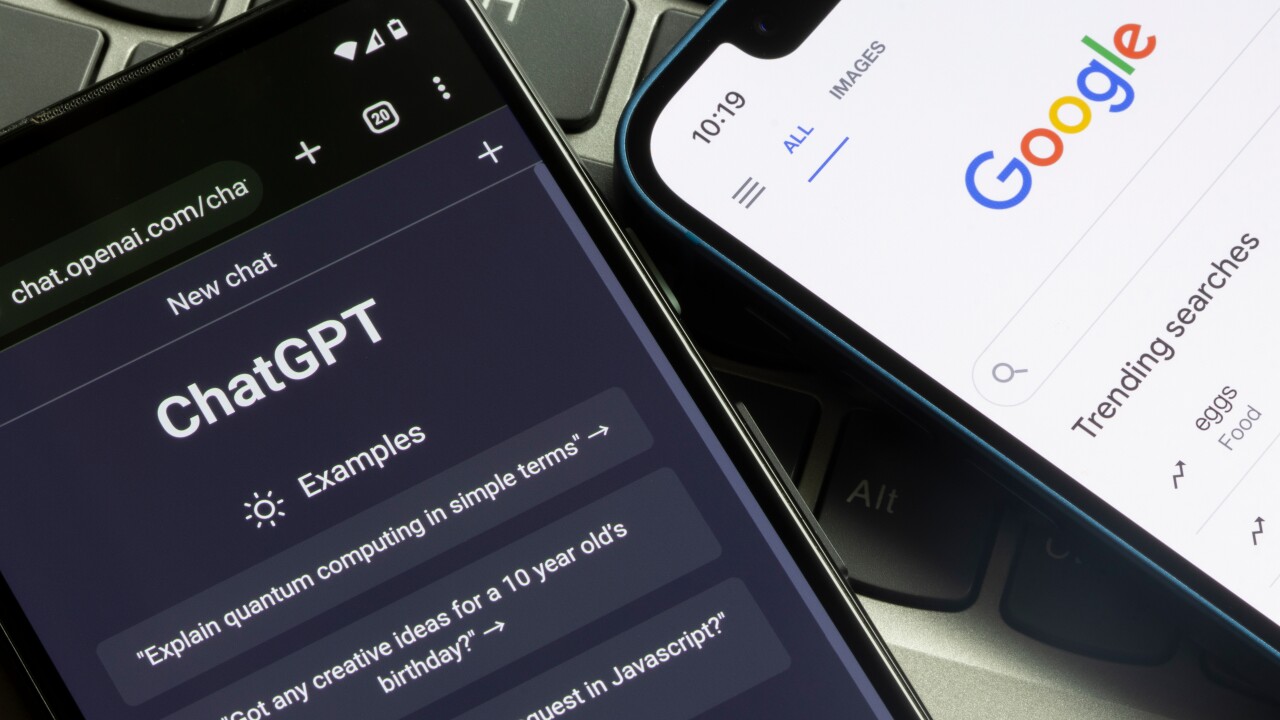

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

-

A recent Remax survey found 88% of respondents said they are "very" or "somewhat likely" to purchase a home next year.

-

The Trump administration's decision not to seek funding for the CFPB and transferring remaining enforcement cases to the Department of Justice were cited as reasons for the resignation of Michael G. Salemi, who took over as CFPB enforcement chief earlier this year.

-

New York developers are transforming struggling office buildings into more than 12,000 new apartments in a bid to help offset the city's worst housing crisis in decades.

-

Bank statement loans, a home equity credit card and a blockchain investment product are among the new offerings designed to reach an $11 trillion market.

-

A bipartisan housing provision has emerged as a critical negotiating point for passage of an uncommonly bank-relevant defense authorization bill.

-

Delinquency trends split in Q3, with securitized and agency loans showing more strain while banks and life companies saw small improvements amid uneven vacancy and rent conditions.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

-

There is a real possibility of a large, nonmortgage brand coming into the industry and consolidating a disjointed loan origination process.

-

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from CBCInnovis

- Sponsored by Capsilon

- Partner Insights from Global DMS

- Partner Insights from DocMagic