-

Self-service technology gives borrowers the control, speed and convenience they desire, while providing lenders with higher origination volume.

September 18 Finastra

Finastra -

Any progress made with loosening housing inventory was lost as a high demand of buyers scooped up homes from the market, but sales still slipped from a year ago, according to Remax.

September 18 -

Existing-home sales exceeded their market potential again in August, and the improvement may continue for some time before there's a correction, according to First American.

September 18 -

Home construction surged in August to the fastest pace since mid-2007 on more apartment projects and single-family houses, a welcome sign for the housing sector that has struggled to gain momentum.

September 18 -

Mortgage applications decreased 0.1% from one week earlier as conforming and jumbo interest rates climbed back above 4%, which slowed refinance activity, according to the Mortgage Bankers Association.

September 18 -

The low mortgage rates of August drove new homebuyers to cannonball into the purchase market compared to the year before, according to the Mortgage Bankers Association.

September 17 -

Lower rates and signs that more affordable housing inventory is being built drove Fannie Mae's 2019 origination numbers higher in its latest forecast.

September 17 -

Sentiment among homebuilders climbed to the highest in almost a year on stronger current sales momentum, adding to signs that lower mortgage rates are giving the industry a boost.

September 17 -

It appears a relatively good time to be a homebuyer in the Portland, Ore., area.

September 17 -

Canadian home prices recorded their biggest gain in more than two years, and sales advanced for a sixth straight month in another sign of health in the country's real estate market.

September 16 -

While the critical defect rate for closed mortgage loans fell on a quarter-to-quarter basis, there were increases in income and packaging-related deficiencies, an Aces Risk Management study found.

September 16 -

If warning signs of a possible U.S. recession are currently flashing, Valeria Kremser doesn't see them in the Philadelphia housing market.

September 16 -

Reverse mortgages are surging in Canada as more older people join the country's debt bandwagon.

September 16 -

A mere 7-basis-point increase in interest rates reduced what was a record-high number of borrowers with refinancing incentive by 2 million in a matter of days, according to Black Knight.

September 13 -

Colorado Springs' four-month streak of record-setting home prices was snapped in August, but local buyers still are paying more for housing than last year, a new Pikes Peak Association of Realtors report shows.

September 13 -

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

Mortgage rates rose seven basis points compared with the prior week, but remained below 3.6% over four consecutive weeks for the first time since the fourth quarter of 2016, according to Freddie Mac.

September 12 -

Mortgage application fraud risk plummeted in the second quarter as refinance loans poured into the market, according to CoreLogic.

September 11 -

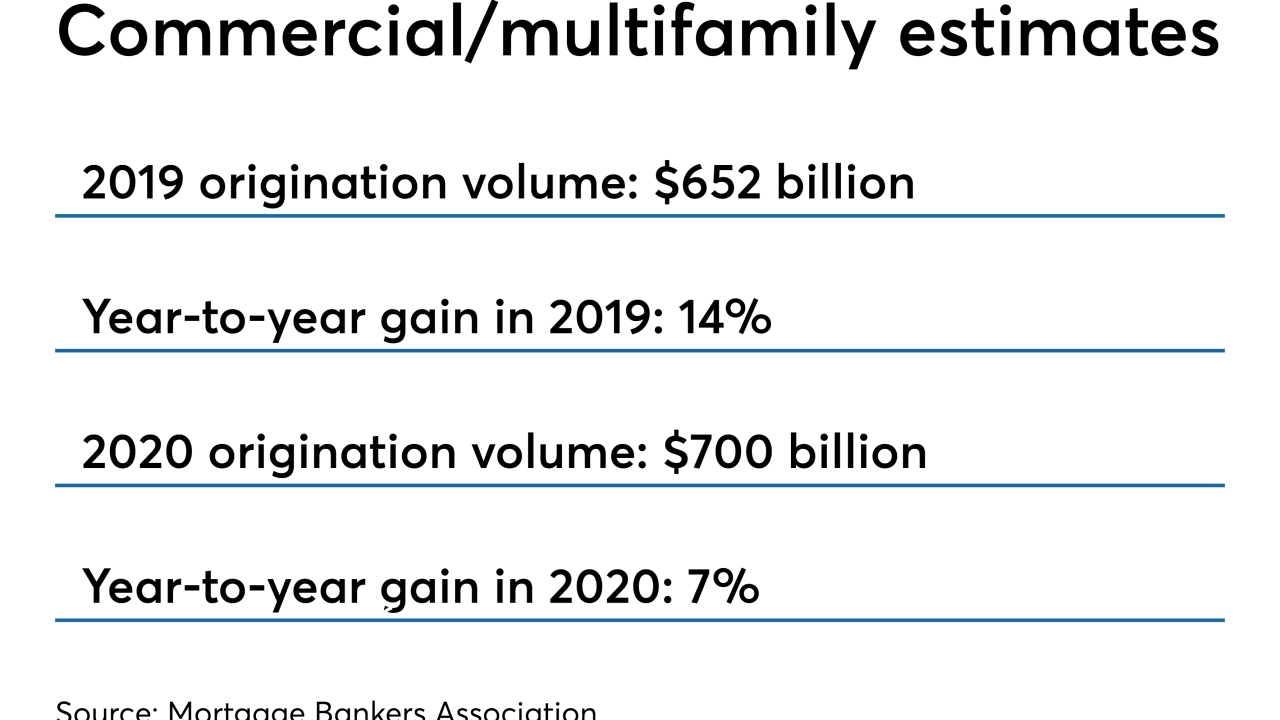

Lower interest rates are expected to drive financing secured by income-producing properties to new heights by year-end, according to the Mortgage Bankers Association.

September 10 -

Atlanta home prices have been rising for seven years — and lower mortgage rates could fuel a new run-up.

September 10