Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Home prices dipped from February — while annual growth remained suppressed — due to affordability and inventory issues, according to Quicken Loans.

April 9 -

With a strong job market and low interest rates, the mortgage delinquency rate fell to its lowest January level in at least 20 years.

April 9 -

Sluggish growth in originations spurs consolidation. Keep in mind, there's more to M&A than just agreeing on a price.

April 8 -

Artificial intelligence, automation, electronic closings; the 2019 Top Producers identified the biggest technology initiatives bending the way mortgages get done.

April 4 -

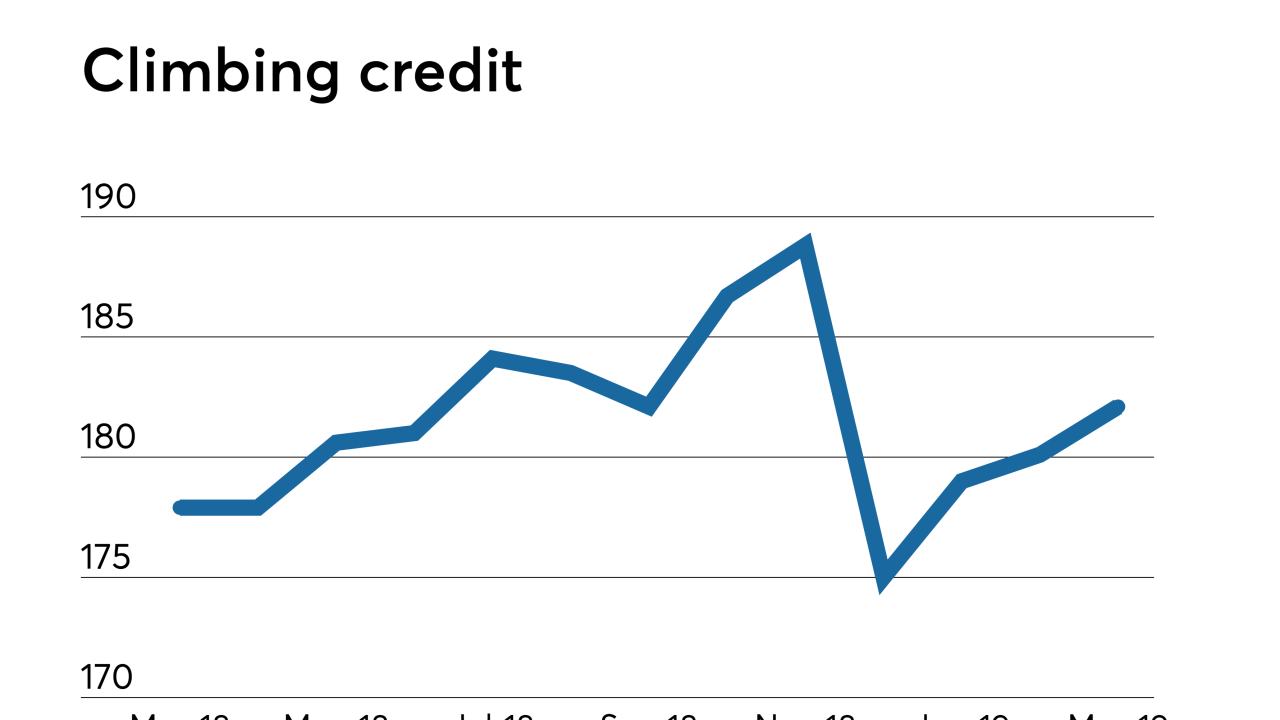

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Despite slowing home price growth, nearly 75% of millennials make financial concessions to afford housing compared to 40% of older generations, according to CoreLogic.

April 2 -

The total number of days that elapsed between consumers' initial home tours and their closing dates fell to the lowest level in at least six years this winter, according to Redfin.

April 1 -

Technology, staffing, reform: Here's a look at 12 key insights from the 2019 Top Producers, from what they considered critical to success to stances they have on industry initiatives going forward.

April 1 -

From the high of the Rocky Mountains to down all across the South, here's a look at the 12 housing markets with the largest average annual migration.

March 29 -

As affordability lacks around the country, improving wages and shifting balance toward buyers could turn the tide, according to Attom Data Solutions.

March 28 -

Borrower hunger for fully digital mortgages and data automation grows, with the end goal of accelerating the lending process as much as possible. But a fragmented industry stands in the way of that goal.

March 27 -

Mortgage costs to close surged in the last decade because of technological investments as borrowers clamored for speed and digitalization. Industry experts believe those costs will decrease in the near future once acclimation sets in.

March 26 -

Lenders must do more to address the safety of borrowers' personal information as digital mortgage strategies spread and regulatory scrutiny increases.

March 25 -

Commercial and multifamily lending lags the technology available in the residential market. A look at how one expert thinks the gap could be closed.

March 22 -

While fading 9.53% annually, February mortgage delinquencies posted a month-over-month increase for the first time in 12 years, according to Black Knight.

March 21 -

Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

March 20 -

From the desert of the Southwest to all across Florida, here's a look at the 12 housing markets deemed best for first-time home purchasers.

March 20 -

PanoramIQ compiles and analyzes both public and proprietary property data, saving mortgage lenders time and costs by filling the gaps in property histories.

March 18 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14