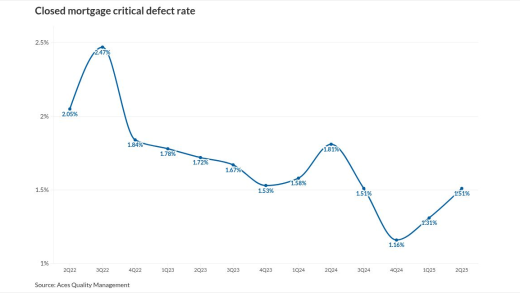

Application error findings rose over 15%, the second quarter in a row they have moved higher, the post-closing file review from Aces Quality Management found.

The massive lender and servicer continues to tout its recapture opportunity, with a quarter of its $700 billion portfolio holding note rates above 6%.

Borrowers with new foreclosure filings also grew, but the number of loan modifications decreased, according to the Office of the Comptroller of the Currency.

Diane Kennedy, CPA, is head of tax education for

Ran Harpaz is founder and CEO of

-

Federal Reserve bank supervisors are monitoring community and regional banks' commercial real estate portfolios amid concerns over "lower commercial property values," the agency said.

-

Fortress has been one of the most active home equity investment firms in November, investing $1 billion in Cornerstone.

-

Perceived risk among lenders may result from a struggle to fully understand what the technology can and won't do as advocates tout its efficiency and speed.

-

Now that the Consumer Financial Protection Bureau has refused to request funding from the Federal Reserve System, many experts see the case making its way to the Supreme Court.

-

If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

-

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Many mortgage servicers are still relying on spreadsheets to manage their tasks, rather than looking to automation as a problem solver.

-

For the mortgage industry, the question of whether the Fed can control its target range for interest rates is crucial for managing volatility.

-

The ways in which hedging can be improved by a digital process are more often than not presumed versus proven by industry practice.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Sponsored by Tavant Technologies

- Sponsor Content from Enterprise America, Inc.

- Partner Insights from IDS

-