Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Minneapolis' offering of affordable starter homes and inflated supply of below-median-priced options made it the housing market with the highest low-income ownership rate, according to Redfin.

March 5 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

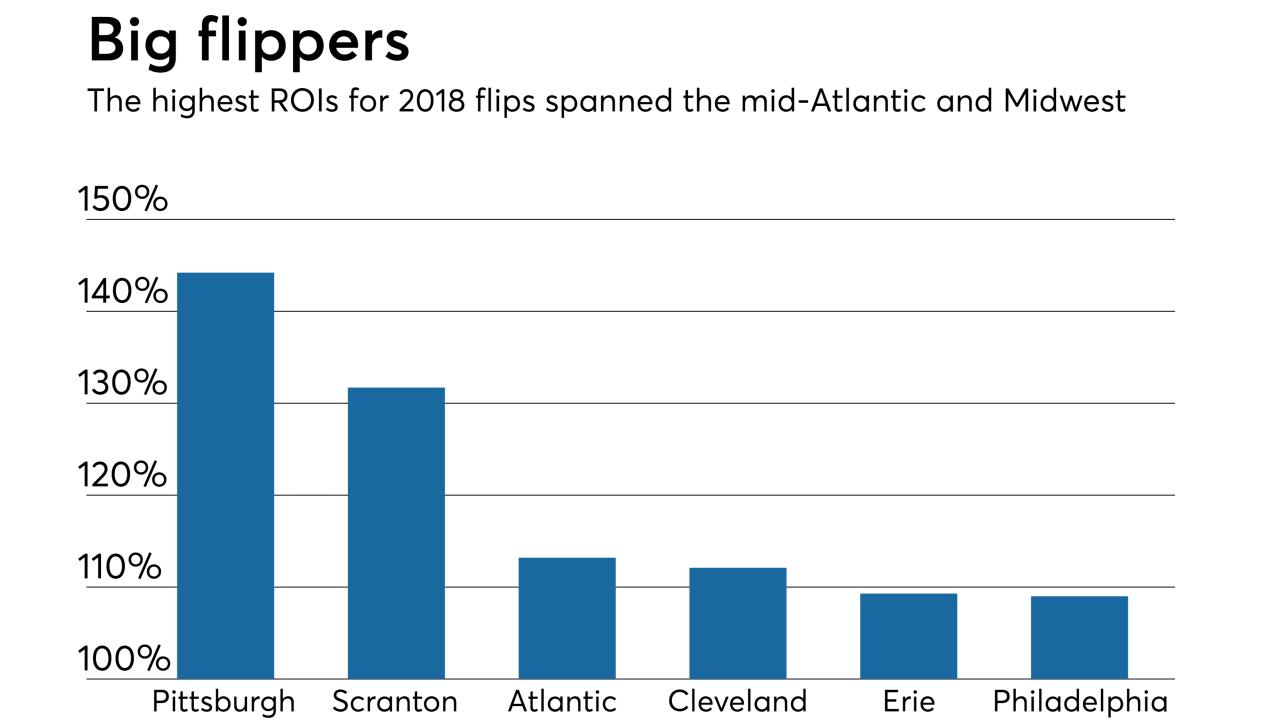

Financing poured into purchasing homes to flip in 2018, reaching the highest total since 2007, according to Attom Data Solutions.

February 28 -

The Money Source has filed three provisional patent applications as part of its efforts to develop new innovations in mortgage servicing, including the use of blockchain technology.

February 27 -

Slower home price growth and cooled mortgage rates could bring buyers out in droves in 2019, according to NerdWallet.

February 26 -

Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.

February 25 -

While overall housing sales have suffered due to affordability, the trend is even more drastic for typically higher-priced new homes, according to Redfin.

February 22 -

With its latest round of funding, the mortgage fintech company will continue to build its digital platform, with a goal of reducing the complexities and costs of home buying.

February 21 -

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21