In a separate announcement, the government-sponsored enterprise also announced the extension of Michael Hutchins' leadership term as interim CEO.

Other issues have overshadowed closing costs of late but they're still a homeownership hurdle. Part five of five in a series: Automation and expenses

State distribution of the Treasury funds for distressed homeowners is now reportedly at least two-thirds complete.

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

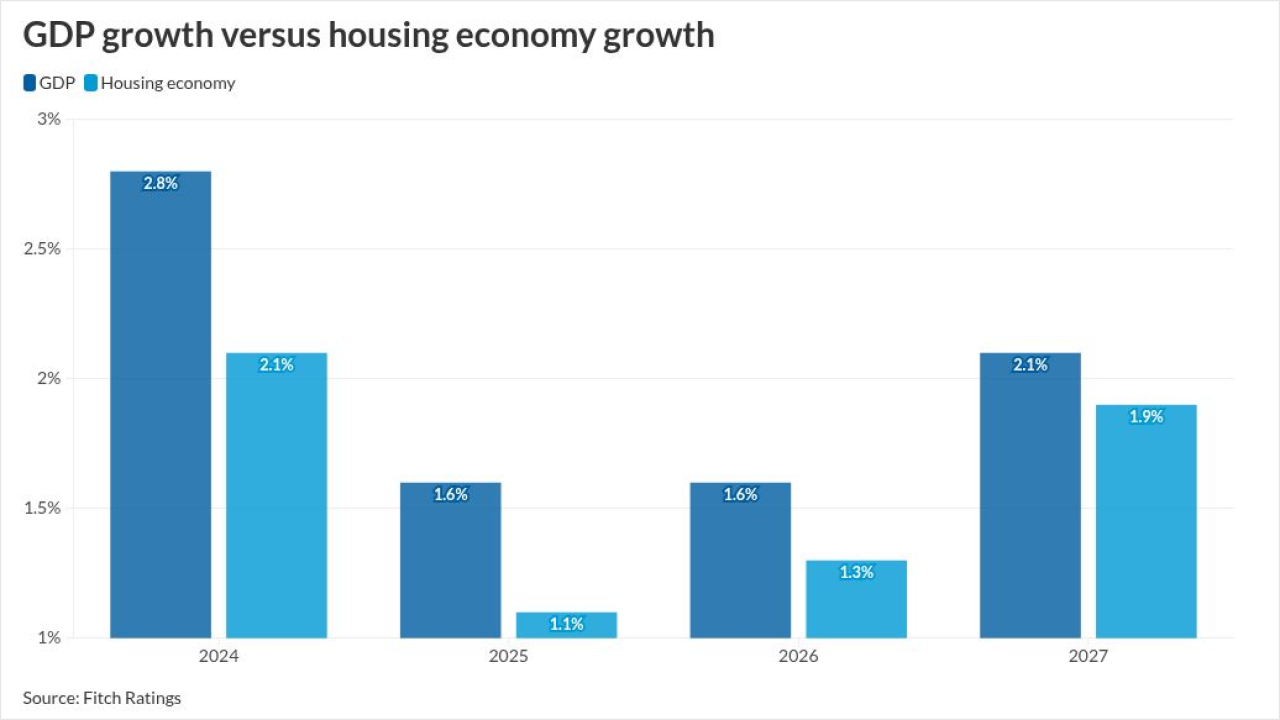

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

-

Total mortgage origination volume is forecasted to barely eclipse $2 trillion by the end of the year for the first time since 2022, iEmergent said.

-

Growth in multifamily and investment property mortgage originations, the highest risk segments, drove the 6% rise in the National Fraud Index, Cotality said.

-

A lapse in the National Flood Insurance Program because of the US government shutdown threatens to snarl home sales in the nation's riskiest floodplains and leave some homeowners without coverage in the middle of hurricane season.

-

Federal Reserve Gov. Michael Barr said in a speech Thursday that he fears the gradual pace of price increases from tariffs being passed on to consumers may prolong the one-time inflationary effect of the tariffs to the point where it affects consumers' inflation expectations.

-

Along with the company's rebranding to Lendware, a new CEO also takes the helm following allegations of financial mismanagement among some former leaders.

-

The shutdown halted the release of employment data, typically a driver of mortgage rate activity, likely resulting in trackers moving in varying directions.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Although many believe home prices to be impervious to inflation, they are still susceptible to speculation surrounding the Federal Reserve's rumors and decisions on monetary policy.

-

Appellate courts are officially playing pingpong with underwriters' employment status, leaving lenders to decide whether or not they qualify as employees exempt from minimum wage and overtime pay and open to regulatory scrutiny.

-

The California Supreme Court's recent ruling that a borrower has the right to challenge a wrongful foreclosure opens the door for a tighter mortgage market while leaving key questions about future borrower lawsuits unanswered.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland