-

The DocVerify deal adds to Black Knight's goal of providing tools for each step in the home-buying and mortgage processes.

August 28 -

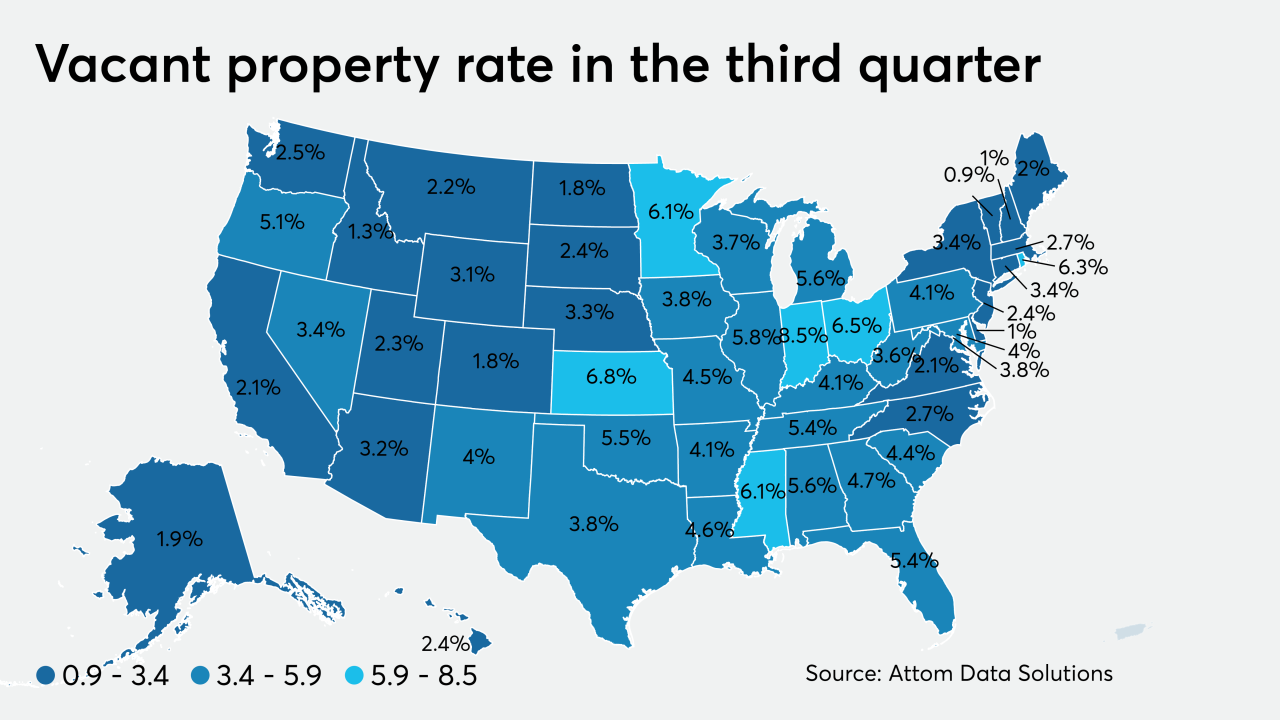

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

Party polarization and racial equity issues make it tougher for trade groups to manage internal divisions while ensuring the field supports those who get their hands on the levers of power.

August 27 -

With mortgage rates and housing inventory both at all-time lows, the majority of consumers would overshoot their budgets for the right home without accounting for future costs, according to LendingTree.

August 26 -

The housing market reaped the rewards of new construction increasing before the coronavirus took effect, netting a boost in July sales, according to Redfin.

August 25 -

Kasasa's turnkey product for community banks and credit unions offers a "take-back" option.

August 25 -

The number of loans going into coronavirus-related forbearance decreased for the tenth straight week, but to a lesser degree than in previous weeks, according to the Mortgage Bankers Association.

August 24 -

As swelling demand constricts inventory to record-low levels, home price growth cuts into the purchasing power afforded by plunging interest rates, according to First American.

August 24 -

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Fannie Mae's new chief administrative officer position focuses on diversity, inclusion and affordable housing.

August 19 -

Freedom Mortgage's acquisition of RoundPoint Mortgage Servicing gives it a MSR portfolio of over $300 billion.

August 18 -

The number of loans going into coronavirus-related forbearance decreased for the ninth consecutive week, according to the Mortgage Bankers Association.

August 17 -

As inventory dropped to an all-time low in July, borrowers hunted for houses further and further from city centers, causing price spikes in rural markets, according to Redfin.

August 17 -

As more borrowers exit their plans, fewer than 4 million loans sit in forbearance, according to Black Knight.

August 14 -

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

A survey conducted throughout the second quarter found knowledge gaps based on race and income.

August 12 -

Refinance volume led the spike in mortgage applications for the week ending Aug. 7 as interest rates continued tumbling.

August 12 -

In a letter to the Consumer Financial Protection Bureau, the Mortgage Bankers Association recommended adding six more months to the latest GSE patch proposal.

August 12 -

The number of loans going into coronavirus-related forbearance was down for the eighth consecutive week, as the growth rate fell 23 basis points between July 27 and August 2, according to the Mortgage Bankers Association.

August 10 -

Conditions have improved for the first time since November.

August 6