-

Rising defaults, fraud risks, and collapsing rents are converging in urban multifamily, threatening lenders and taxpayers, according to the Chairman of Whalen Global Advisors.

February 5 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Looking to build on last year's live sing-along, Lady Gaga will be performing the theme to Mister Rogers Neighborhood in a campaign from Rocket and Redfin.

February 5 -

More mortgage professionals told National Mortgage News they expect their companies to hire, or stand pat, rather than fire workers this year.

February 5 -

Fraudsters and modestly dishonest employees can use generative AI to quickly create convincing fake utility bills, pay stubs, passports and other documents banks rely on.

February 5 -

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

February 4 -

Home equity investment platforms continue to attract dollars from the venture capital community but also face a proposed de facto ban in one state.

February 4 -

Shaw, which was part of last year's standstill agreement with Third Point, said it will support shareholder-driven change on Costar's board.

February 4 -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

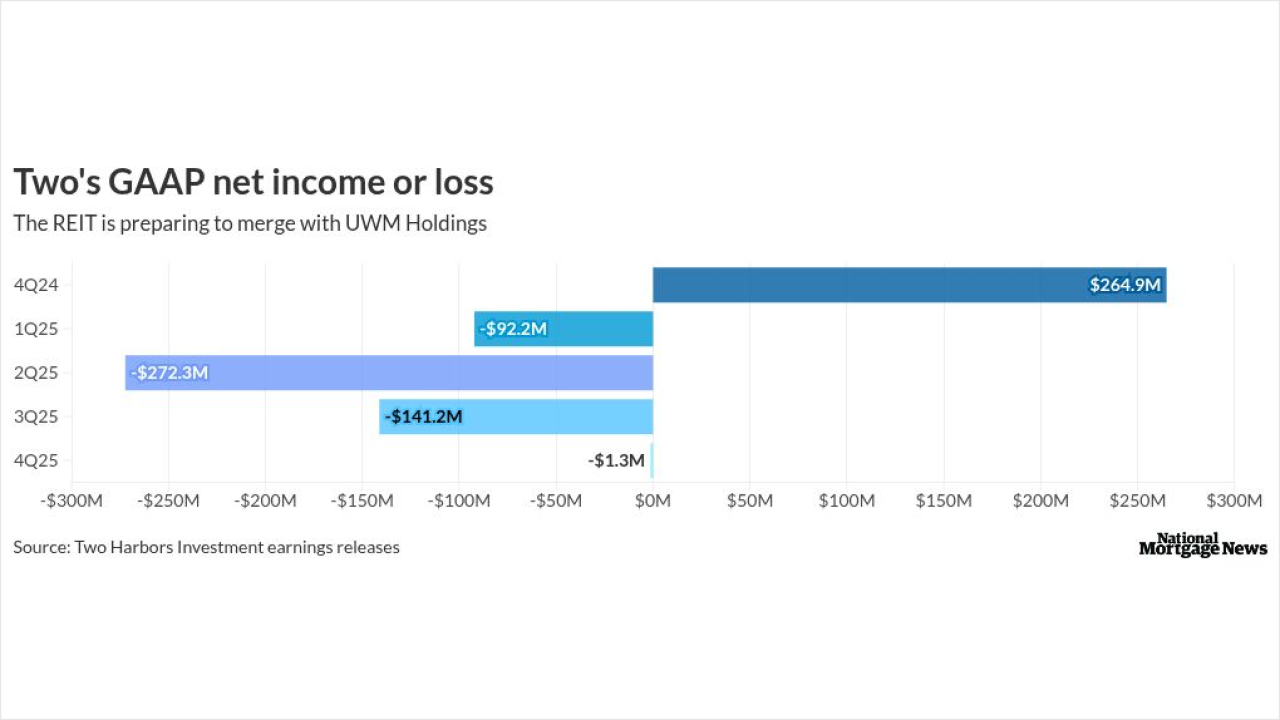

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

February 3 -

Lennar Corp. and Taylor Morrison Home Corp. are among the firms that have worked on the proposal, which calls for builders to sell entry-level homes into a pathway-to-ownership program funded by private investors, according to people familiar with the plan.

February 3