Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

At the metro level, Buffalo, N.Y., had the worst undervaluation for Black-owned homes at 86% followed by 72% in both Memphis, Tenn., and Indianapolis, Redfin found.

April 20 -

As listings were snagged at near-record speed, inventory hit yet another new low point, according to Remax.

April 19 -

And with demand far outweighing supply, the average new-home purchase loan ascended to another record high.

April 15 -

COVID-19 quickly altered the hierarchy of borrower debt, with home financing payments taking precedence over credit cards and auto loans, according to TransUnion.

April 14 -

In the nonstop deluge of loan volume, last year’ highest producing loan officers leaned on tech — though sometimes reluctantly — to adapt in the digital marketplace.

April 14 -

While the overall delinquency rate decreased for the fifth straight month, states with unemployment rates that were double and triple the national average had the most overdue loans, a CoreLogic report found.

April 13 -

The stabilizing economy drove one of the biggest mortgage recoveries on record, according to the Mortgage Bankers Association.

April 12 -

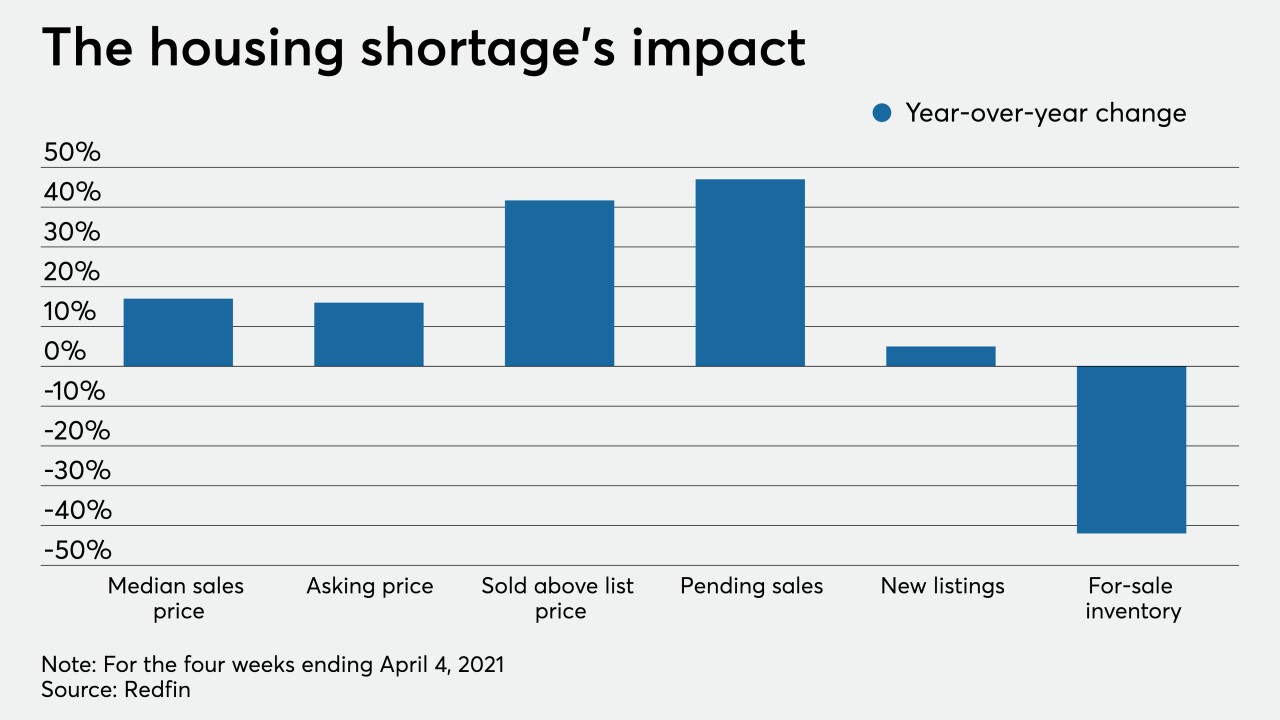

Even as properties spent the least time ever on the market and the average sale-to-list home price ratio broke 100%, some indicators point to a slight reversal, which could head off “runaway home price speculation or a housing bubble,” Redfin chief economist Daryl Fairweather said.

April 9 -

The digital lender’s valuation ballooned to $6 billion from $4 billion less than five months after closing a $200 million fundraise.

April 8 -

More lenders are willing to take on borrowers who are lower on the qualification spectrum as the economy rebounds.

April 8 -

As vaccinations proliferate, homeowners who held off during the pandemic are finally gearing up to list their properties, a recent survey finds.

April 7 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

Increasingly extreme weather patterns and natural disasters weigh heavy on the majority of borrowers looking to buy a house, while half will move because of it, according to Redfin.

April 5 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

As credit remains tight, Opportunity Financial’s work with consumer financial services Brightside firm aims to offer a wider swath of borrowers access to small loans.

March 31 -

As home values surged at record highs, the latest month-to-month movements indicate price growth could start returning to a pre-pandemic pace, according to the Federal Housing Finance Agency.

March 30 -

Efforts to improve representation in the workforce have to be measurable in order to avoid becoming an empty trend, according to the Mortgage Bankers Association’s chief financial officer and diversity & inclusion officer.

March 30 -

Stuck between local zoning hurdles and a lack of ideal federal financing, ADUs could be an important aspect to unlocking much-needed inventory.

March 24 -

Proptech CEOs and investors fully expect a huge year for the sector due to the pandemic’s “watershed” effect on digitization, according to Keefe, Bruyette & Woods.

March 18 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17