Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

From origination to servicing and everything in between, here's a sneak peek at the companies and products presenting demos at the 2018 Digital Mortgage Conference.

September 10 -

The typical homeowner spends 17.5% of their income on monthly mortgage payments, according to Zillow's second quarter affordability report.

September 6 -

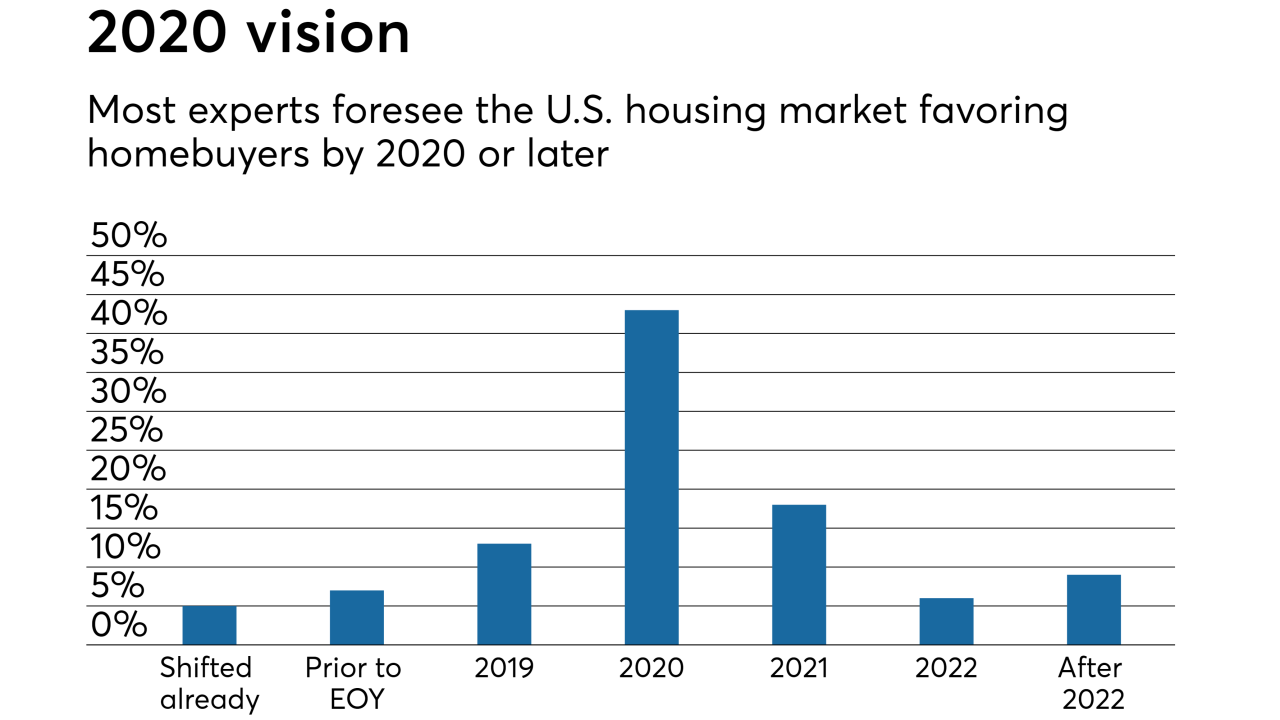

After home prices soared due to a lack of inventory and a recovering economy, three-quarters of experts believe the shift to a buyer's housing market should come in two years.

September 5 -

Growth in home prices remained churning at a steady pace, with sellers holding out for better returns and suppressing the supply of available housing.

September 4 -

New Jersey Governor Phil Murphy signed a bill to revise the state's Residential Mortgage Lending Act to facilitate transitional licensing for loan officers and to streamline the law's provisions for borrower fees.

August 31 -

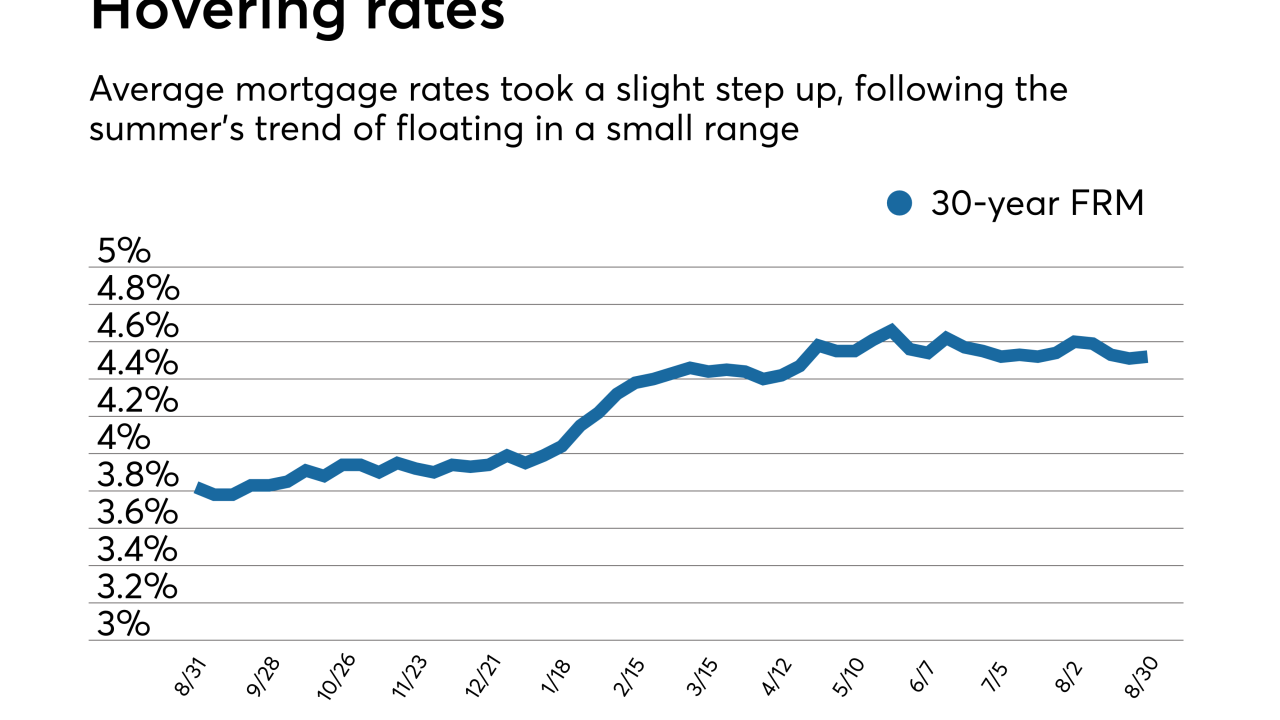

Mortgage rates took small steps up after hitting a four-month low, but continued hovering around the same range they have all summer, according to Freddie Mac.

August 30 -

With spring homebuying in bloom, the second quarter brought profits to independent mortgage bankers after going negative for the second time ever, according to the Mortgage Bankers Association.

August 29 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

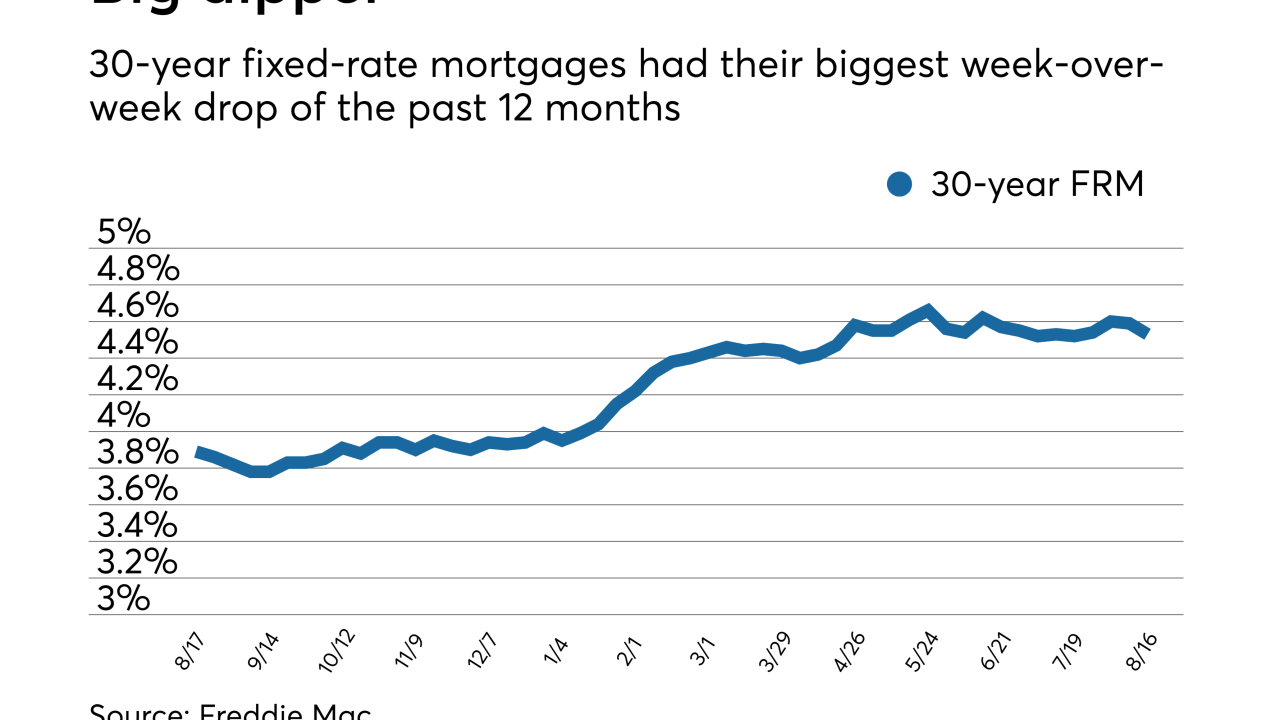

Average mortgage rates fell, including the largest week-over-week drop of the past 12 months, but homebuyer demand stays mum, according to Freddie Mac.

August 16 -

Mortgage applications waned for the fifth week in row, hitting their lowest levels in six months, as the summer's growing interest rates plateaued.

August 15 -

Mortgage delinquency rates dropped on an annual basis, a sign of a strengthening economy, but could soon see a spike due to this year's wildfires, according to CoreLogic.

August 14 -

The risk of mortgage defaults reached its highest point since the second quarter of 2015 as lenders loosen credit, according to VantageScore.

August 10 -

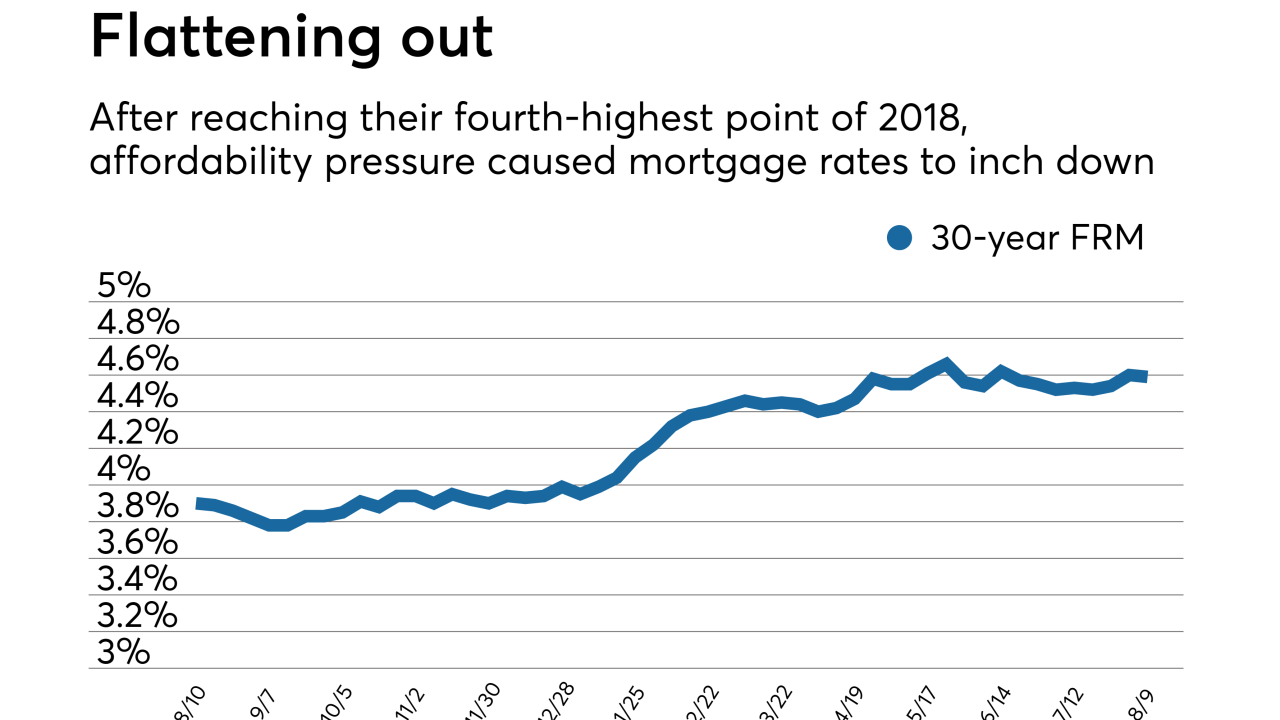

Mortgage rates took a small step back due to affordability pressure after climbing for the past two weeks, according to Freddie Mac.

August 9 -

Mortgage applications declined for the fourth consecutive week as interest rates remained at high levels.

August 8 -

Mortgage credit accessibility kept climbing in July, mostly thanks to an expansion of jumbo loan products offered, pushing that index to its historical high point, according to the Mortgage Bankers Association.

August 7 -

Home price appreciation slowed throughout 64% of the U.S., a boon to affordability, according to Black Knight's most recent three-month figures.

August 6 -

Social media is a main avenue for mortgage lenders to reach the next generation of homebuyers. New American is trying to make their own lenders experts in the space.

August 3 -

Mortgage rates rose to their highest level in seven weeks and fourth-highest of 2018, thanks to strong economic trends, according to Freddie Mac.

August 2 -

Mortgage applications dropped for the third consecutive week around rising interest rates and languid housing starts.

August 1 -

Freddie Mac produced modest second-quarter results, reflecting a stabilizing business that CEO Donald Layton compared to a utility company.

July 31