-

Mortgage-backed securities investors are looking to the specified pool market to counter higher prepayment speeds seen with loans purchased through the TBA window.

August 9 -

In the world’s biggest covered-bond market, a Danish bank says it’s now ready to sell 10-year mortgage-backed notes at a negative coupon for the first time.

August 5 -

The Federal Reserve reduced short-term rates for the first time in years, and accelerated its plan to stop shrinking the Fed’s balance sheet by rolling maturing mortgage-backed securities into Treasuries.

July 31 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

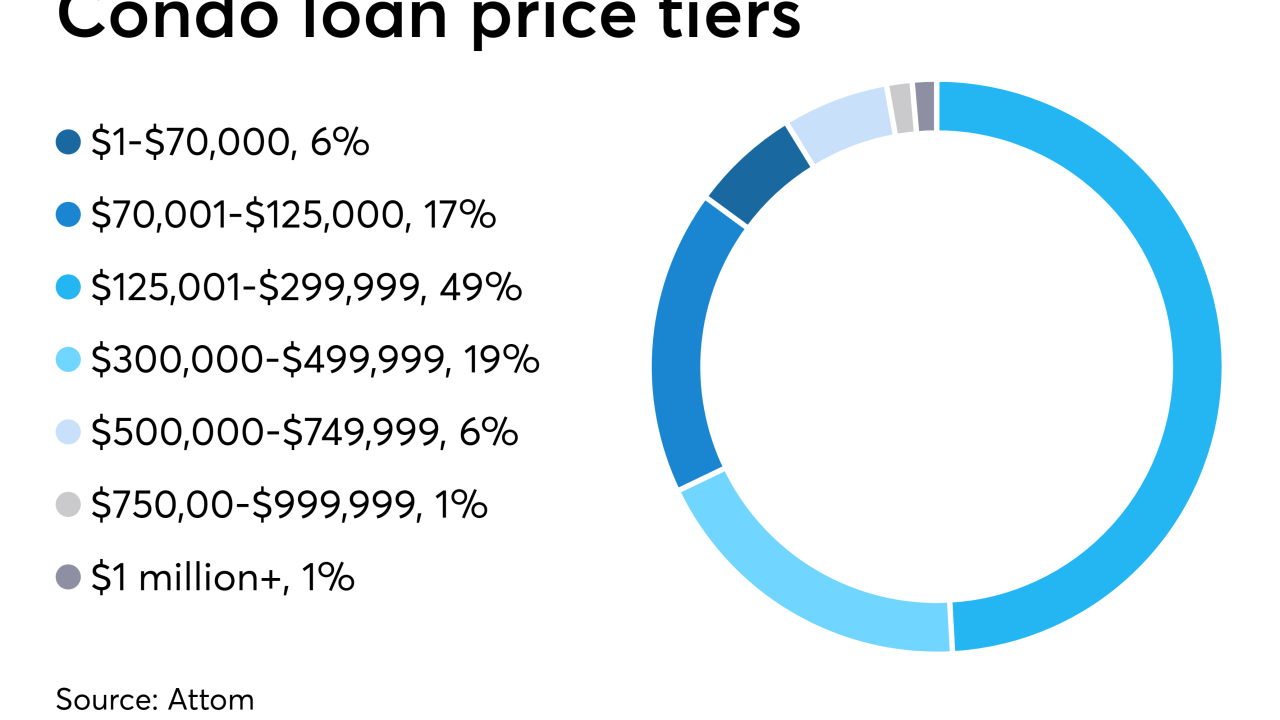

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

Prepayment speeds for loans included in agency mortgage-backed securities were up approximately 20% both monthly and annually during May as the decline in interest rates boosted activity, according to Keefe, Bruyette & Woods.

June 11 -

The assumption that conservatorship can end without significant changes in how the GSEs operate may be the most dangerous one of all.

June 4 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The consolidation of the two companies' securitization platforms into a single bond market became official on Monday.

June 3 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

The investment research firm plans to merge DBRS' ratings business with its existing Morningstar Credit Ratings Service.

May 29 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

Issuance of mortgage-backed securities increased and came close to matching 2018 levels in the latest month tracked by Ginnie Mae.

May 14 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

Investors can now exchange certain existing Freddie Mac bonds for to-be-announced uniform mortgage-backed securities in preparation for the full launch of UMBS next month.

May 8 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

HomeStreet Bank could receive nearly $190 million in total for selling $14 billion in mortgage servicing rights to New Residential and PennyMac, and selling its home loan centers to Homebridge.

April 8