Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Ellie Mae is tackling home equity lines of credit loans with its latest Encompass Digital Mortgage Solution update as signs point to a surge in home equity borrowing.

October 22 -

A surge in home equity borrowing may be around the corner as household equity levels surpassed their previous housing bubble peak, according to a TransUnion study.

October 19 -

Property values have grown enough for households to establish equity and make a profit, but homeowners continue staying put, causing sales to underperform their potential.

October 18 -

First American Mortgage Solutions is stepping up its digital mortgage game by offering electronic closing capabilities.

October 16 -

Wells Fargo Home Lending is tapping eOriginal to launch an electronic note program, marking a step forward for the mortgage industry's push toward a more digital process.

October 15 -

The share of homes for sale listed with a price cut hit its highest level since 2014, but the reductions themselves are shrinking, according to Trulia.

October 12 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

The mortgage delinquency rate fell to a 12-year low, with declines expected to continue as the unemployment rate stays down, according to CoreLogic.

October 9 -

Property values for homes that were foreclosed on during the Great Recession are outpacing the nation's average house price appreciation, according to Zillow.

October 5 -

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

Some lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 4 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2 -

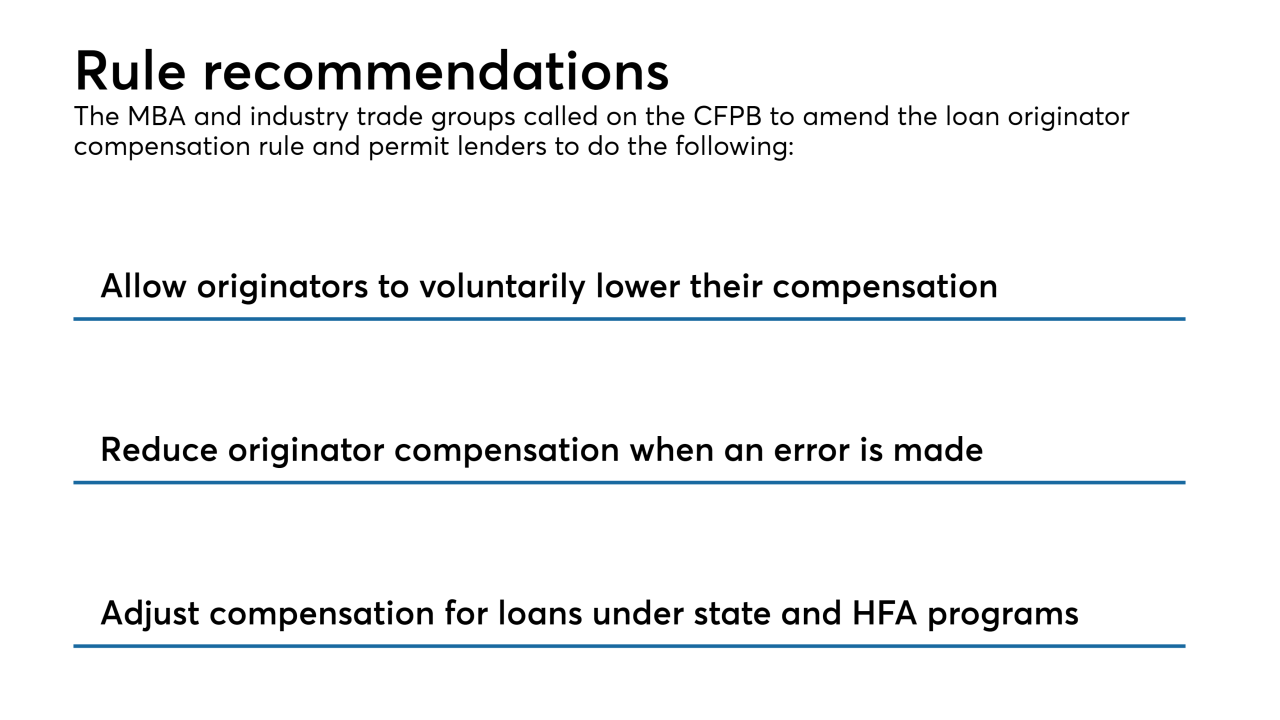

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

From music by Lil Wayne to a quote from Albert Einstein, here’s a look at 17 ways #DigMortgage18 speakers made an entrance.

September 28 -

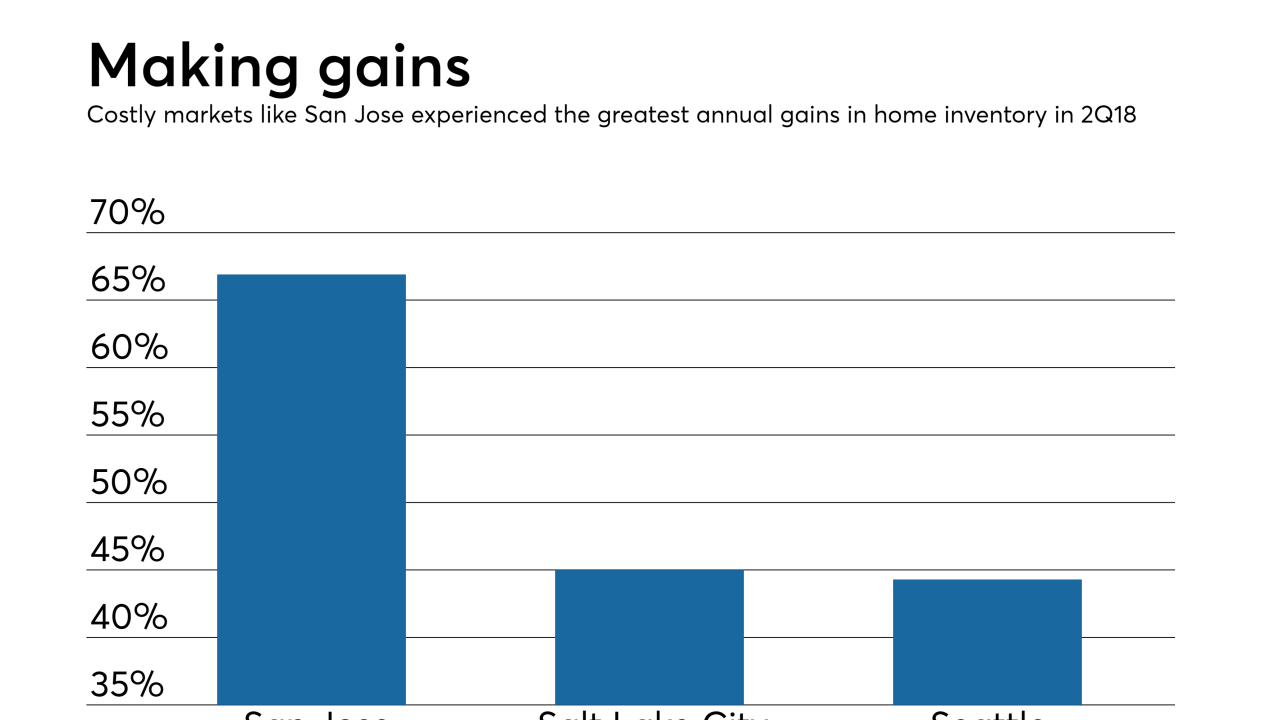

Lenders may start to see more homebuyers enter the market as the number of homes for sale is higher than at any point this year, according to Trulia.

September 27 -

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

An artificial intelligence platform that integrates with key industry utilities and keeps critical data at lending professionals' fingertips was selected as the top fintech demo by attendees of the 2018 Digital Mortgage Conference.

September 26 -

Lower corporate tax rates weakened the incentive for developers to use the Low-Income Housing Tax Credit program, which could prompt affordable housing construction to fall by as much as 40% by 2022, according to data aggregator Reis.

September 25 -

A stronger economy, easing house price appreciation and slightly improving inventory conditions aren't enough to push up home sales this year, according to Freddie Mac.

September 24