-

American Financial Resources, a Parsippany, N.J.-based mortgage lender, will pay any required agent fees for U.S. Department of Veterans Affairs loans for its brokers and correspondents on all AFR-related VA loan submissions starting Veterans Day.

November 12 -

More veterans are turning to Department of Veterans Affairs loans to buy a house as the number of purchase mortgages shot up 59% compared to five years ago.

November 9 -

The housing market slows down for winter, but it doesn't stop. Here's a look at 12 cities where price cuts, rent appreciation and affordability conditions will give house hunters more negotiating power going into the new year.

November 8 -

Mortgage industry executives claim sparse affordable housing supply is the most impactful hurdle for first-time homebuyers entering the market in 2019, but the majority don't think regulatory policy will help the cause.

November 6 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

Mortgage rates dropped slightly for the second time in the past three weeks as yields on the benchmark 10-year Treasury note remained flat for most of the period, according to Freddie Mac.

November 1 -

Atlanta's average home prices are up 5.8% since last year, according to a high-profile report on the nation's housing market issued Tuesday.

October 31 -

The homeownership rate in the U.S. increased in the third quarter, a sign that first-time buyers may be seeing the cooldown in housing as a buying opportunity.

October 30 -

Student debt continues to weigh down potential homebuyers, as the share of first-timers decreased for the third-consecutive year, according to the National Association of Realtors.

October 29 -

While all portions of mortgage credit underwriting standards have slipped since the early post-crisis period, it is the deteriorating conditions that most increases vulnerability for future loan quality, a Moody's report said.

October 29 -

Despite rising mortgage rates and a dismal start to the fall, homebuilders in the Twin Cities are picking up the pace.

October 29 -

Sales of previously owned homes eased in September to the weakest pace in almost three years, a sign rising prices and mortgage costs are keeping potential buyers on the sidelines, National Association of Realtors data showed.

October 19 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

One report found that 95% of homebuyers searched websites before buying a home, and that number jumps to 99% among millennials. In short, almost everyone starts shopping online, and a vast majority are going to Zillow.

October 10 J.D. Power

J.D. Power -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

Property values for homes that were foreclosed on during the Great Recession are outpacing the nation's average house price appreciation, according to Zillow.

October 5 -

The state's red-hot housing market may be cooling a bit, according to the head of the New Hampshire Housing Authority.

October 5 -

While digital expansion of the mortgage application process increases convenience, it inherently comes with the downside of heightened fraud risk.

October 3 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2 -

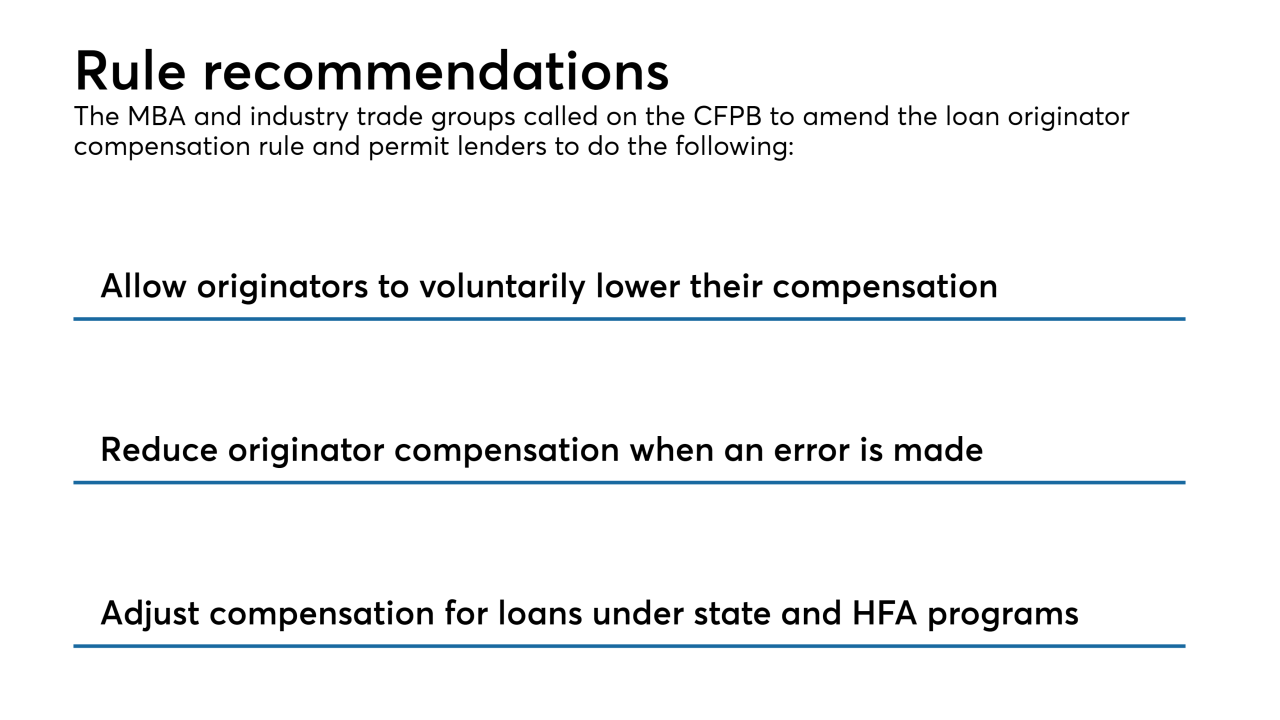

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1