Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

The gap in home price perception between appraisers and property owners widened in April, reaching its greatest spike in four years, according to Quicken Loans. At the same time, home values continued climbing.

May 15 -

Strong levels of employment and continued economic expansion drove February's mortgage delinquencies and foreclosures to 20-year lows, according to CoreLogic.

May 14 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

As home price appreciation levels off, the amount of underwater loans rose in the first quarter while equity-rich properties continued adding value, according to Attom Data Solutions.

May 9 -

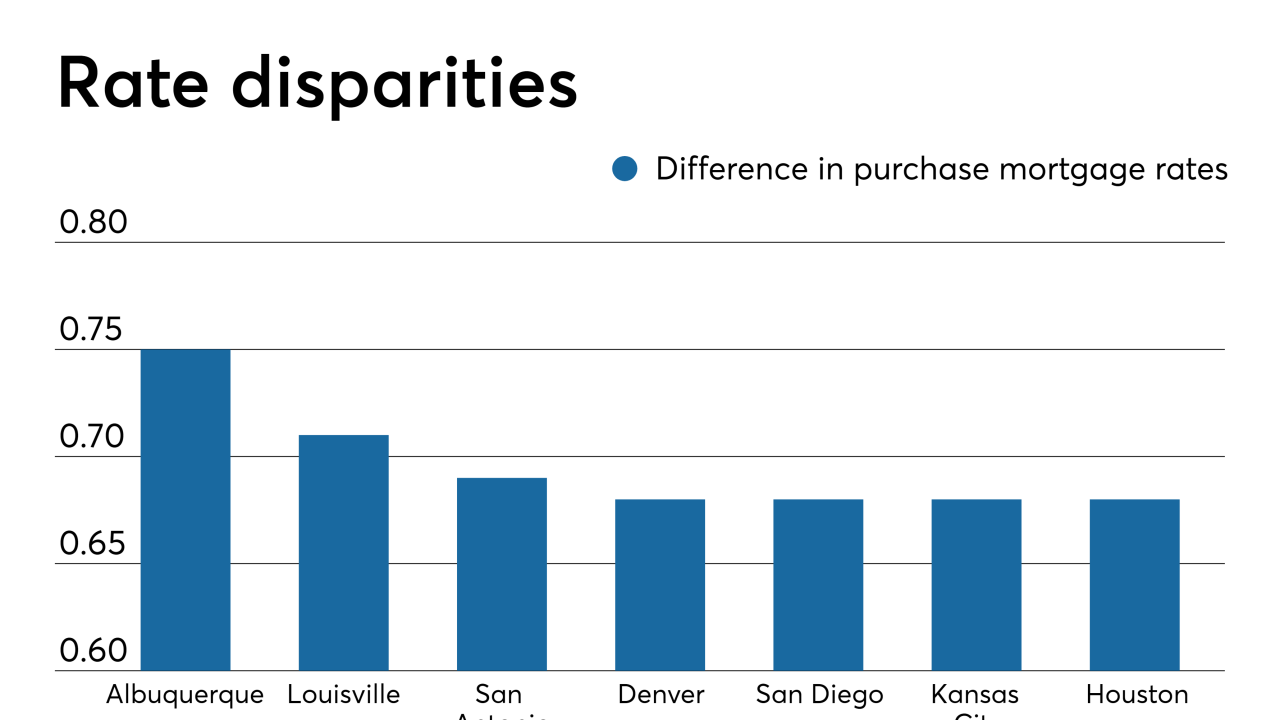

Lenders can help both the consumer save money and their own volumes by offering the most competitive rates or reducing their fees. Here's a look at the 12 housing markets borrowers save the most over the life of their loan by shopping around for a mortgage, according to LendingTree.

May 8 -

Home price appreciation remained modest as affordability and tight inventory keep demand down, though prices are expected to accelerate in 2020, according to CoreLogic.

May 7 -

Consumers always want more bang for their buck and are moving to places where their dollar goes further. With that as a driver, here's a look at the 10 hottest housing markets homebuyers are flocking to, according to Redfin.

May 6 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

May 1 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

Growing wages combined with flat mortgage rates handed homebuyers' increased affordability with a 2.4% boost in purchasing power for February, according to First American Financial Corp.

April 29 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

After a strong February, existing-home sales took a U-turn in March. While buyer conditions heat up and mortgage rates remained low, consumers took a patient approach — especially in the expensive West Coast markets.

April 22 -

Ally Financial took a stake in Better Mortgage, just the latest in the growing trend of banks investing in mortgage fintech companies to enhance their digital lending offerings.

April 18 -

Surging loan production expenses and low revenue killed profits in 2018 for loans originated by independent mortgage bankers and subsidiaries of chartered banks, according to the Mortgage Bankers Association.

April 17 -

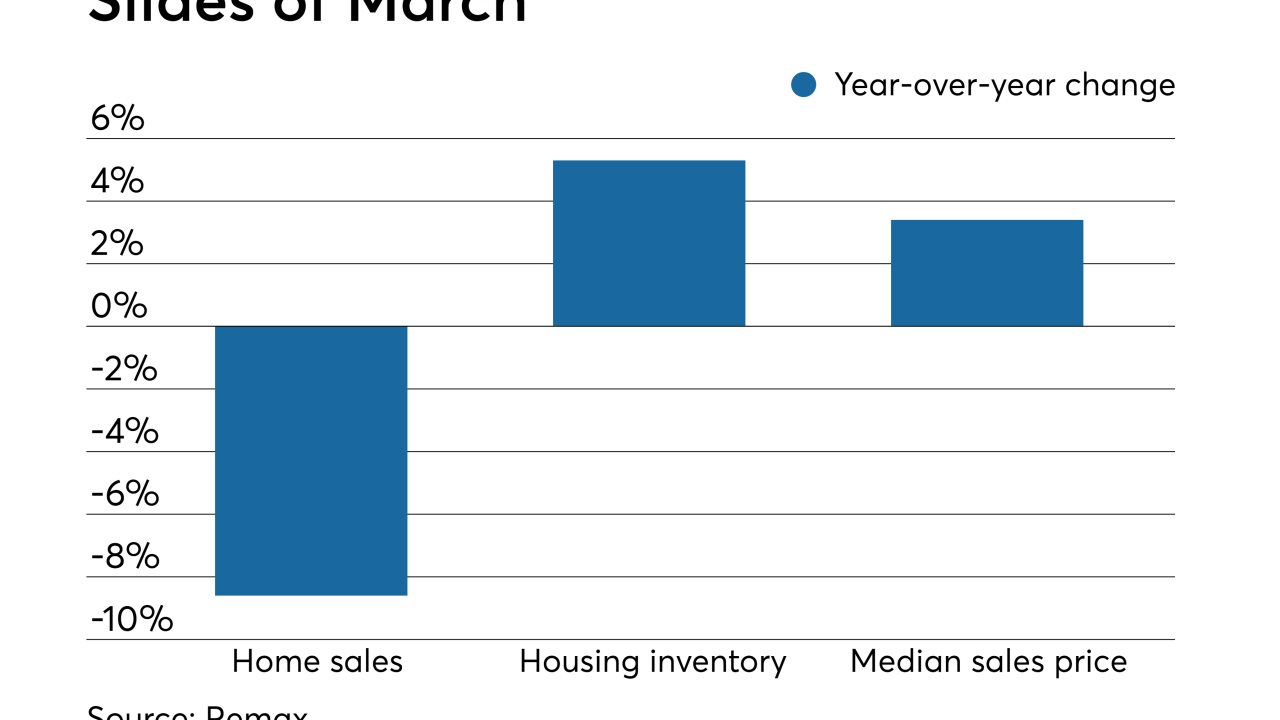

While improving market conditions set up for an anticipated boom in spring home buying, March had the smallest month-to-month sales growth since 2014, according to Remax.

April 16 -

As the dangers of global warming lead to heightened natural disasters, those disasters result, at least temporarily, in a higher amount of mortgage defaults. From Texas to the nation's capital, these are the 12 most hazard-prone housing markets, according to Redfin.

April 15 -

From the middle of the country to the Pacific Northwest, here's a look at cities where consumers wield the most purchasing power for the upcoming home buying season, based on changes in housing values compared to local wages and mortgage rates.

April 12 -

The number of properties with foreclosure filings dropped to the lowest quarterly amount since the Great Recession, according to Attom Data Solutions.

April 11