Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

With record low mortgage rates driving buyer demand, home sales and prices spiked in September, shrinking the supply and days on market, according to Remax.

October 19 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

While spiking from the year before, mortgage applications to purchase new homes fell in September from August, with low supply and high unemployment keeping it in check, according to the Mortgage Bankers Association.

October 15 -

A surge of mortgage originations allowed Ginnie Mae to surpass its high watermark for mortgage-backed security issuance by nearly 33%.

October 14 -

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

Record-low interest rates, high origination volumes and social distancing created a perfect storm for mortgage fintechs like SnapDocs and LoanSnap to score a cash infusion.

October 13 -

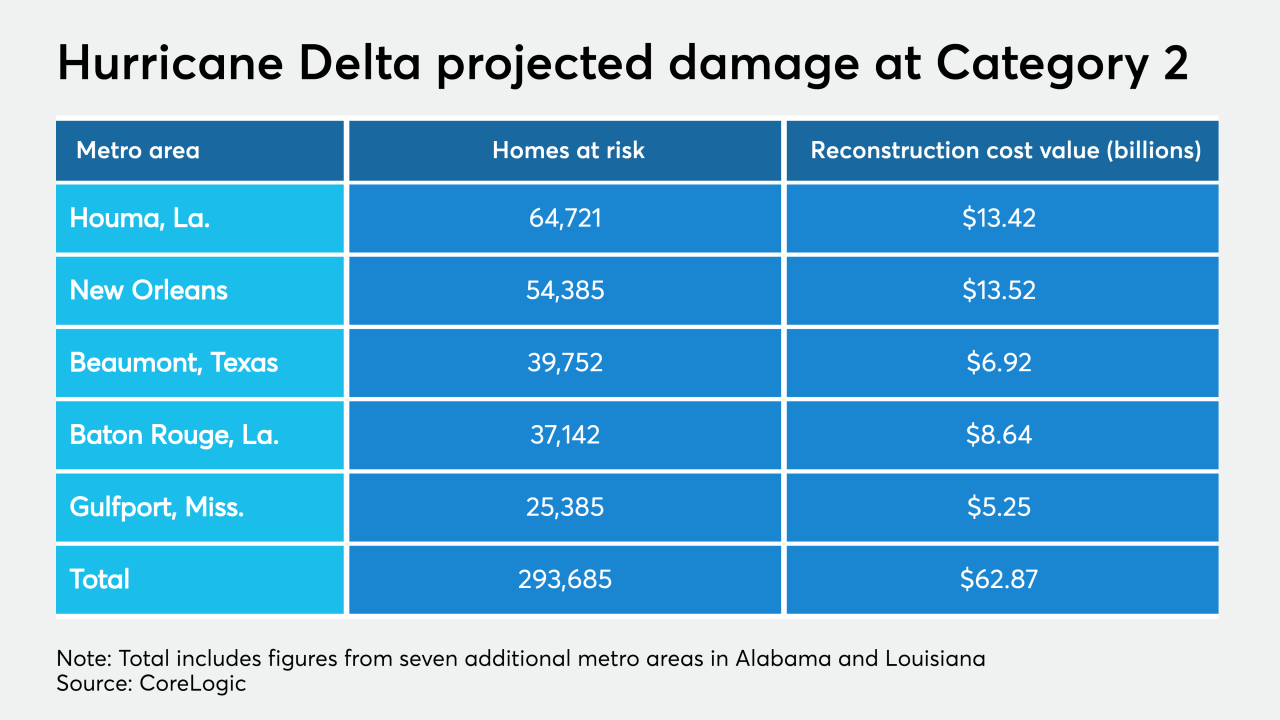

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

The metro areas surrounding New York, Washington, Philadelphia and Baltimore face the highest risk of impact from the pandemic based on home affordability, equity and foreclosures.

October 8 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

Diversity initiatives for home appraisers would cut down the racism and bias within the valuation process.

October 7 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

The automated closing disclosures software aims to be "40% faster than the 'old fashioned' method," a company spokesman said.

September 30 -

Consumer home purchasing power gained steam in July thanks to plummeting interest rates and gains in the median income despite steady price growth, according to First American.

September 28 -

For the majority of borrowers, interest rate research for mortgage refinancing came with unwanted and annoying sales calls, which could ultimately hinder potential business for lenders.

September 28 -

After an annual gain in July, newly constructed home listings tumbled in August as coronavirus complications caused the largest inventory drops on record, according to Redfin.

September 25