The Consumer Financial Protection Bureau has withdrawn guidance that allowed states to bring enforcement actions broadly under federal consumer protection laws.

Relying on hope, as implied in the "survive until '25" slogan, is not a business strategy that will get a company through the year.

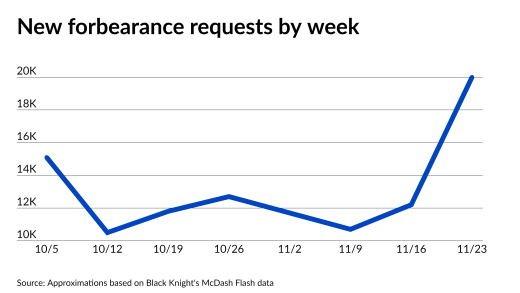

Like the stock market rout around news of the Omicron variant, the recent increase in payment suspensions suggests financial troubles associated with the pandemic may not be over.

Joe Crawford is Director of Professional Services at Glassbox, where he helps banks and financial institutions unlock insights from customer engagement data. He brings over 20 years of experience in enterprise monitoring, digital analytics, and performance engineering from leadership roles at Citi, Morgan Stanley, and AT&T. Joe specializes in applying behavioral data and AI to improve digital experiences and reduce operational risk.

The 30-year conforming fixed rate mortgage ended this week at its lowest since last Oct. 17, helped by bond traders pricing in a reduction in short-term rates.

-

The equity-backed loan offers Rocket customers funds for down payments and closing costs on a new purchase while giving them six months to sell their existing property.

-

Federal Reserve Chair Jerome Powell testified in the House Tuesday on the heels of yet another pointed social media post from President Donald Trump. But House Republicans largely avoided landing political blows against the central bank chair.

-

The Consumer Financial Protection Bureau cut short a five-year agreement with Bank of America Corp. over the bank's alleged submission of false mortgage data as the significantly curtailed government agency rolls back a bevy of settlements.

-

Transparency has improved for mortgages but associations still lack access and insurance is a challenge in efforts to balance access to housing with safety.

-

Regulatory changes after the Surfside collapse are making more condos nonwarrantable, which presents some opportunities while also complicating mortgage access.

-

Senate Republicans are coming around to the $40,000 cap on state and local tax deduction key House lawmakers demand in President Trump's massive tax package.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

When choosing either to fight or take flight, in the mortgage industry it is causing significant M&A activity.

-

Getting the prep work done now for creating next year's business plan.

-

Multiple companies have allegedly used borrowers maternity/parental leave status to delay or deny loans. This is in violation of the law and alienates a key group of borrowers.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland