-

The market for existing-home sales underperformed its potential by 3.8% because of the inventory shortage, according to First American Financial Corp.

June 20 -

The young adult homeownership rate should increase by 1.5 percentage points over the next two decades as education attainment among racial and ethnic minorities continues to rise.

June 20 -

More homes went on the market last month than in any since 2008, a sign that the logjam that's characterized the Portland-area market in recent years could be breaking.

June 20 -

The Bay Area's super-costly housing market has made it hard — sometimes impossible — for schoolteachers to put down roots and buy homes near their jobs.

June 15 -

The HUD secretary said millennials are being shut out of the market but the purchase of a condominium unit is often the first step to homeownership.

June 9 -

North Texas home prices are still on a hot streak.

June 9 -

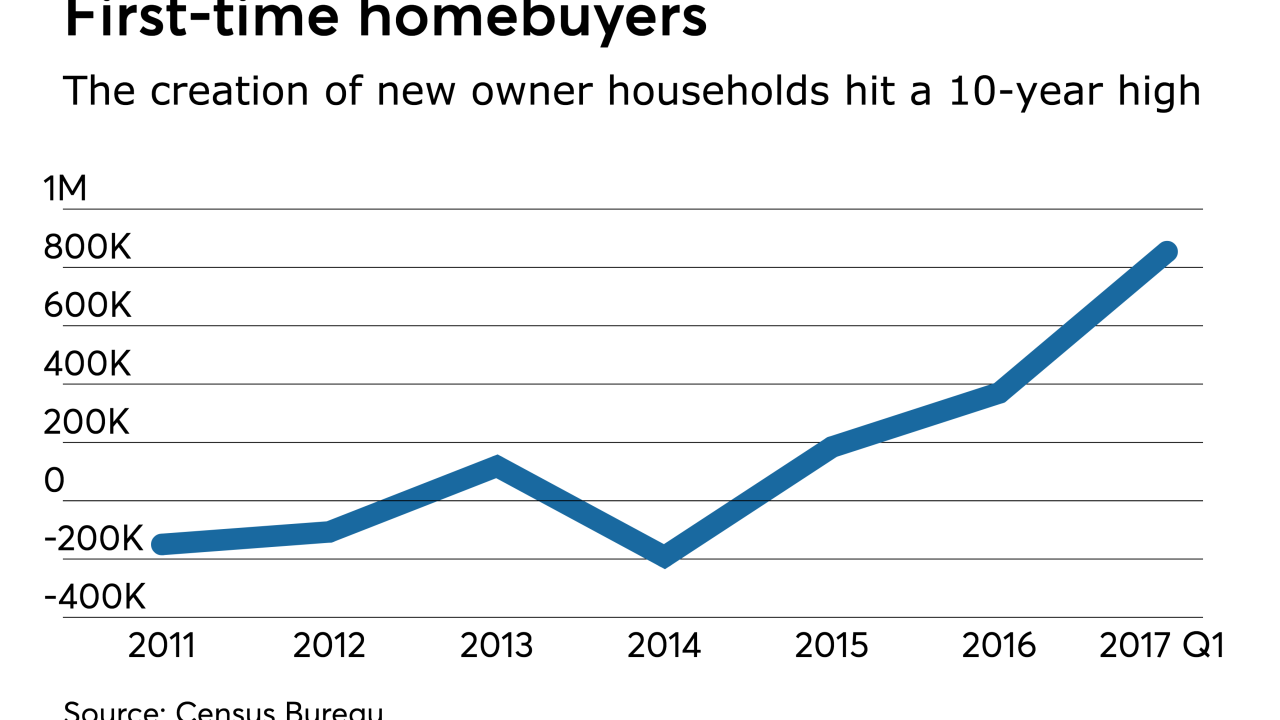

The number of first-time single-family homebuyers has hit a peak not seen since 2005 and is expected to spur the origination of more mortgages with higher loan-to-value ratios.

June 8 -

During a five-year run of real estate prosperity, some South Florida communities that bore the brunt of the excruciating housing collapse are enjoying the biggest spikes in value, homeowners and brokers say.

June 5 -

The Federal Housing Administration's gateway to homeownership could be widened if the Trump administration takes actions to reduce mortgage insurance premiums and clarify lender penalties under the False Claims Act.

June 2 -

For the first time in a decade, new-owner households created in the first quarter were higher than the creation of renter households.

June 2 -

Guild Mortgage is reaching out to millennials who often have higher debt-to-income ratios and lack down payments with a grant that allows them to put just 1% down.

June 1 -

Refinance mortgage volume hit a 10-year low during the first quarter, while a tepid market for purchase lending put total origination activity at its lowest level since 2014.

May 25 -

HLP has received a $20,000 grant award from the CBC Mortgage Agency, a government housing agency owned by a Native American tribe.

May 24 -

Down payment standards should be relaxed to just 10% to spur homebuying among millennials, Bank of America CEO Brian Moynihan said this week.

May 19 -

The lack of knowledge around the home purchase process was cited by 39% of mortgage executives as the leading barrier keeping potential first-time buyers from entering the market.

May 18 -

Here's a look at the 12 cities where the number of affordable homes increases the most when buyers have a 20% down payment rather than only putting down 10%.

May 16 -

Cities in the South are more affordable for first-time homebuyers because of less competition and lower prices, according to Zillow.

May 12 -

Pending sales of existing detached homes in the Albuquerque metro area during April shot up 23% from a year ago.

May 12 -

JPMorgan Chase will give its Sapphire credit card customers 100,000 rewards points for closing home-purchase loans with the bank.

May 9 -

While consumers pay for mortgage insurance policies, carriers like Arch MI are forging new relationships with real estate agents and strengthening lender partnerships to reach the growing segment of millennial and low-to-moderate-income homebuyers.

May 9