-

Mortgage applications decreased 5.3% on a seasonally adjusted basis from one week earlier led by a decline in conventional refinance loan demand, according to the Mortgage Bankers Association.

December 26 -

Freddie Mac reduced its origination forecast for 2020 to under $2 trillion, now projecting $184 billion less in refinance volume compared with its November outlook.

December 24 -

The Bay Area home market remained sluggish in November, as buyers searched for cheaper homes and sales slowed entering the holiday season.

December 24 -

Homebuyer purchase power took another big jump in October as wages grew and mortgage rates stayed low despite continuously tight housing inventory, according to First American Financial.

December 23 -

Palm Beach County's housing market continues to confound the lofty expectations created by robust job growth and rock-bottom interest rates.

December 23 -

Sales of new homes increased in November, capping the best three months for demand since 2007 and reflecting sustained momentum in a residential real estate market that’s helping to underpin the economy.

December 23 -

Pending new home sales increased both on a month-to-month and annual basis, benefitting from the current low mortgage rate environment, although they are still constrained by inventory issues, a Meyers Research report said.

December 20 -

Despite home prices continuing to rise faster than household income, affordability gains inched up due to the low mortgage rate landscape, according to Attom Data Solutions.

December 19 -

The critical defect rate for closed mortgage loans continued its decline in the second quarter, as lenders benefited from increased loan volume and profitability, an Aces Risk Management study found.

December 19 -

Mortgage rates ended the week unchanged from the previous seven-day period, according to Freddie Mac, although not without some gyrations from the results of the elections in the United Kingdom and U.S-China trade talks.

December 19 -

Sales of previously owned homes declined to a five-month low in November, indicating lean inventories are holding back a residential real estate market that's been supported by low mortgage rates and job growth.

December 19 -

Dallas-Fort Worth home sales and construction totals are expected to rise only modestly in 2020, but the expected increases could still be enough to push area home numbers to new highs.

December 19 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

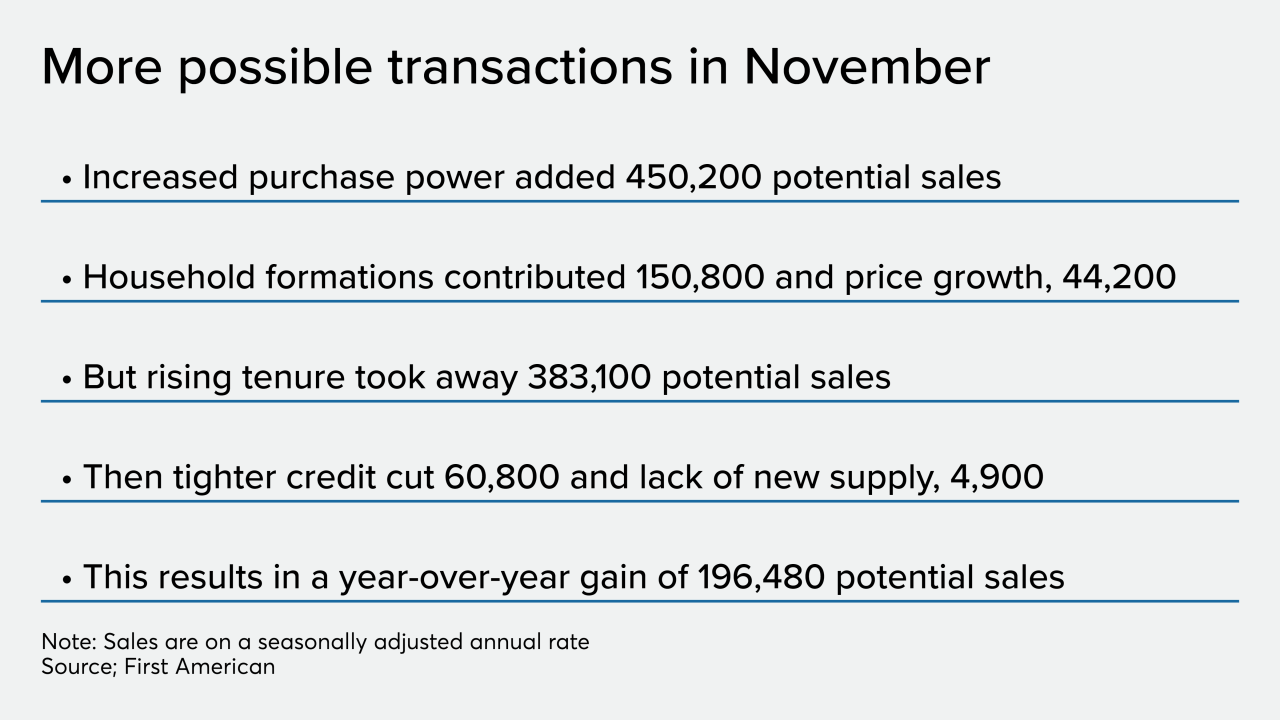

November was another month in the latter part of 2019 where actual existing-home sales outperformed their potential, but that momentum seems unlikely to continue in 2020, First American said.

December 18 -

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

Construction of new homes increased more than forecast in November and permits to build climbed to a 12-year high as the housing market strengthened amid low mortgage rates, solid job growth, and optimistic buyers and builders.

December 17 -

Even with an increase in both new and existing home construction activity during November, the slowdown over the previous 11 months will constrain inventory going into 2020, according to BuildFax.

December 16 -

Houston's feverish housing market is poised for another record year as low mortgage rates, population growth and a relatively healthy economy fuel sales throughout the region.

December 13 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Mortgage rates rose slightly with a stronger-than-expected jobs report starting the week and the Federal Open Market Committee decision to hold the line on short-term rates ending it, according to Freddie Mac.

December 12