The Federal Housing Finance Agency said it is reviewing more than 9,000 pages of records tied to fraud tips submitted through a hotline launched last April.

Some mortgage companies are taking advantage of a loan-interest deduction that was designed to benefit community banks, a Washington State legislator alleged.

The sector has specialized data that experts can help with and may mitigate cyclical risk, but costs and customers are considerations, an industry veteran says.

-

Judges on the U.S. Court of Appeals for the District of Columbia struggled to find a resolution to an injunction issued last year that halted reductions-in-force by the Consumer Financial Protection Bureau.

-

Federal Deposit Insurance Corp. report shows margins widened and profitability remained high even as credit quality saw some wobbles from consumer and commercial loan portfolios.

-

Federal Reserve Bank of Chicago President Austan Goolsbee said the central bank should focus on getting inflation to its 2% target before making any additional cuts to short-term interest rates.

-

Gatti will be based in the firm's Washington, D.C. office, where he focuses on structuring and executing asset-backed securities deals and other structured finance transactions.

-

The CFPB is in an existential legal brawl against it's own acting director, Russell Vought, and President Donald Trump, whose confirmed goal is to kill the agency.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

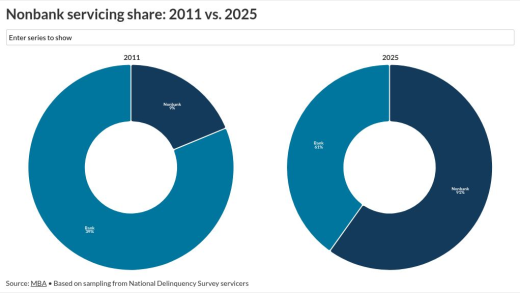

Bowman's Basel III relief may ease MSR capital but won't bring banks back; risk weights and economics still favor nonbanks, according to the Chairman of Whalen Global Advisors

-

Treasuries rallied and broke key levels, but stubborn 5-year resistance still caps momentum and rate-cut expectations remain unchanged, the CEO of IF Securities writes.

-

The 5-year yield swung sharply after conflicting BLS jobs and CPI data, with softer inflation boosting rate-cut hopes, according to the CEO of IF Securities.

Big players, Wall Street and tech firms stand to gain. Community lenders call for policymakers to protect g-fee parity and the cash window. Part 5 in a series.

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

- UPCOMING LIVESTREAMThursday, March 19, 20261:00 p.m. / 10:00 a.m.

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- Partner Insights from Hyland

- Partner Insights from Plaid

-

-