Fortress has been one of the most active home equity investment firms in November, investing $1 billion in Cornerstone.

Among the nation's 50 largest metropolitan areas, 25 had annual price increases in July, while the others recorded price declines, Zillow found.

The private mortgage insurers reported just 5% less business versus the third quarter and 33% more new insurance written over the fourth quarter 2023.

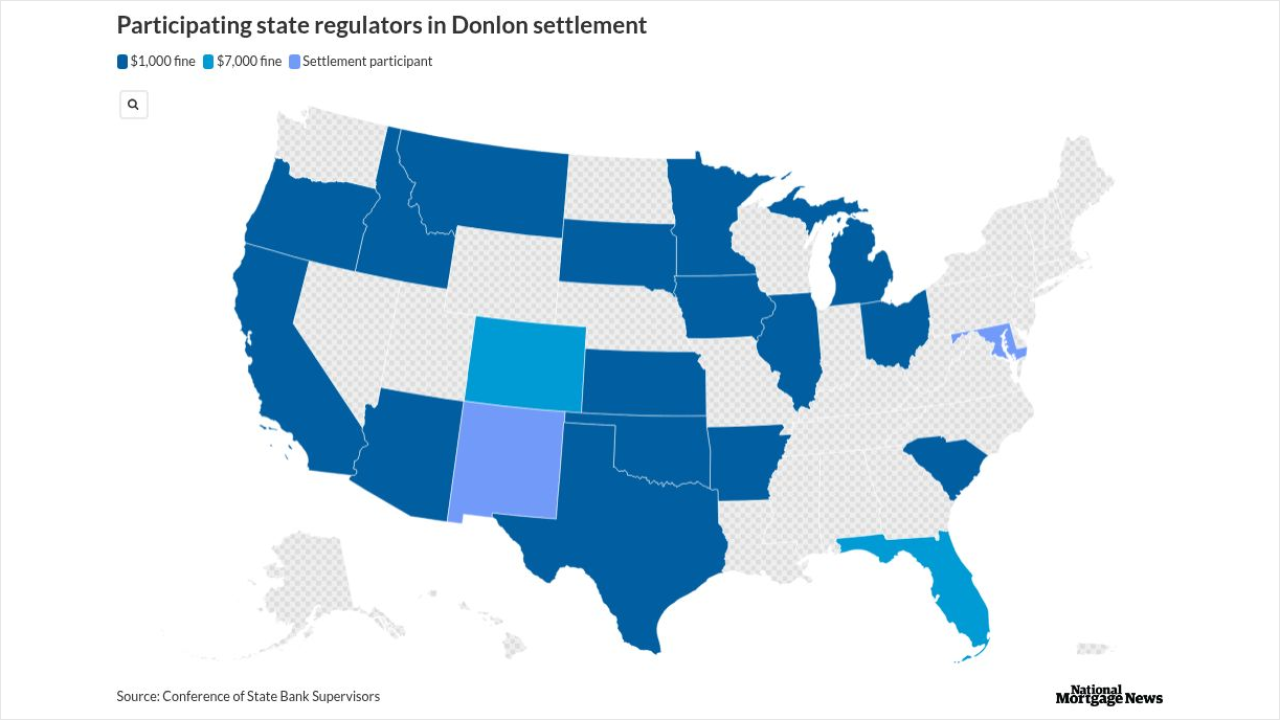

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

-

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

-

The decision in a New York case that is also undergoing federal review puts pressure on related parties to get things right within a statute of limitations.

-

Democratic senators are calling for Senate Banking Committee Chairman Tim Scott to compel the acting director of the Consumer Financial Protection Bureau to testify.

-

An influx of adjustable-rate and cash-out refinance mortgage programs during the month pushed the Mortgage Credit Availability Index 0.7% higher in November.

-

Home Depot Inc. is offering cautious preliminary guidance for next year, a sign that the home-improvement retailer doesn't anticipate the housing market to rebound in the short term.

-

In a new interpretive letter, the Office of the Comptroller of the Currency will allow banks to serve as middlemen for "riskless" crypto trades, extending existing brokerage authority for securities to digital assets.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

-

Congress should act in the next relief bill to provide the additional resources needed to build more affordable housing.

-

By providing flexibility for property tax payments localities can help keep local businesses going and maintain their tax base for the future.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from Informative Research

- Partner Insights from New American Funding

- Partner Insights from Cloudvirga

- Partner Insights from DocMagic