Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

As the mortgage industry continues evolving digitally, MISMO is developing standards for business-to-consumer transactions on mobile devices, according to the Mortgage Bankers Association.

July 25 -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

As property values continue appreciating, Caliber Home Loans added a jumbo loan product to its portfolio lending suite to support borrower needs in a climate of higher home prices.

July 17 -

From Cleveland to Pittsburgh, here's a look at 12 markets offering favorable costs for housing, helping turn renters into potential homebuyers by quickly saving for a down payment.

July 13 -

Foreclosure filings plummeted in the first half of the year, but 40% of local markets saw foreclosure starts increase, with the last housing bubble no longer to blame for the growth, according to Attom Data Solutions.

July 12 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

Healthier economic conditions, more effective underwriting methods and recovering hurricane-impacted states helped drive delinquency and foreclosure rates to their lowest level in over 10 years, according to CoreLogic.

July 10 -

Despite available home equity shooting up in the first quarter, the share of total equity withdrawn by borrowers hit a four-year low, likely due to an increase in interest rates, according to Black Knight.

July 9 -

While affordability remains a top challenge for homebuyers, rental costs are also soaring, which could bring even more house hunters to the market.

July 6 -

The Consumer Financial Protection Bureau's practice of "regulation by enforcement" and use of nonbinding guidance materials makes its regulatory efforts "unfair and ineffective" to lenders and servicers, the Mortgage Bankers Association said.

July 5 -

Purchasing power took a plunge in some of the nation's hottest housing markets, as a competitive spring purchasing season continues to drive home prices higher.

July 3 -

The decline in homeownership among young adults can be attributed to a variety of financial headwinds like student loans and societal shifts like marriage rates, but rising housing costs are the core issue, according to research by Freddie Mac economists.

July 2 -

From lowering expectations about their ideal home to moving faster to close a deal, here's a look at five ways house hunters say they would react to average mortgage rates reaching 5%.

June 29 -

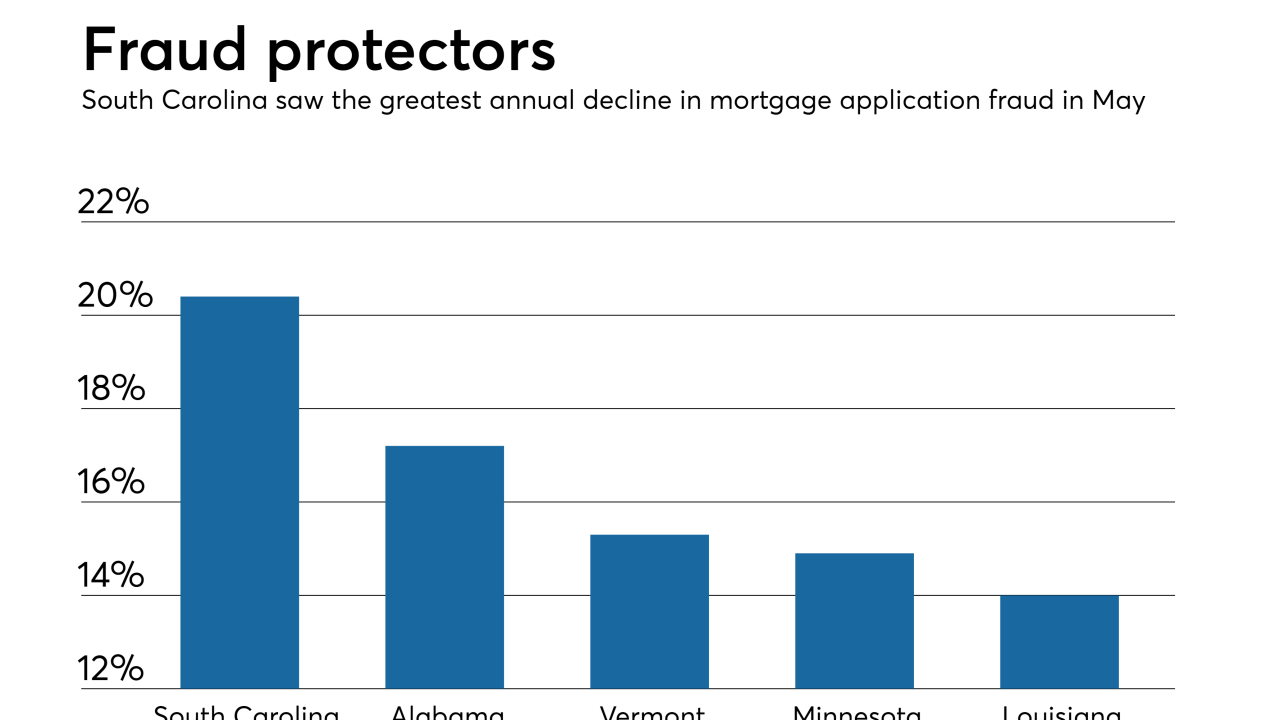

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Commerce Home Mortgage and its parent company, The Capital Corps, are acquiring LoanStar Home Loans as a move to expand access to capital throughout the Northwest and Texas.

June 27 -

Most mortgage lenders and banks do not maintain a comprehensive vendor management strategy, exposing institutions to increased compliance risk, according to a recent survey.

June 26 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

Mortgage debt outstanding remains below pre-crisis levels and home equity is growing, even as overall consumer debt is on pace to surpass its previous 2008 peak by $1 trillion, according to LendingTree.

June 25 -

The share of consumers confident that it wouldn't be difficult to obtain a mortgage in the current market shot up 10% from a quarter ago, according to the National Association of Realtors.

June 22 -

With affordability down to its lowest level in nearly 10 years, average wages aren't enough to afford a home in 75% of local housing markets, according to Attom Data Solutions.

June 21