-

Homebuyers saving for a down payment contributed to the slowest rate of August price appreciation in nearly two years; and the market could have even less momentum by next summer.

October 2 -

The strong U.S. economy pushed mortgage rates in the past week to their highest level in over seven years, and further hikes are on the way, according to Freddie Mac.

September 27 -

Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

September 26 -

Purchases of new homes rebounded in August from the slowest pace in almost a year, a potential sign of stabilization in the market, according to government data Wednesday.

September 26 -

A stronger economy, easing house price appreciation and slightly improving inventory conditions aren't enough to push up home sales this year, according to Freddie Mac.

September 24 -

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

September 20 -

As mortgage rates remained mostly tepid throughout the summer, closed refinances had their first month of growth in August, according to Ellie Mae.

September 19 -

Mortgage applications were up 1.6% from one week earlier, marking only the second increase of the past two months despite key interest rates rising, according to the Mortgage Bankers Association.

September 19 -

New-home construction rose more than forecast to a three-month high in August, while permits unexpectedly saw the biggest drop since February 2017, adding to signs that homebuilding is struggling to stabilize.

September 19 -

Confidence among homebuilders stabilized in September as demand held up and lumber prices fell, a National Association of Home Builders/Wells Fargo report showed.

September 18 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

Mortgage rates jumped 6 basis points over the past week, which led to the largest year-over-year gain in over four years, according to Freddie Mac.

September 13 -

Staggering home prices and steep tax rates are pushing people from expensive cities along the coasts to more affordable locales.

September 12 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

The number of workers employed by nonbank mortgage lenders and brokers reversed course and inched lower in July as affordability constraints and limited income gains reduced demand.

September 7 -

The typical homeowner spends 17.5% of their income on monthly mortgage payments, according to Zillow's second quarter affordability report.

September 6 -

Mortgage rates inched higher for the second straight week and further increases are likely in the near term, according to Freddie Mac.

September 6 -

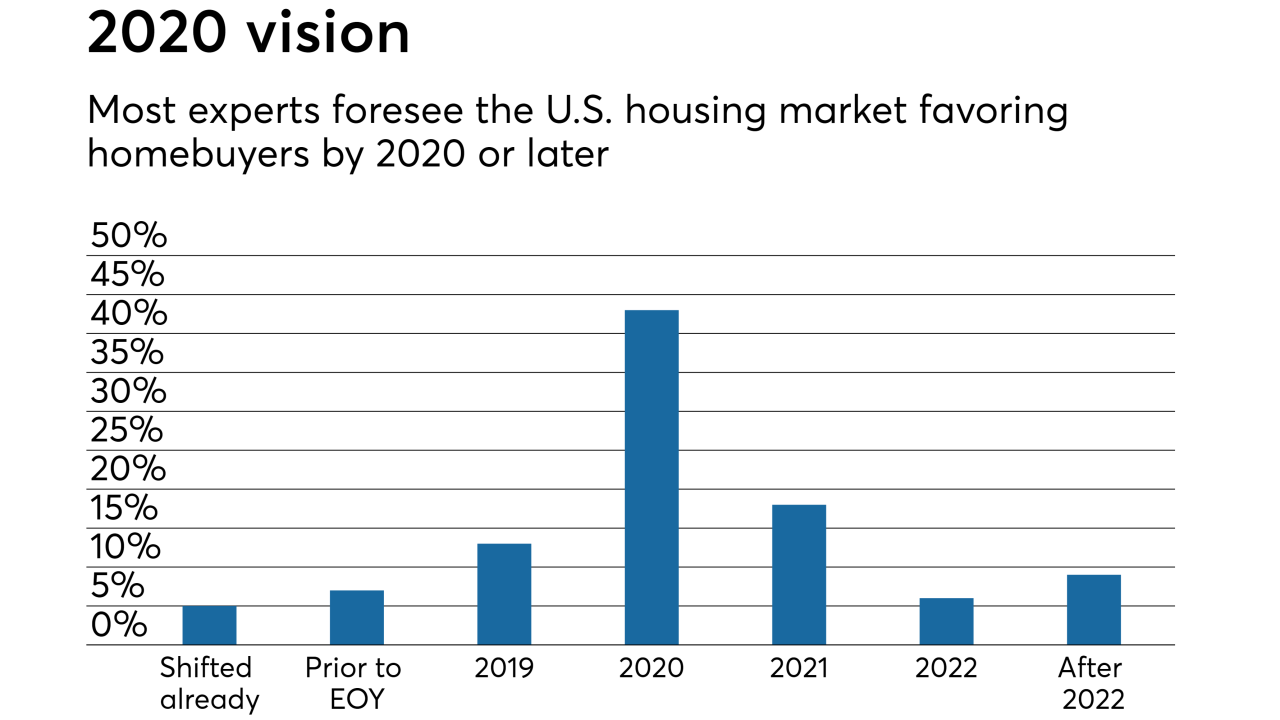

After home prices soared due to a lack of inventory and a recovering economy, three-quarters of experts believe the shift to a buyer's housing market should come in two years.

September 5