From reduced demand for auto loans to a slowdown in mergers and acquisitions, here's some of the new trade war's potential fallout for lenders.

Borrowers in the $1.4 billion Marcus portfolio could be mined for first-time home buyer leads, a BTIG report speculated.

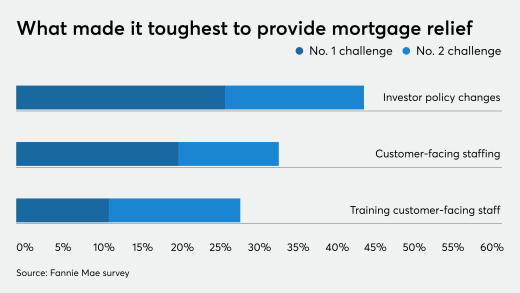

Changes in rules related to repayment options and refinancing criteria have complicated servicers’ lives, but otherwise this crisis hasn’t been as bad as that of 2008, a Fannie Mae survey finds.

Faheem Shakeel,

One loan sale is planned for Wednesday, while the other is tentatively happening in September. All-in-all, the two offerings are worth close to $1 billion.

-

In a dramatic move, conservative hardliners blocked President Donald Trump's tax and spending bill, which would have included many measures favored by banks.

-

Servicing profit offset origination losses for some companies, but more than 40% were unprofitable, according to the Mortgage Bankers Association.

-

Lenders using an automated process can save up to $1,500 per loan but do they have the capacity to pass those through to applicants as the FHFA director asks?

-

CSBS hires veteran regulatory expert, Selene welcomes two new executives, Polly grows C-suite, Leaderone finds new president, plus more mortgage moves.

-

Housing starts increased in April as a pickup in multifamily home construction more than offset a decline in single-family dwellings caused by elevated inventory.

-

Sean Grzebin discusses his plans to leverage JPMorgan Chase's massive consumer audience to pick up mortgage market share.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Although the rule faces justified concerns, the regulatory agencies have been receptive to insights provided by lenders most affected.

-

We're hearing as this is a holiday week, it seems fitting that my blog post focus on a recent vacation.

-

Like schoolyard bullies, cyberbullies scan the financial marketplace looking for weakness to exploitand they may have found it in smartphone and tablet applications.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland