Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

The forbearance rate rose behind slowed economic recovery, according to the Mortgage Bankers Association.

December 21 -

The new bill ordering $600 stimulus checks and $25 billion in emergency rental assistance won't be enough to help millions of Americans struggling to make housing payments, according to industry watchers.

December 21 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

The boom continues, with refinances making up a 61% share of all mortgage loans issued that month, according to Ellie Mae.

December 17 -

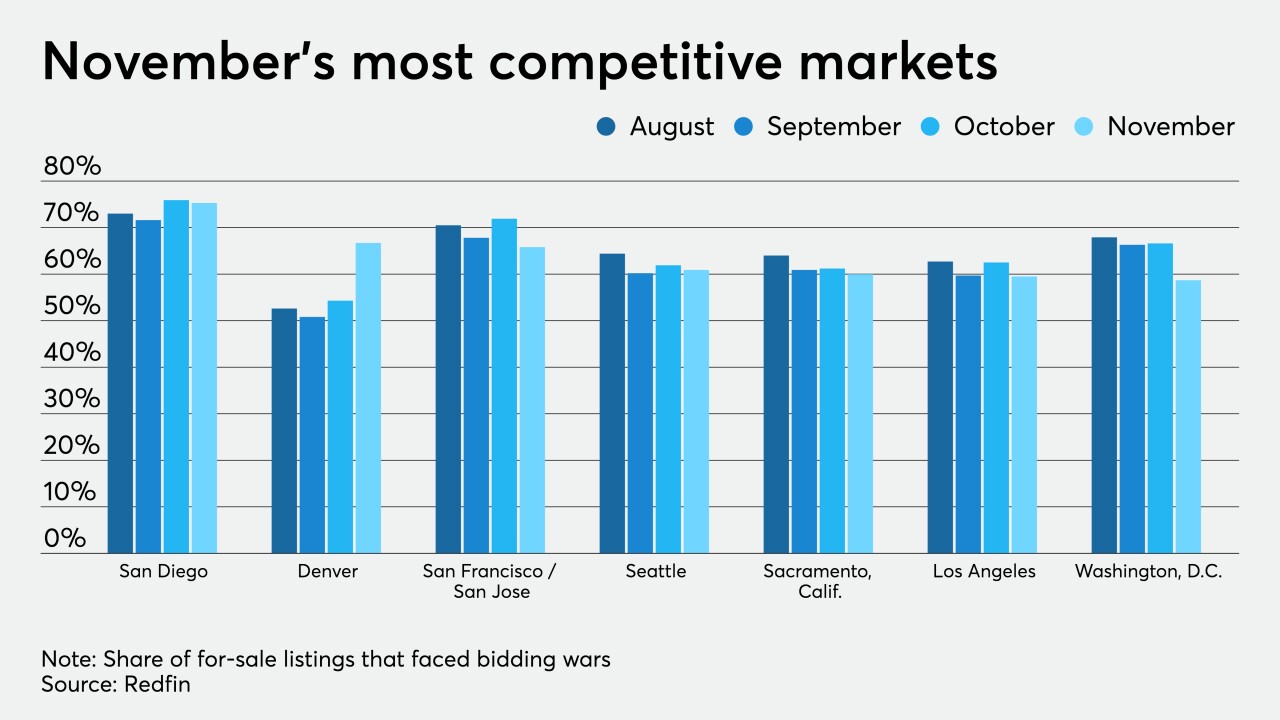

While the haggling tapered off slightly alongside the housing market’s seasonal slowdown, home sales remained five times more competitive than the year before, according to Redfin.

December 16 -

With coronavirus inoculations underway and government stimulus likely to come, the outlook for next year’s housing market and lending environment grew more optimistic in December.

December 15 -

The forbearance rate continued its improvement, but the surge of COVID-19 cases could lead to more borrowers needing mortgage relief, according to the Mortgage Bankers Association.

December 14 -

The largest concerns are with pandemic risk and defaults, along with business resilience and adaptability, according to a Wolters Kluwer survey.

December 14 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

The November foreclosure rate represented an 80% decline from the year before, according to Attom Data Solutions.

December 10 -

Borrowers who exit CARES Act-related forbearance in the spring and have stacks of other bills to attend to may be in search of liquidity via such products, the company predicts.

December 10 -

Clear HOI — an encrypted, cloud-based tool that automates homeowners insurance underwriting — is getting released to the broader market by Rocket Mortgage’s sister company Nexsys Technologies.

December 9 -

While distressed mortgage rates crept down overall, serious delinquencies still tripled year-ago rates in September, according to CoreLogic.

December 8 -

The surge of COVID-19 cases slowed economic recovery and hampered improvements in the forbearance rate, according to the Mortgage Bankers Association.

December 7 -

Employment worries and the pandemic's ongoing obstacles for home buying wore down consumer confidence in November, according to Fannie Mae.

December 7 -

Bee Mortgage App will use blockchain and automation provided by Elphi to create "a COVID tool for real estate agents" to get fully digital mortgage approval in under three minutes.

November 25 -

Overall housing value growth continued in the third quarter, as some markets more than doubled the national average, according to the Federal Housing Finance Agency's Home Price Index.

November 24 -

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 23