-

In remarks to credit unions, the Senate Banking Committee Chairman said that fixing the government-sponsored enterprises and data security were priorities.

March 13 -

Mortgage lenders are optimistic about their business prospects during this spring's home purchase season even with the negative sentiments about demand in the previous three months, Fannie Mae said.

March 13 -

The Securities Industry and Financial Markets Association approved changes to its good delivery guidelines that ease the path to the government-sponsored enterprises issuing uniform mortgage-backed securities starting on June 3.

March 12 -

Agency mortgage-backed security prepayment speeds increased in February with much of the refinance activity coming from newer loans and those with high coupons, a report from Keefe, Bruyette & Woods said.

March 11 -

Mark Calabria, who could be confirmed as early as this month, is expected to focus on changes to Fannie Mae and Freddie Mac’s conservatorships to let the mortgage giants keep more of their profits.

March 10 -

Freddie Mac is broadly offering instant representation and warranty relief for automatically validated self-employment income following a test of the concept last year.

March 6 -

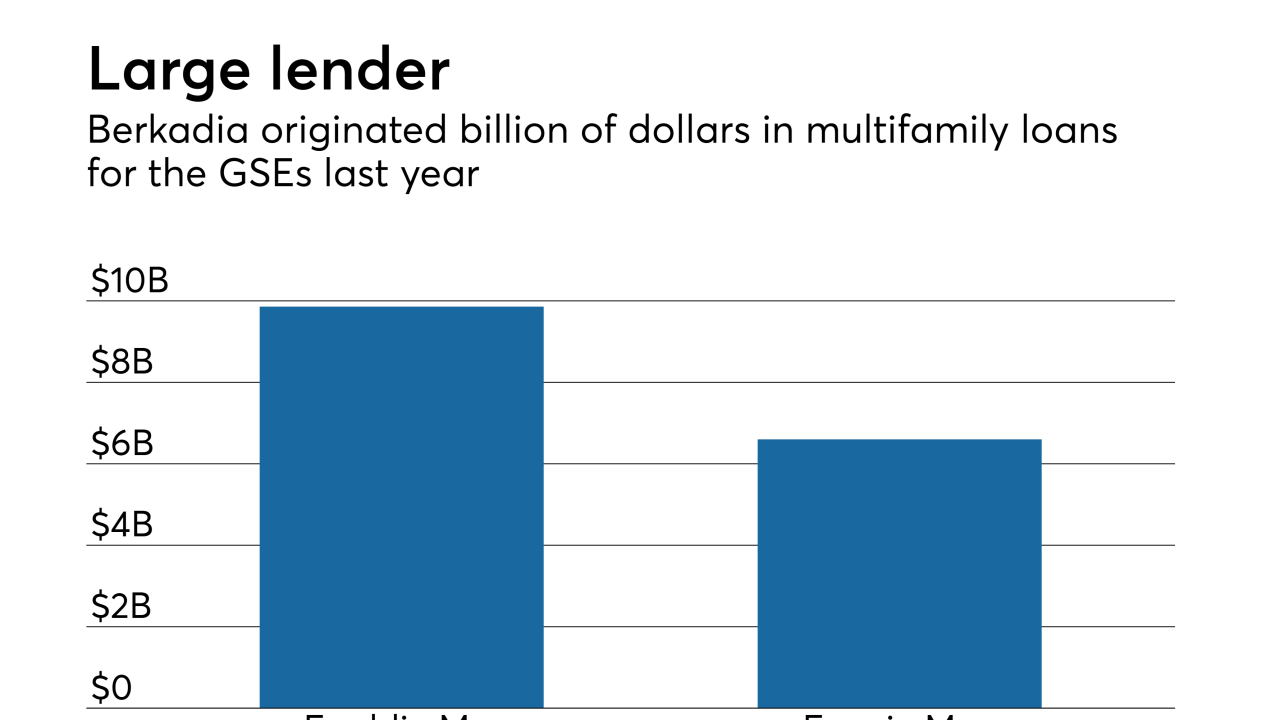

Berkadia, a joint venture run by Berkshire Hathaway and Jefferies Financial Group, is acquiring real estate capital advisory firm Central Park Capital Partners to diversify its capital sources.

March 6 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

Arch Capital Group named Michael Schmeiser president and CEO of its U.S. mortgage insurance business as the former head moved up the corporate ladder.

March 4 -

Whether through greater investments in technology and talent, or streamlining back-end processes to improve the decision-making process, mortgage servicers are doing more to prioritize borrowers. Here's a look at seven of these borrower-focused initiatives and how they're reshaping mortgage servicing.

March 1 -

The conventional market recaptured a lot of the first-time homebuyers it lost during the financial crisis, but service members instead have increasingly stuck with loans insured by the Department of Veterans Affairs.

March 1 -

Arch Capital’s next offering of credit risk transfer notes features heavy exposure to residential mortgages that have been modified by Fannie Mae or Freddie Mac.

March 1 -

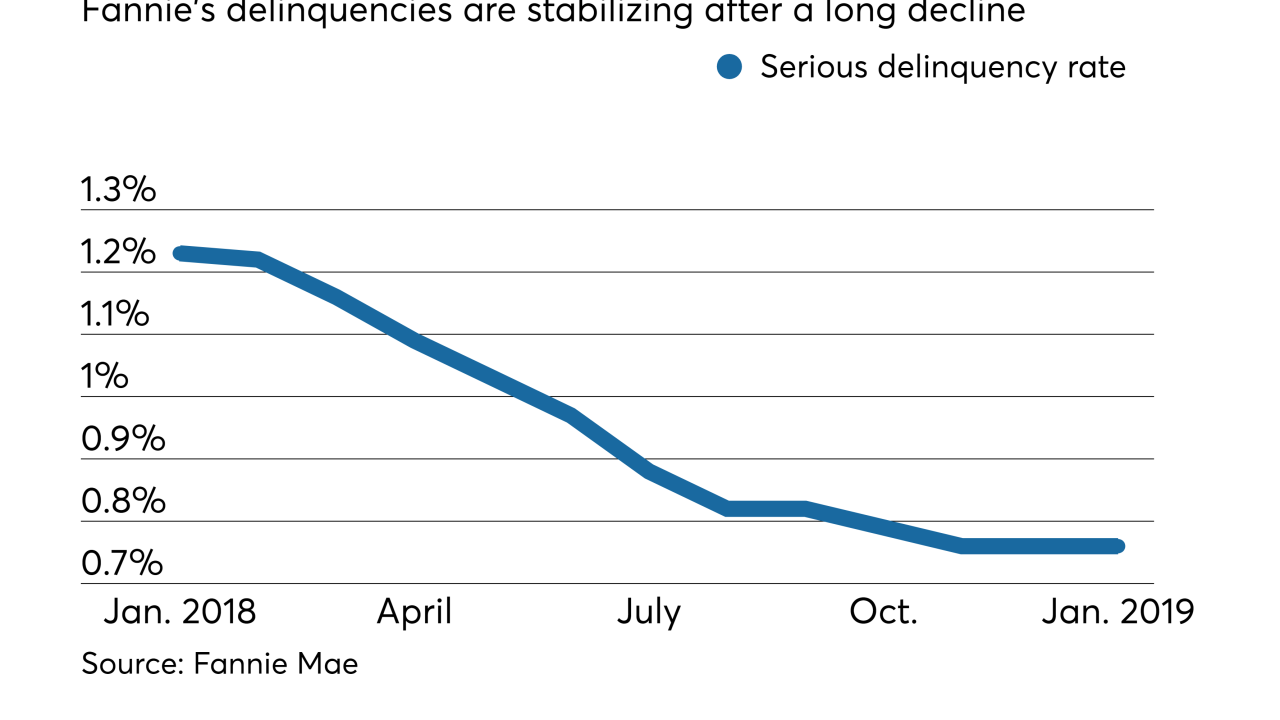

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1 -

Freddie Mac again increased its origination forecast for the next two years, as the rate drops of the past few months are expected to boost refinance volume.

March 1 -

The new regulation, codifying requirements already in practice, is meant to help the mortgage giants prepare for the adoption of a uniform security in June.

February 28 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26 -

If confirmed to lead the Federal Housing Finance Agency, Mark Calabria would have a central role in any efforts to reform the government-sponsored enterprises Fannie Mae and Freddie Mac

February 26 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

The six private mortgage insurers had a great year as they continued to grab market share from the Federal Housing Administration. Despite some headwinds, 2019 is shaping up to be another good year.

February 22 -

From FICOs to purchase volume, here's a look at seven mortgage lending trends that will shape the housing market this year.

February 20