A group of 22 Democratic state attorneys general filed a lawsuit against acting Consumer Financial Protection Bureau Director Russell Vought, the bureau and the Federal Reserve, arguing that the administration's position that the CFPB cannot be funded is wrong.

The new platform already counts two businesses as embedded partners, with the rollout coming as mortgage leaders see rising demand coming for DSCR loans.

The anti-evasion exception introduced during the Covid-19 pandemic provided servicing flexibility to help borrowers struggling for many reasons, ABA said.

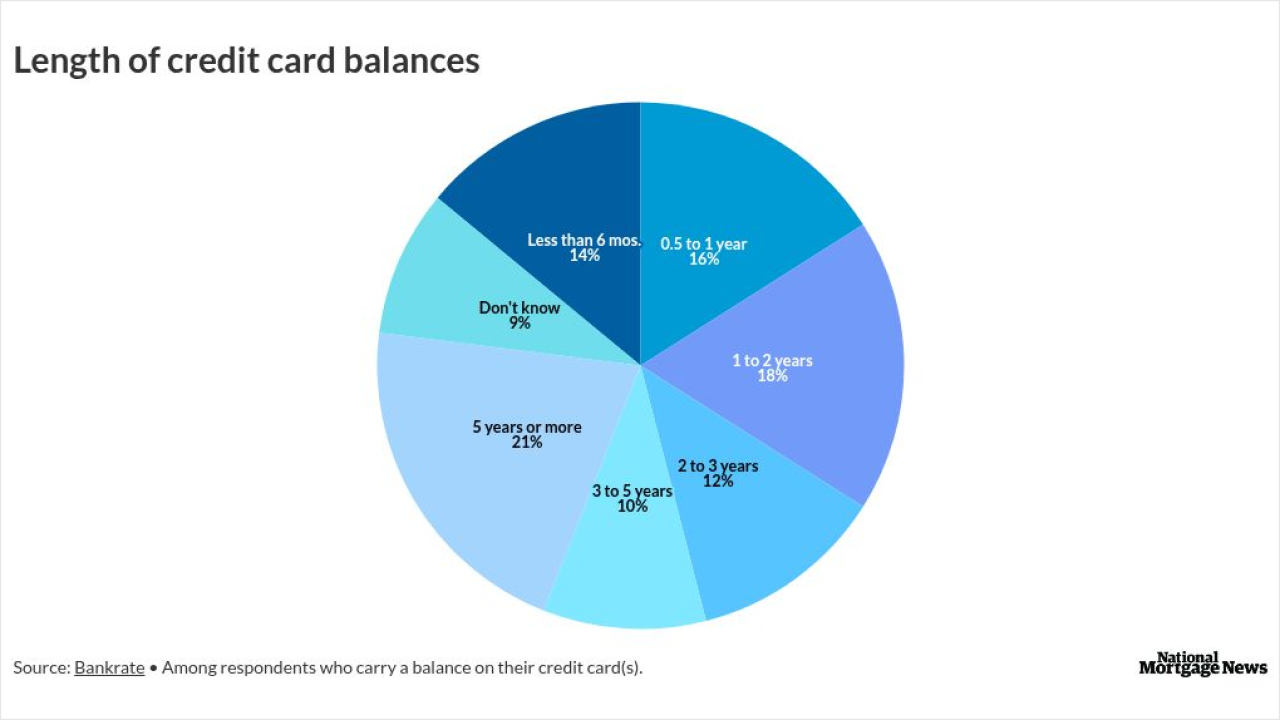

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

-

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

-

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

-

Three U.S. senators opened an inquiry into insurance ratings firm Demotech and whether its assessments may be exposing taxpayers to growing risks tied to climate-driven insurer failures.

-

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

-

As CFPB oversight recedes, servicers are turning to FHA, VA and state rules for guidance, with distressed loan compliance, redefaults and local registration risks rising in 2026.

-

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

As the real estate finance industry transitions from the highs and lows of the COVID era into the new normal of 2022, industry standards will continue to play a key role in helping us solve ongoing business challenges, regardless of the market environment, writes the president of MISMO.

-

Former principal economist at the Federal Housing Finance Agency does the math on how the changes impact the missions of Fannie Mae and Freddie Mac.

-

Demand for advances from the Home Loan banks has plummeted as the Federal Reserve has flooded the financial system with liquidity. But with a nudge from Congress, these government-sponsored enterprises could remain relevant by broadening their mission and opening membership to more lenders.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

- Sponsor Content from DataVerify Flood Services

-