-

Sentiment among homebuilders increased in May by more than expected, sustaining this year's upward swing on stronger sales and lower mortgage rates.

May 15 -

The gap in home price perception between appraisers and property owners widened in April, reaching its greatest spike in four years, according to Quicken Loans. At the same time, home values continued climbing.

May 15 -

Some good news emerged in the housing market recently, but there's one factor that means homebuyers aren't likely to see any relief soon: low supply.

May 14 -

While prepayment speeds on agency mortgage-backed securities rose in April, that increase should be short-lived as further significant interest drops are not expected, said a report from Keefe, Bruyette & Woods.

May 13 -

Affordability got better for mortgage borrowers at the start of 2019, but housing inventory constraints limited the degree of improvement, according to the National Association of Home Builders and Wells Fargo.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Single-family home sales across the Houston area were up 7.8% in April, the third straight monthly increase and the biggest gain so far this year, according to the Houston Association of Realtors.

May 10 -

Whether online or advertised on a sign, very few consumers will qualify for that incredible low-rate deal. Here's why.

May 9 -

Mortgage rates continued to decline during May, as fears over a possible trade war with China drove investors into safer instruments, according to Freddie Mac.

May 9 -

Nonbank mortgage companies have traditionally been monoline or focused businesses, but in the current market they must create multiple revenue lines and strike a healthy balance between them to survive.

May 8 RoundPoint Mortgage Servicing Corp.

RoundPoint Mortgage Servicing Corp. -

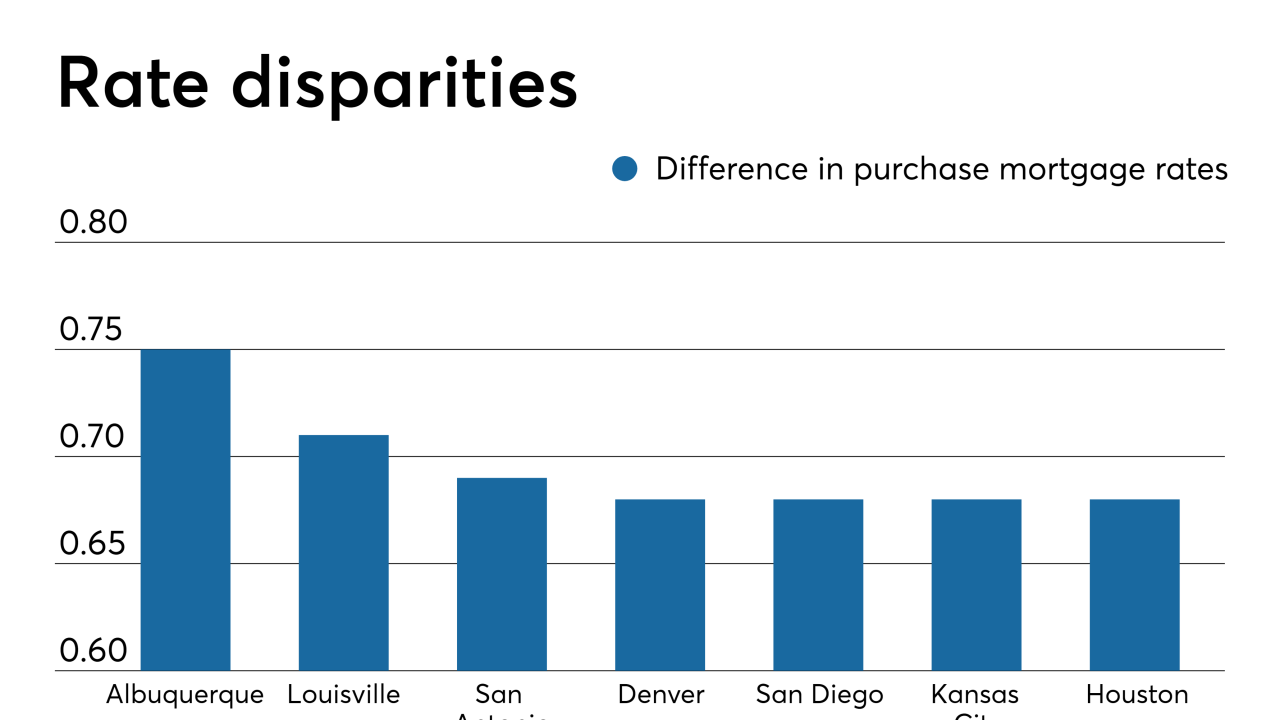

Lenders can help both the consumer save money and their own volumes by offering the most competitive rates or reducing their fees. Here's a look at the 12 housing markets borrowers save the most over the life of their loan by shopping around for a mortgage, according to LendingTree.

May 8 -

An increase in purchase activity drove the week-over-week rise in mortgage application volume as homebuyers entered the market while interest rates fell, according to the Mortgage Bankers Association.

May 8 -

Dallas-Fort Worth is still the country's top homebuilding market.

May 8 -

Consumer expectations of further mortgage rate drops leaves them seemingly in no rush to enter the purchase market which could be why their optimism on home buying is falling, a Fannie Mae report said.

May 7 -

Home price appreciation remained modest as affordability and tight inventory keep demand down, though prices are expected to accelerate in 2020, according to CoreLogic.

May 7 -

Regions Bank, like many lenders, has seen its refinancing volume shrink dramatically as a percentage of overall originations over the last few years, prompting it to refocus its mortgage bankers on very different purchase originations.

May 7 -

Customer retention for mortgage servicers hit an all-time low at the start of the year, and a sensitive mortgage rate environment is only creating more competition, according to Black Knight.

May 6 -

Tight housing inventory and some unexpected behaviors from potential buyers and sellers of homes have prompted Citizens Bank to make changes to its services and mortgage-loan products.

May 6 -

It's been a dreary spring for many homebuilders in the Twin Cities.

May 6 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3