Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Here's a look at the 12 cities with the biggest gap between the current wages needed to buy a home and the historical average, a sign a housing bubble might be brewing.

October 4 -

While digital expansion of the mortgage application process increases convenience, it inherently comes with the downside of heightened fraud risk.

October 3 -

If California voters approve Proposition 10 in November, the ramifications will be felt on the state's affordable housing, according to the Mortgage Bankers Association.

October 2 -

As more sellers lower their asking prices and competition eases, the share of homes sold above their listing keeps declining, according to Redfin.

October 1 -

Rising home prices and the depleted housing inventory led to another drop in pending home sales, according to the National Association of Realtors.

September 28 -

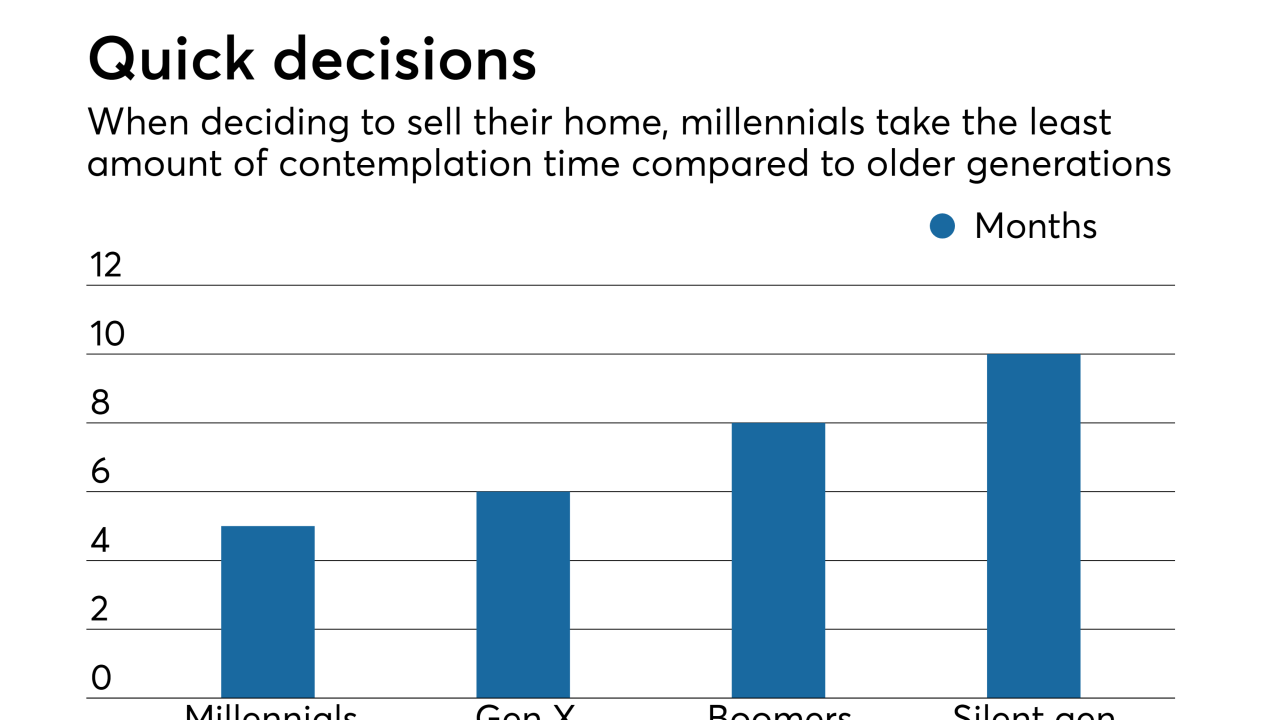

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

As home prices continue to rise, a record-high 77% of people surveyed think it's currently a strong time to sell a house, according to the National Association of Realtors.

September 26 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

As mortgage rates jump and housing inventory rises, over a quarter of all home listings dropped their price in the past month, according to Redfin.

September 21 -

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

September 20 -

As mortgage rates remained mostly tepid throughout the summer, closed refinances had their first month of growth in August, according to Ellie Mae.

September 19 -

More buyers could be in the market for new homes as housing authorizations and maintenance volume increased while remodels fell, according to BuildFax.

September 18 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

Staggering home prices and steep tax rates are pushing people from expensive cities along the coasts to more affordable locales.

September 12 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10