-

PointPredictive has rolled out IncomePASS, which uses machine learning technology to determine if the borrower's income as stated on the application is realistic.

October 25 -

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

The most successful mortgage originators will use artificial intelligence and machine learning to enhance and enable their people to have better, more meaningful engagements with customers.

September 20 Total Expert

Total Expert -

Credit decisions were a natural place to start with artificial intelligence, but now banks and credit unions are taking the technology to all parts of their businesses.

September 11 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

Capacity, formerly Jane.ai, originally designed its chatbot to answer consumers' questions, but when employees started using it, that gave the startup an idea for a new business line.

August 21 -

Banks need to mitigate potential bias in algorithmic predictive models using artificial intelligence, as regulators are weighing how to oversee the emerging technology.

August 6 Regions Bank

Regions Bank -

Savings related to artificial intelligence could add up to a couple million dollars within 12 months for lenders with sufficient scale, according to an independent researcher hired by Black Knight.

July 12 -

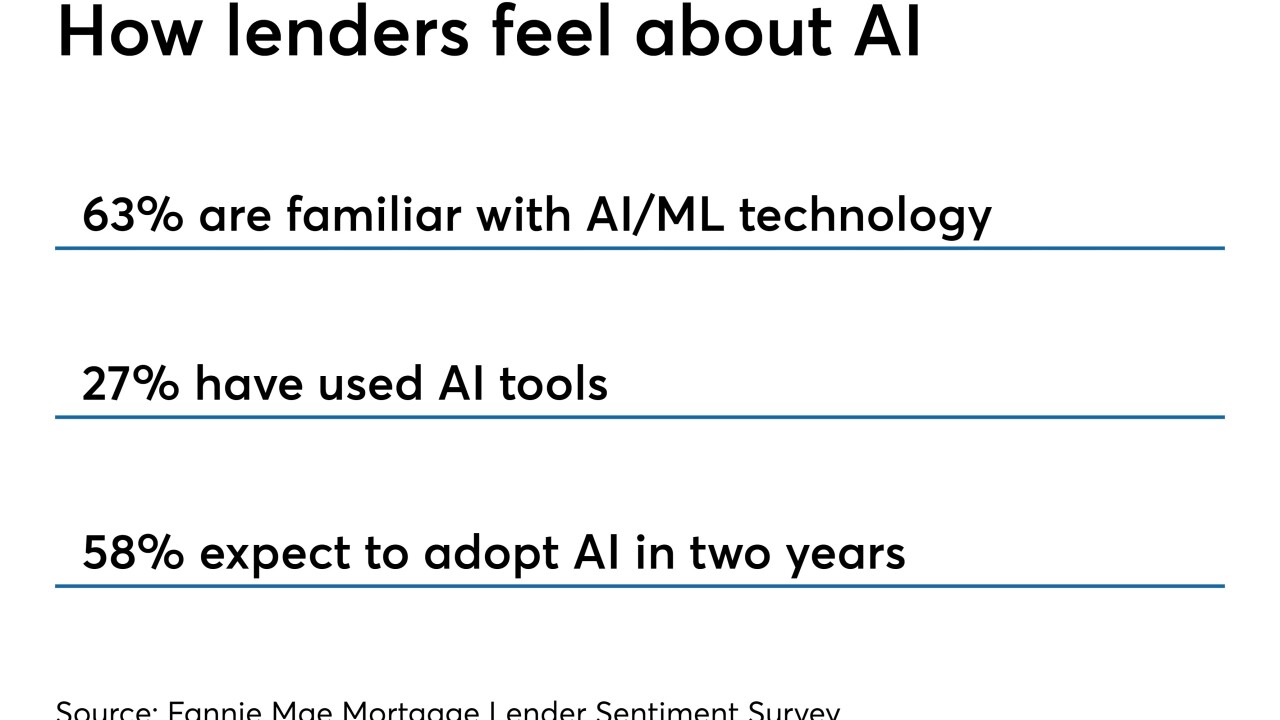

The mortgage industry identified two technology initiatives it claims have the greatest potential to improve processes and be the most broadly adopted over the next two years, according to Fannie Mae.

April 23 -

Mortgage lenders have invested heavily in various digital tools that improve the consumer experience, but what they really need to focus on is artificial intelligence that will improve data quality.

April 16 LoanLogics

LoanLogics -

The mortgage industry is eager to adopt digital strategies like artificial intelligence to streamline processes, but they are finding it difficult to extend through the full lifecycle of the loan.

March 26 -

Software startups say bringing borrowers, builders and lenders onto one digital platform can remove some of the risks lenders faced during the crisis.

March 14 -

A digital mortgage startup called Brace is using machine learning to automate loss mitigation and has lined up backing from several venture capital sources, including a fund with high-profile investors like Amazon founder Jeff Bezos.

February 19 -

As the mortgage industry braces for even more market uncertainty in 2019, emerging technologies that improve the borrower experience and streamline back-office tasks may provide a glimmer of hope to beleaguered lenders.

December 26 -

Executives urged the consumer bureau at a public meeting to keep a closer eye on artificial intelligence innovations developed by fintech firms that are subject to less regulation.

December 6 -

Ellie Mae plans to more quickly adapt to an evolving digital mortgage landscape with Amazon's help rebuilding from the inside-out.

November 26 -

-

Some lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 4 -

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6