-

Mortgage banking revenue stemming from a year-to-year increase in rates weighed down noninterest income at U.S. Bancorp, but increased interest income from higher rates helped improve earnings overall.

July 18 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

New-home groundbreaking and permits fell in June to the slowest pace in nine months, as higher mortgage rates and elevated costs for labor and materials pinch the housing market.

July 18 -

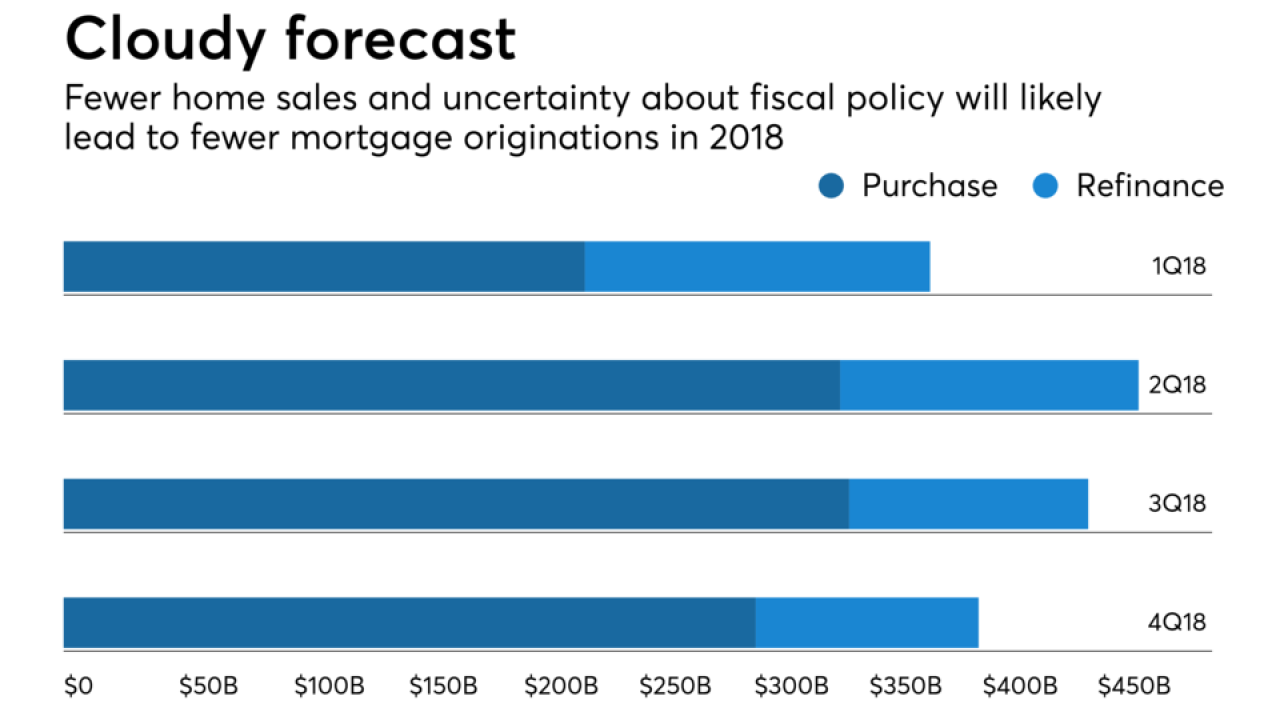

Fewer sales of existing homes and uncertainty around future fiscal policies will result in fewer mortgage originations than previously expected, according to Fannie Mae.

July 17 -

Confidence among homebuilders held steady in July, matching the lowest level of the year, as solid job gains support demand while elevated material costs pressure developers.

July 17 -

Mortgage rates broke from their recent respite, increasing for only the second time in the past seven weeks, according to Freddie Mac.

July 12 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11 -

The job market gaining steam year-over-year pushed the purchase and overall mortgage application volume upward despite refinance activity dropping to an 18-year low.

July 11 -

Despite available home equity shooting up in the first quarter, the share of total equity withdrawn by borrowers hit a four-year low, likely due to an increase in interest rates, according to Black Knight.

July 9 -

Slight declines in consumer expectations for more favorable future job security, income and interest rates knocked Fannie Mae's Home Purchase Sentiment back down from a record high in June.

July 9 -

Volatility in the financial markets, uncertainty with foreign trade and the housing supply deficit caused mortgage applications to drop for the second straight week.

July 5 -

Mortgage rates maintained their recent slide and have now declined in five of the past six weeks, according to Freddie Mac.

July 5 -

Housing demand is high, but few homeowners are interested in selling and the resulting inventory shortage continues to drive home prices higher.

July 3 -

Purchasing power took a plunge in some of the nation's hottest housing markets, as a competitive spring purchasing season continues to drive home prices higher.

July 3 -

Dallas-area home prices are up 7.8% from a year ago in the latest national comparison by CoreLogic.

July 3 -

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

From lowering expectations about their ideal home to moving faster to close a deal, here's a look at five ways house hunters say they would react to average mortgage rates reaching 5%.

June 29 -

Mortgage rates declined over the past week as worried investors increased their purchases of 10-year Treasuries, according to Freddie Mac.

June 28 -

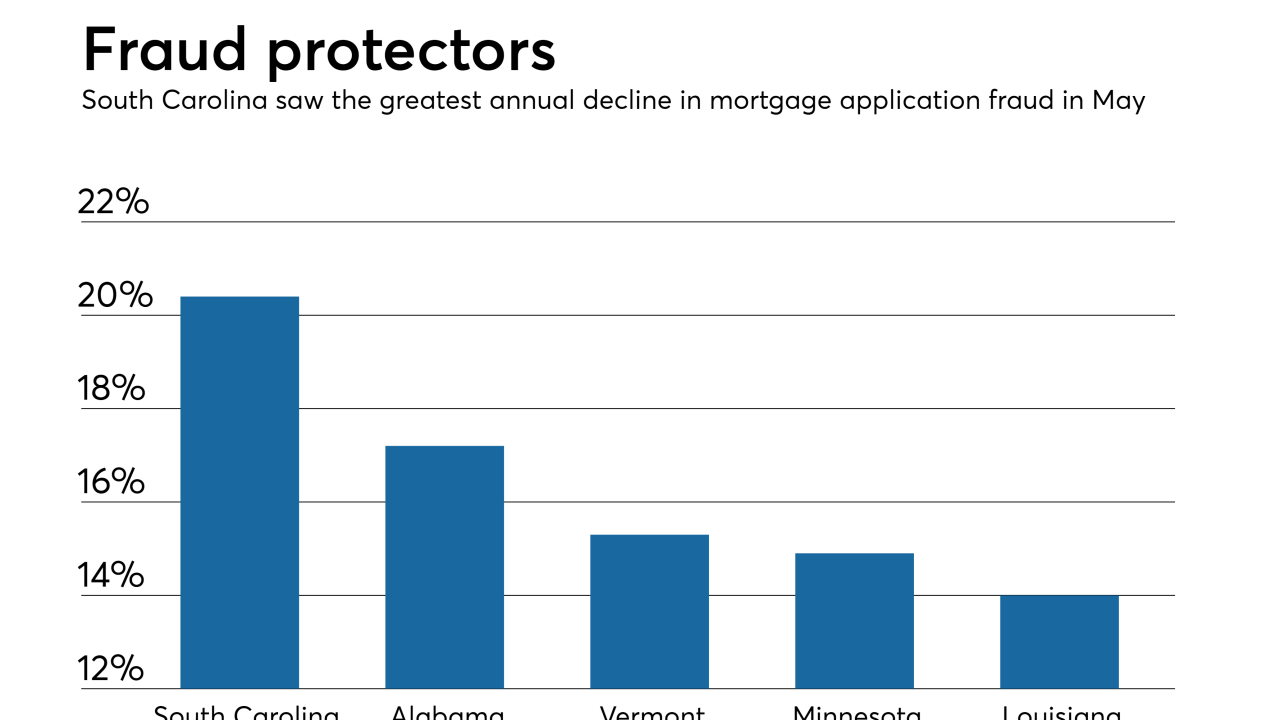

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

An index of contract signings to purchase previously owned homes unexpectedly declined for a second month in May, reflecting a persistent shortage of available homes.

June 27