-

The final version of the amended rule, like the original proposal, makes fair lending claims tougher to prove; but it does soften language that otherwise might have allowed mortgage companies to use algorithms to prove nondiscrimination.

September 9 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

The mortgage industry comes together to address current issues and prepare for a post-COVID marketplace Sept. 14 to 17.

September 4 -

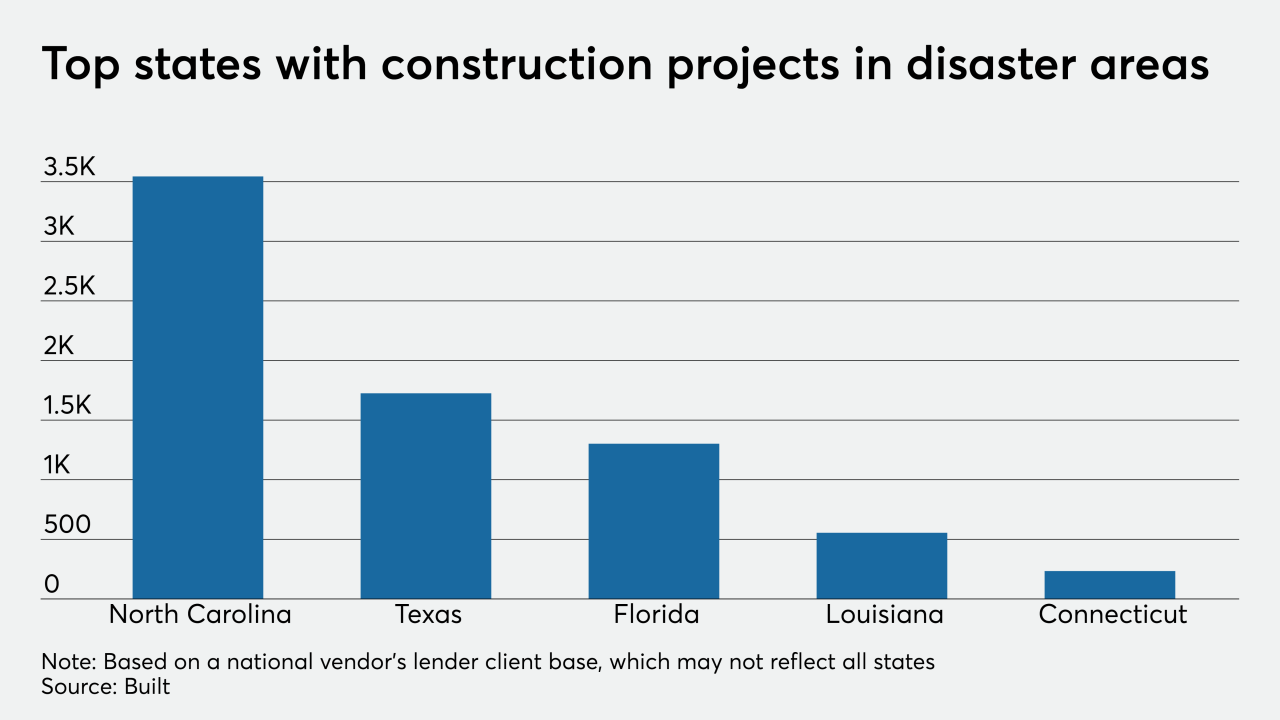

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

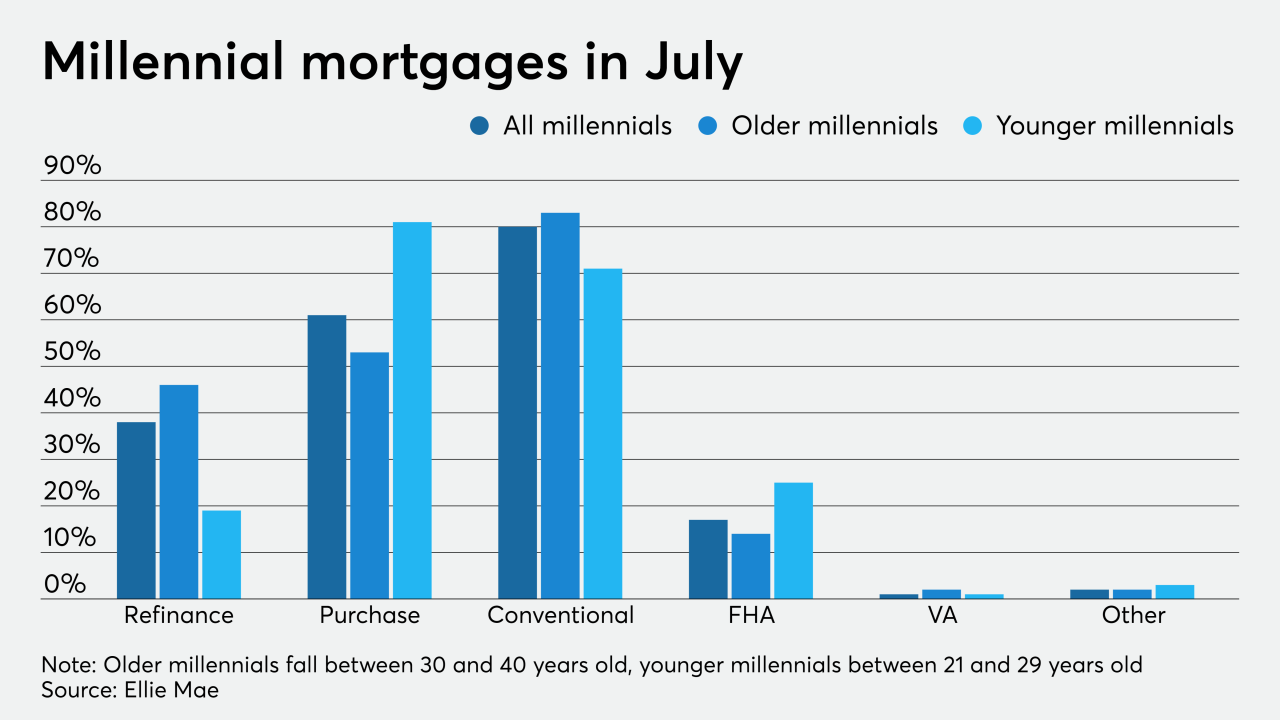

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

The decision is the latest development in an ongoing dispute between the shuttered company and its regulator.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Cannae and Senator said they are looking to stop CoreLogic from unilaterally cancelling a vote on changing the members of its board.

August 31 -

The DocVerify deal adds to Black Knight's goal of providing tools for each step in the home-buying and mortgage processes.

August 28 -

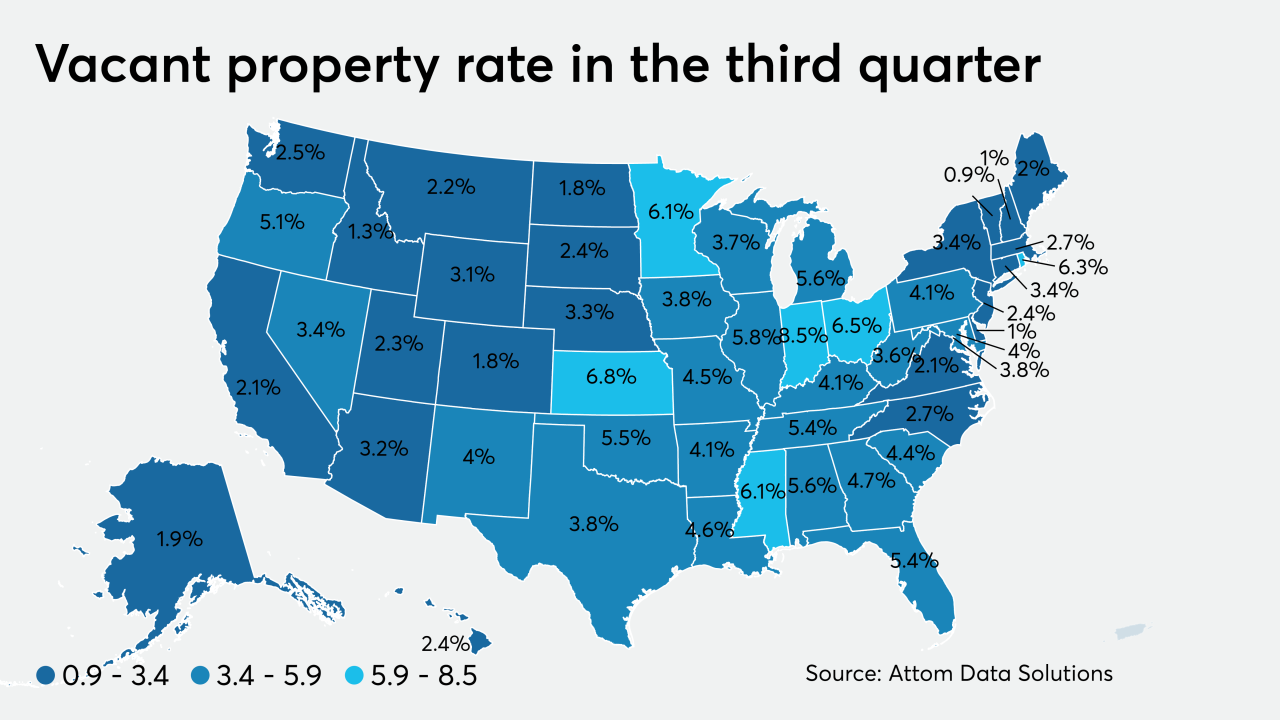

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

Party polarization and racial equity issues make it tougher for trade groups to manage internal divisions while ensuring the field supports those who get their hands on the levers of power.

August 27 -

With mortgage rates and housing inventory both at all-time lows, the majority of consumers would overshoot their budgets for the right home without accounting for future costs, according to LendingTree.

August 26 -

The housing market reaped the rewards of new construction increasing before the coronavirus took effect, netting a boost in July sales, according to Redfin.

August 25 -

Kasasa's turnkey product for community banks and credit unions offers a "take-back" option.

August 25 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

As swelling demand constricts inventory to record-low levels, home price growth cuts into the purchasing power afforded by plunging interest rates, according to First American.

August 24 -

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Fannie Mae's new chief administrative officer position focuses on diversity, inclusion and affordable housing.

August 19